The assumptions underpinning our energy sector modelling are primarily centred upon the continued diversification of the Chinese electricity sector into all fuel forms other than coal. And yet again, China has exceeded its ambitious targets for renewable energy. The latest target to be exceeded is for 100 gigawatts (GW) of total installed wind capacity by 2015. We expect China will exceed this target by 30% by end 2015, having achieved it 16 months early.

The interim results presentation from Xinjiang Goldwind Science & Technology Co. (Goldwind) of China makes interesting reading because it provides a detailed overview of the Chinese domestic wind market. We provide a summary of some of the key points below. As background, Goldwind is China’s leading wind turbine manufacturer with a market share consistently in-excess of 20% of China’s total wind installations. This puts Goldwind in the top five wind companies globally. Goldwind entered the Chinese wind turbine market more than two decades ago, and has established a name for quality and reliability, building up an in-house research and development capability.

Before we examine the Chinese wind sector, some context.

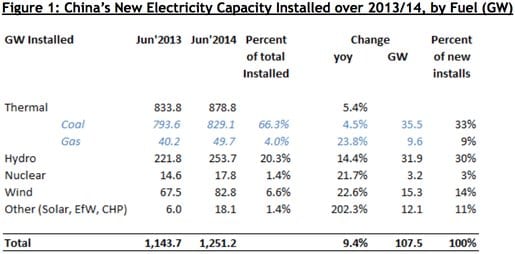

China is rapidly diversifying its electricity sector away from coal. This means more gas-fired power generation, more nuclear, renewables and hydro. Figure 1 details that in the year to June 2014, China installed 9.6GW of gas-fired capacity, 21.9GW of new hydro, 3.2GW of nuclear power, 15.3GW of wind and 12.1GW of other, primarily solar. Total capacity installed grew by 107.5GW or 9.4% year-on-year, double the rate of electricity demand growth which was 5.3% year-on-year. The underlying economic transformation of China toward less electricity intensive sectors and a slower rate of real GDP growth will see electricity demand growth continue to grow at a decelerating rate, materially assisted by China’s continued emphasis on energy efficiency.

Source: National Energy Agency, July 2014, IEEFA calculations

A coal analyst might take comfort in the substantial 35.5GW of new coal-fired power capacity installed. However, the merit order effect is very clear – low marginal cost electricity sources will take priority in supplying demand. High marginal costs mean that coal fired capacity utilisation rates have fallen in the last twelve months. Hence the report that China’s domestic coal consumption actually declined 0.9% year-on-year in the first six months of 2014. We expect very few new coal-fired power plants will be built in China once the current batch are commissioned into 2015/16, and that net retirements will become the norm for China thereafter.

Consistent with this, included in China Resources Power (CR Power)’s interim results last week was a HK$2bn (A$280m) writedown associated with its relatively small, vertically integrated coal mining operations in China. CR Power is one of China’s largest listed electricity generators, with 27GW of coal-fired power and 3GW of wind farms. Management flagged coal price weakness is expected to continue. This month Goldman Sachs estimated that China would bring on 700-800Mtpa of additional coal mining capacity over 2014-2016 (a 20% expansion of domestic production), further exacerbating the oversupply situation and suggesting China could rapidly scale back its 300Mtpa of coal imports in order to protect its domestic coal workforce. Lower prices and reduced demand from the largest coal import nation globally does not auger well for Australia’s coal industry.

China already has the world’s largest wind farm installed base, with 98.6GW as of June 2014. America is second with some 62GW in operation and Germany third with 36GW. China will also install three times the quantity of windfarms in 2014 as will America, and six times that of Germany, accelerating China’s global lead in the race to transform to a lower carbon economy.

Goldwind’s corporate presentation makes it clear – China is on track to install at least the 18GW of new windfarms targeted for 2014. This means 2014 wind capacity installs will be up at least 15% from the 16.1GW in 2013 (and 13GW in 2012). Installs in the first half of 2014 were up 30% year-on-year (yoy) – Figure 2.

Source: Xinjiang Goldwind Science & Technology Co. Ltd, 25 August 2014

China’s National Energy Administration set a target for 100GW of installed wind by 2015. Given the expected installation of more than 11GW of wind in the six months to Dec’2014, this target has probably been exceeded already. IEEFA forecasts another 18-20GW of wind installs in China in 2015, such that China is forecast to have 130GW of total wind capacity by end 2015, exceeding this intermediate target by 30%. China’s current target is for 200GW of total wind installs by 2020. IEEFA forecasts this target likewise will also be exceed by 10% in due course.

A key constraint on the Chinese electricity industry over 2011-2013 related to the central government requirement that wind farms were to be paid for any wind electricity generated, even if the grid operator was not physically able to connect the wind farm to the grid. Curtailments of wind capacity (forced temporary closures) due to insufficient transmission grid capacity has been the norm for China. Curtailments peaked at 16% of all wind electricity produced in 2012. Goldwind reports that wind curtailments were down to 8.5% in the first half of 2014, well below the 13.6% seen in first half of 2013. We expect the curtailment factor will continue to gradually reduce to low single digits over the next two years.

The central government planning for large scale wind bases across China continues. China has announced 12 new major ultra-high voltage transmission lines to enhance renewable energy capacity. The first batch of these should come online by 2016.

China tendered for 12.3GW of new wind projects nationally over the first six months of 2014, growth of 39% year-on-year. Goldwind reported its volume of wind turbine sold in the half grew 42% yoy and also reported an order backlog of 8.9GW as at June 2014, up 18% in just six months. Consistent with past disclosures, this includes new orders fully contracted and those under final bid – Figure 3.

Source: Xinjiang Goldwind Science & Technology Co. Ltd, 25 August 2014

Almost all of the wind developments detailed above involve onshore wind farms. The National Development and Reform Commission (NDRC) in 2011 set an offshore windfarm target of 30GW by 2020 as part of the total for wind at 200GW, with the offshore target rising to 200GW by 2050. However, three years on, China has only commissioned 0.4GW of offshore wind.

In large part this was a deliberate slowdown to ensure the construction, grid connection and technology issues seen in offshore wind in Europe in the North Sea over 2012-14 were avoided, and to wait for the deployment cost to materially decline. With significant technology advances achieved in the last three years, each of ABB Group, Siemens and Dong Energy continue to cite confidence in their commercial target to lower the cost of offshore wind projects by up to 40% by 2020. This would imply a still high levelised cost of electricity of €100/MWh, but further technology and economies of scale are likely.

Goldwind expects China to progressively step up activity in offshore wind and is positioned to lead this process. To encourage more investment in the sector, the NDRC in June 2014 announced China’s power grids will pay 0.75-0.85 yuan per kWh (US$120-140/MWh) for electricity produced by offshore wind turbines if commissioned by 2017.

In contrast to the federal government of Australia, a key national strategy of the Chinese government is to be a world leading supplier of technologies and industries of the future. To this end, Goldwind continues to carefully expand its overseas footprint. This is a slow process, given the need to get its technology accredited through commercial deployment in each new domestic market. Goldwind has successfully exported its wind turbines to markets as diverse as Chile, Panama, the US, Ethiopia, Romania and Egypt. In Australia Goldwind has deployed turbines across the 166MW Gullen Range and 20MW Mortons Lake projects.

Energy security is a key strategic priority for China. While Australia continues to build more and more thermal coal mines plus rail and port infrastructure, the world’s largest consumer (China was 50% of global thermal coal consumption in 2013) is doing everything possible to diminish its need for one of Australia’s largest exports. The global oversupply of thermal coal will likely leave the Australian coal mining cash margins close to current levels of zero for some time to come.

Tim Buckley is Director of Energy Finance Studies, Australasia for IEEFA