India’s EV evolution: The impact of government subsidies over 10 years

Comprehensive analysis reveals targeted policy support drives segment-specific growth, with state-level interventions critical for overcoming persistent adoption barriers.

Key Takeaways:

While central subsidies under FAME-II and state incentives have successfully given a boost to absolute EV sales, their effectiveness differs across segments.

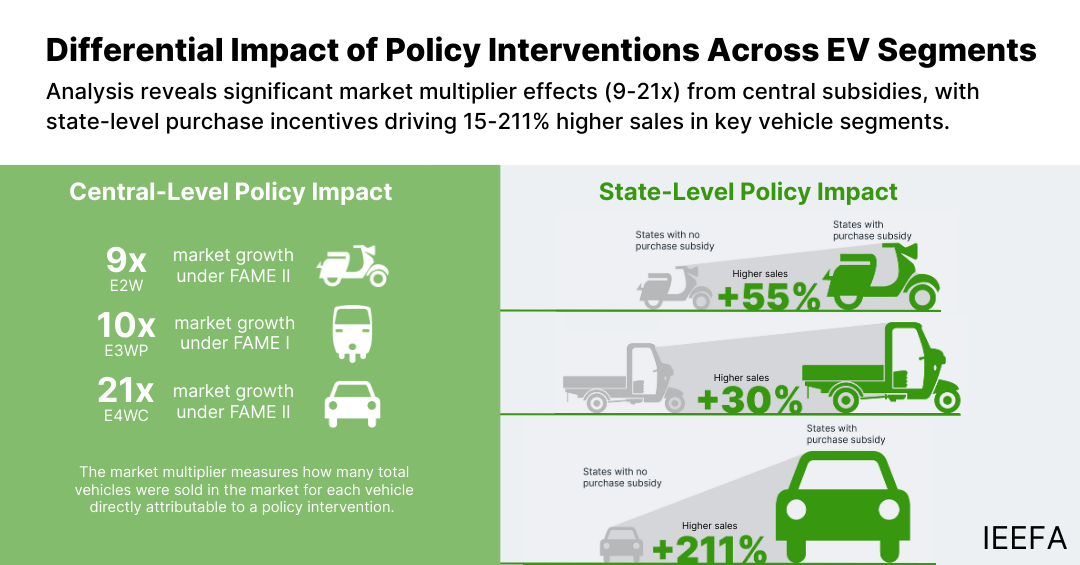

India’s EV subsidies demonstrated remarkable economic leverage, with market multipliers of 9-21x across vehicle segments—meaning each rupee of public investment catalysed up to Rs21 of market value, far beyond direct policy impacts.

EV policy effectiveness hinges on segment-specific fiscal interventions that recognise and address the distinct market maturity levels and adoption barriers unique to each vehicle category.

27 May (IEEFA South Asia): While India has made significant strides in promoting the adoption of electric vehicles (EVs) through fiscal and non-fiscal incentives, achieving deeper market penetration requires a combination of sustained financial incentives, infrastructure development and regulatory innovation, a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) finds.

The study employs a 10-year panel dataset (2014-23), covering EV policy interventions by all major states/UTs and the Centre across five vehicle segments. It assesses the evolution of India’s EV policy landscape, including FAME-I (2015-19), FAME-II (2019 onwards), automotive and battery Production Linked Incentive (PLI) schemes and state subsidies using econometric methods.

The report finds that India’s electric two-wheeler (E2W) market witnessed a significant boost in sales between 2019 and 2023, coinciding with the FAME-II period. However, the adoption rate—the percentage of E2W sales compared to total two-wheeler sales—did not increase noticeably. This gap suggests that purchase subsidies alone cannot transform overall market composition without complementary measures.

To achieve India’s vision of 30% EV sales penetration by 2030 in the E2W segment, India should expand support beyond purchase subsidies—for instance, by investing in reliable public charging infrastructure. “The government should continue offering purchase subsidies to sustain momentum but clearly communicate a phased-down trajectory for a longer term. This will help consumers and manufacturers plan better, while nudging the market towards cost parity and self-sufficiency,” says Charith Konda, Energy Specialist, IEEFA, one of the report’s co-authors.

The electric three-wheeler passenger (E3WP) segment experienced significant growth during FAME-I, establishing a foundation for sustained market development. This segment demonstrated unique responsiveness to early policy intervention compared to other EV categories, the report finds.

“Strengthening financing, local manufacturing and urban integration can help the segment achieve greater scale and quality without reverting to broad-based subsidies,” says Subham Shrivastava, Climate Finance Analyst, IEEFA, one of the co-authors.

The report highlights that in the case of the electric three-wheeler cargo (E3WC) segment, its evolution from 2015 to 2023 is an example of successful market transformation. Although the direct statistical linkage between FAME subsidies and sales growth or adoption rate appears modest in the regression analysis, the segment’s dramatic market capture—from virtually non-existent to nearly one-third market share by the end of 2023—highlights the catalytic role of market policy, the authors of the report say.

As E3WC shows strong market viability, policymakers should phase down direct subsidies predictably rather than abruptly. “Monitoring cost trends and sales or adoption rates will be critical to ensuring that scaling back does not stall the segment’s momentum,” adds Shrivastava.

In the electric four-wheeler commercial (E4WC) segment, FAME-I had a limited impact with sales remaining low while the increase in subsidy under FAME-II helped drive growth. While central schemes like FAME‐II and the auto PLI catalysed early growth in E4WC adoption, the absence of electric car purchase subsidies under PM E‐DRIVE risks stalling momentum. “Coordinated central and state action, pairing targeted purchase incentives, infrastructure rollout, and manufacturing scale-up can help electric cars compete effectively with their counterparts in India’s commercial vehicle market,” says Saurabh Trivedi, Sustainable Finance Specialist, IEEFA, and one of the report’s co-authors.

In the case of electric buses (e-buses), both FAME-I and FAME-II failed to generate any significant e-bus market momentum. To increase the adoption of e-buses, the authors suggest the government can extend subsidies to public as well as private operators, introduce an interest rate subvention scheme to lower the cost of financing for e-buses and nudge vehicle financing and leasing companies to offer e-bus leasing programmes for private bus operators. “Robust highway charging infrastructure, parking facilities and the development of highway amenities could also go a long way in boosting adoption,” Trivedi adds.

“As India transitions from FAME schemes to PM E-DRIVE and other similar initiatives, policymakers must recognise that each EV segment requires tailored intervention,” Konda emphasises. The success of India’s EV transition will depend not just on the incentives offered, but also on their strategic calibration to match each segment’s unique adoption journey, ensuring long-term market self-sufficiency and sustainable mobility expansion.

Read the report: From Incentives to Adoption: A Decadal Review of India’s EV Subsidy Effectiveness

Media contact: Prionka Jha ([email protected]); +91 9818884854

Author contacts: Saurabh Trivedi, PhD ([email protected]), Charith Konda ([email protected]), Subham Shrivastava ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)