IEEFA U.S.: Private equity reshapes nation’s largest power market while raising investor risk

Key Takeaways:

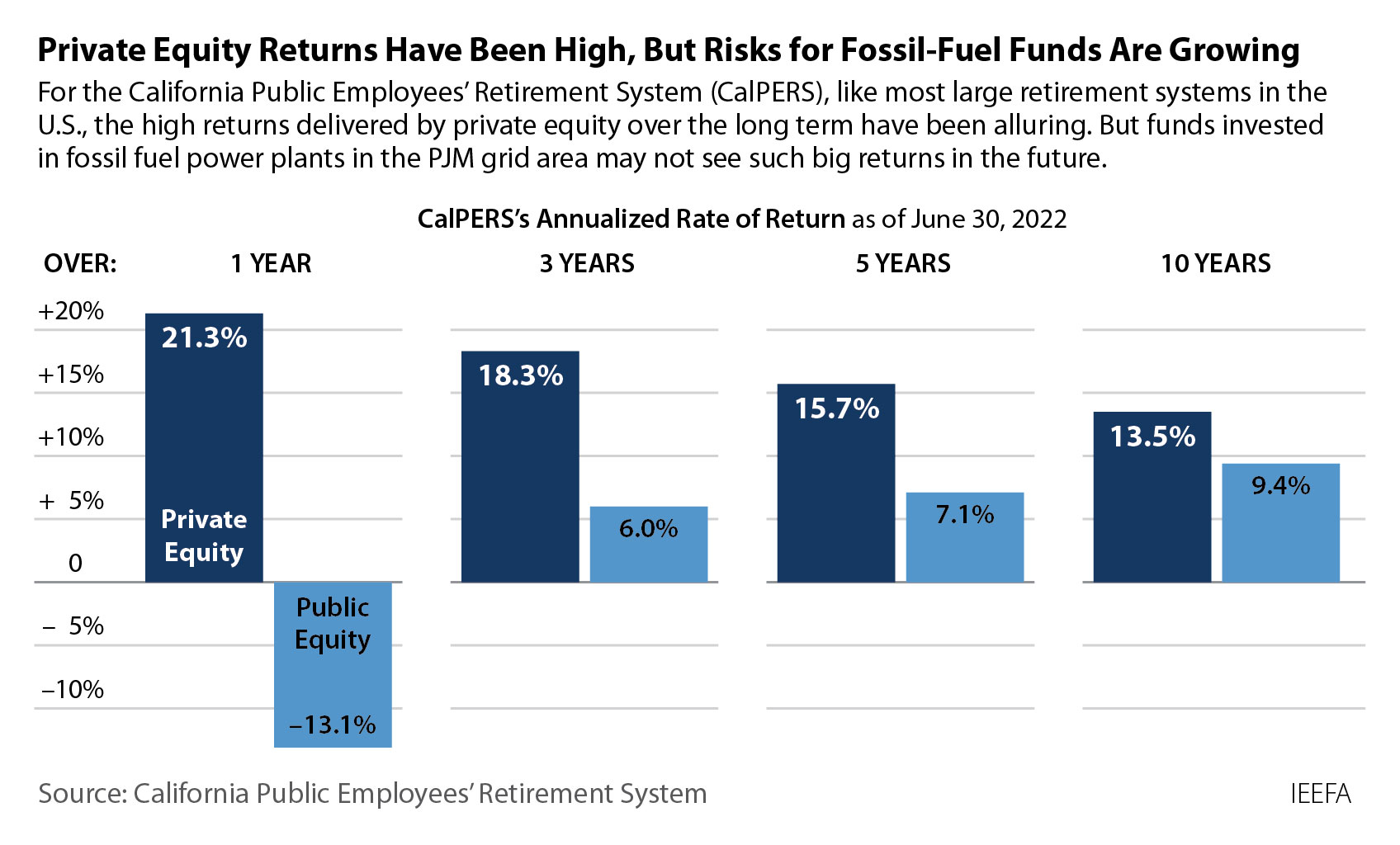

The changing regional power environment is likely to shift the outlook for pension funds and other institutional investors with holdings in private equity firms by lowering annual returns, raising investment risks, or both.

Beyond financial risks, investors face mounting reputational risks from their gas and coal investments as concerns increase about climate change and the negative impact of fossil fuel emissions.

The next few years could see additional performance problems at many of these infrastructure and PJM-focused funds, potentially lowering returns for investors.

It is a new, much riskier situation for private equity firms with holdings in the nation’s largest power market, and those risks are now trickling down to investors.

Private equity investment has reshaped PJM, the nation’s largest power market over the last decade, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

PJM delivers electricity to all or parts of 13 states and the District of Columbia, including Ohio, Pennsylvania, West Virginia, New Jersey, Maryland, and most of Virginia. Lower capacity payments, significant fines for poor performing plants last December, and looming market reforms have boosted risks for private equity firms and are also likely to squeeze financial returns for the state and corporate limited partners that have invested in infrastructure and other private equity funds with significant levels of fossil fuel assets in the region.

The IEEFA report, Private equity in PJM: New risks for limited partners, private capital, finds that the performance of several of these funds already lags peer benchmarks. The report focuses on the pension and retirement funds that have poured money into private equity in the past decade, and have generally seen those investments pay off. But the changing regional power environment is likely to shift the outlook for investors by lowering annual returns, raising investment risks, or both.

For example, results at three major PE funds with PJM-focused investments, ArcLight Energy Partners V and VI and Blackstone Capital Partners VII, have been significantly below similar funds since their inception—meaning the state and corporate pensions that invested in those funds likely are not doing as well as they had projected. And this is before the recent runup in regional risks fully begins to affect fund performance.

“The next few years could see additional performance problems at many of these PJM-focused funds,” said Dennis Wamsted, IEEFA energy analyst and author of the report. “While pension funds and other investors cannot pull out of these existing commitments, these new risks should be taken into account when considering future investments.”

Another issue facing investors highlighted in the report is the fallout from bankruptcy filings, in which firms end up owning assets they may not want. For example, Nuveen/TIAA now finds itself in that situation for the second time in three years, following the recent bankruptcy restructuring of Talen Energy, and the earlier bankruptcy restructuring of FirstEnergy Solutions, which became Energy Harbor.

Beyond these rising financial risks, investors face mounting reputational risks from their gas and coal holdings as concerns increase about climate change and the negative impact of fossil fuel emissions.

The report today on the increasing investor risk is the second of three. In its first report on the changing risk environment in PJM, IEEFA detailed the threats to private equity investors.