IEEFA U.S.: Financial rationale for Mountain Valley Pipeline has evaporated in changing market

March 8, 2021 (IEEFA) — A 303-mile pipeline that would move natural gas from the Appalachian Basin to markets in the eastern and southern U.S. is in financial jeopardy because of reduced demand projections and legal challenges, according to a report released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

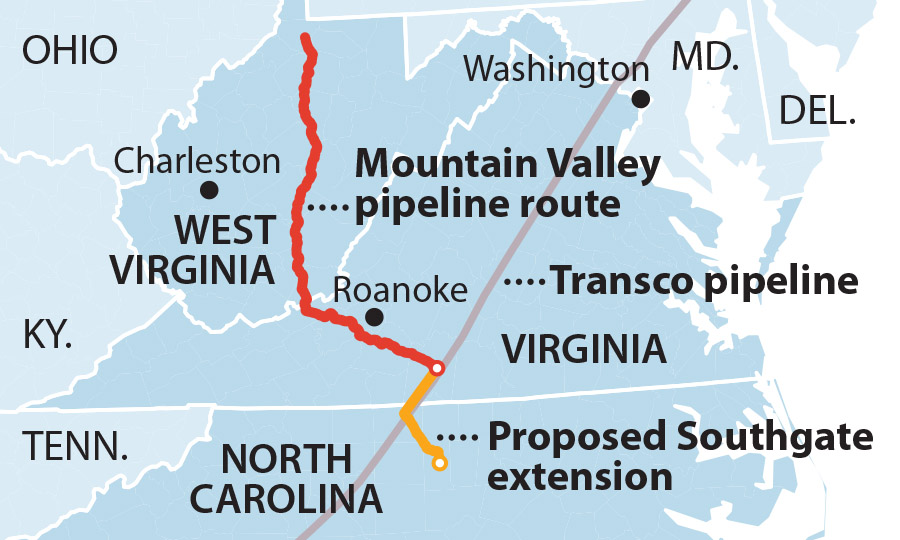

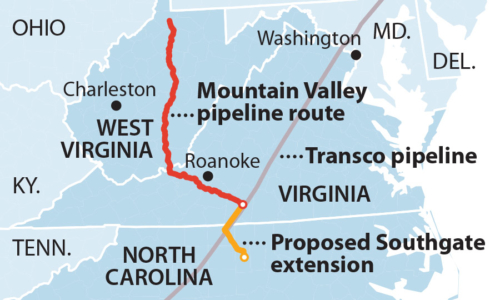

The Mountain Valley Pipeline, cutting across the fabled Appalachian Trail, would deliver natural gas from northern West Virginia to southern Virginia, connecting with another interstate pipeline that extends from Texas to New York.

The Mountain Valley Pipeline, cutting across the fabled Appalachian Trail, would deliver natural gas from northern West Virginia to southern Virginia, connecting with another interstate pipeline that extends from Texas to New York.

“Natural gas markets have changed since the Mountain Valley Pipeline was proposed,” said Cathy Kunkel, an IEEFA energy finance analyst and co-author of the report. “The pipeline faces a significant risk that its capacity is no longer needed.”

The IEEFA report found four primary reasons to be skeptical of the pipeline’s financial viability:

- Revised forecasts now predict lower natural gas demand than when the project was first proposed. The U.S. Energy Information Administration predicts gas demand will fall at least through 2030 in the Southeast and mid-Atlantic.

- The likely cancellation of the Southgate Extension, a spur meant to funnel gas from the Mountain Valley project to North Carolina, weakens the financial case for the pipeline. Public Service Company of North Carolina has signed up for 12.5 percent of the Mountain Valley capacity. But if a North Carolina permit denial is upheld in federal court, the extension can’t be built—and the utility can’t use the gas.

- Gas produced in the Appalachian Basin and shipped through the Mountain Valley Pipeline to an interstate connection known as the Transco Pipeline must now compete with cheaper sources of natural gas. Prospects for saving money with gas shipped through the Mountain Valley Pipeline are already on shaky ground; the construction costs of the project have soared 60 percent beyond original estimates, to roughly $6 billion.

- Liquified natural gas (LNG) exports to Asia and the Pacific may not offset declining domestic demand. Asian LNG demand is predicted to be lower than originally anticipated; lower-cost producers such as Qatar could undercut Appalachian gas; new U.S. LNG export terminals face financing challenges; and any new terminals also are likely to look for less-expensive alternatives to Appalachian Basin gas.

The IEEFA report notes that the pipeline was approved under a 21-year-old Federal Energy Regulatory Commission (FERC) policy that bases decisions entirely on the existence of commercial contracts to purchase gas, rather than the actual need for new sources of gas.

“The commission has persisted in its outdated process for evaluating pipeline need that does not consider a rapidly changing domestic natural gas market or the risks associated with growing LNG exports,” said Suzanne Mattei, an IEEFA energy policy analyst and co-author of the report. “FERC’s new leadership has recently signaled its intention to change course, and the vanishing financial case for the Mountain Valley Pipeline highlights the urgency of reforming FERC’s pipeline policy and practices.”

Full report: Mountain Valley Pipeline Faces Financial Plunge

Video explainer: https://youtu.be/ajrn0dI8dds

Author contact

Cathy Kunkel ([email protected]) is an IEEFA energy finance analyst.

Suzanne Mattei ([email protected]) is an IEEFA energy policy analyst.

Clark Williams-Derry ([email protected]) is an IEEFA finance analyst.

Media contact

Vivienne Heston ([email protected]) +1 (914) 439-8921.

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.