IEEFA report: Volts from the blue – floating solar to generate 900% more electricity across Asia-Pacific

July 1, 2020 (IEEFA) – Asia leads Europe in deploying floating solar, also known as floating photovoltaic (FPV), a new IEEFA report finds.

Energy finance analysts Sara Jane Ahmed and Elrika Hamdi note that power demand in the Philippines and Malaysia has dropped by as much as 16% during the COVID-19 lockdown, causing extreme stress to electricity grids due to excess power, although such falls have been smaller in Vietnam and Singapore where the pandemic measures have been less stringent to date.

“If the COVID-19 outbreak is to teach one lesson, it would be that utility companies need agile operations, not outdated power stations that burn coal 24/7 and cannot respond quickly to sudden changes or outages,” says Ahmed.

“OUR RESEARCH SHOWS MORE AND MORE ASEAN COUNTRIES ARE BUILDING SOLAR FARMS that float on rivers, dams, lakes and reservoirs – even the sea – to produce clean electricity at prices that can compete with power from polluting coal-fired plants.”

Solar farms are best when installed near hydropower facilities and able to piggyback existing connections to electricity grids, according to the report. Floating solar power can also balance out the peaks and troughs of consumer demand in complex electricity systems.

“The combination of floating solar and hydro on existing dams and reservoirs trumps the economics of adding new baseload coal-fired power plants on grid systems such as the Java-Bali network that already have generation overcapacity,” says Hamdi.

Floating solar installations have shown they can withstand typhoons, powerful waves, and winds gusting up to 170 kilometres an hour, with offshore FPV now being tested by manufacturers.

“FURTHER, WATER-BORNE SOLAR INSTALLATIONS ARE MUCH QUICKER TO BUILD than fossil-fuelled power stations and can be ready in a matter of months, while coal, gas, hydro generators take up to three years to build, and nuclear plants take much longer,” says Hamdi.

The first FPV system was built in 2007 in Aichi, Japan, while China is the largest FPV player. At the end of 2018, both Japan and China had a combined FPV installed capacity of 1.3GW. Vietnam has installed 47MW of FPV, and most recently, India’s largest power generation firm, National Thermal Power Corporation (NTPC), confirmed it has 200MW of FPV under development across four sites, making it one of the largest developers in the world.

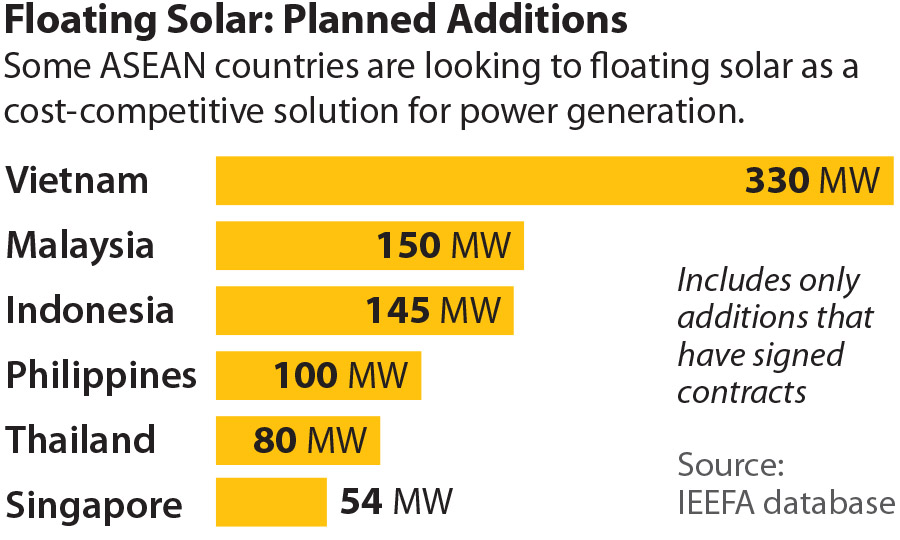

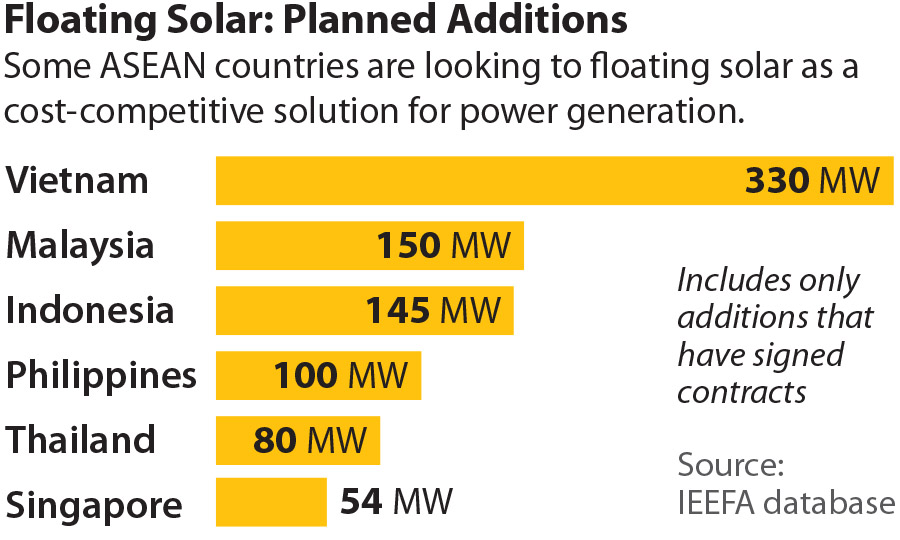

Up to 2019, total installed capacity of FPVs among ASEAN countries was mostly below 1MW. This has changed drastically with at least five countries recently announcing large-scale floating solar plans:

- Singapore: in February 2019, Singapore’s Cleantech Solar announced the completion of a 9.8MW solar installation that includes a mix of rooftop solar and 2.8MW of FPV on a water reservoir to power Cambodian cement manufacturer Chip Mong Insee Cement Corporation (CMIC). Singapore’s water authority, the Public Utilities Board (PUB) procured 50MW of FPV on the Tengeh Reservoir in July 2019, with a targeted operational date of 2021. PUB is also in the process of implementing two smaller 1.5MW FPV systems on the Bedok and Lower Seletar reservoirs.

- Thailand: In June 2019, Thailand’s EGAT issued an invitation for 55.5MW of FPV on the Sirindhorn Dam, co-located with the existing 12MW Sirindhorn Hydropower Plant. Thailand’s EGAT is also planning for a second FPV with a capacity of 24MW on the Ubol Ratana Dam. Then in January 2020, a consortium comprised of Thailand’s B Grimm Power Plc and Energy China was awarded a contract to build 45MW of FPV on the Sirindhorn Dam by EGAT.

- Malaysia: In August 2019, Malaysia’s Pestech entered a partnership with China’s inverter maker Sungrow to jointly develop FPV solutions in the region, while in October 2019 Chinese solar manufacturer Risen Energy Co. Ltd secured a contract to supply 150MW of PV modules to power a floating PV park.

- Vietnam: In October 2019, Vietnam’s Da Nhim–Ham Thuan–Da Mi (DHD), a subsidiary of national utility EVN which owns and operates hydro plants, commissioned 47.5MW of FPV, with a targeted increase of 330MW more in an area where 1MW alone may be able to light 165 homes.

- Philippines: In October 2019, Philippines’ Meralco Powergen Corp, a subsidiary of the country’s largest utility company, announced its plans to build 110MW of FPV on Laguna Lake.

- Indonesia: In January 2020, Indonesia’s state-owned PLN utility company signed an FPV deal with UAE’s Masdar for a targeted 145MW.

For Southeast Asian countries such as the Philippines, Indonesia, Thailand, and Vietnam, the decision to install FPVs is based primarily on the economics of existing grid infrastructure and the issue of land scarcity.

“Focusing on the economics of generation assets in isolation does not make sense because of the need to invest in transmission lines. A grid-level solution, considering the cost of generation plus transmission requirements, is key,” says Ahmed.

IT IS POSSIBLE TO GET COMPETITIVELY PRICED GENERATION through technology-specific auctions of power, and Southeast Asia stands to benefit.

Clean energy sources such as floating solar power can help insulate coal-importing ASEAN countries from the risk of volatile fuel prices and the expensive supply logistics of the global fossil fuels market.

“The geography and demographics of ASEAN present a distinctive opportunity for floating solar,” says Hamdi.

Read the report: Volts from the Blue – Is Combined Floating Solar and Hydro the Energy Solution for ASEAN?

Media contact: Kate Finlayson [email protected] +61 418 254 237

Authors: Sara Jane Ahmed ([email protected]) and Elrika Hamdi ([email protected]) are IEEFA energy finance analysts.

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.