IEEFA Indonesia: DME coal gasification project could lose US$377 million annually

10 November 2020 (IEEFA Indonesia): A proposed coal gasification plant for Sumatra could lose US$377 million dollars annually, finds a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

Author and energy finance Analyst Ghee Peh says that with the COVID-induced economic contraction, this is not the time to be subsidizing a downstream energy project that doesn’t make economic sense.

“Prices are now below breakeven for all but one of 11 listed Indonesian coal companies,” says Peh.

“Into this environment, subsidizing a new loss-making coal gasification plant to produce DME would be hard to justify.”

State-owned Tambang Batubara Bukit Asam’s (PTBA) is proposing a US$2 billion coal gasification plant to produce methanol and subsequently dimethyl ether (DME). DME would then be used as a direct substitute for Indonesia’s liquefied petroleum gas (LPG) imports.

Replacing LPG with DME does not make economic sense

IEEFA estimates that the proposed DME plant would lose US$377 million annually after operating and finance costs. This would exceed any savings from lower LPG imports by US$19 million.

Peh says replacing LPG with DME does not make economic sense.

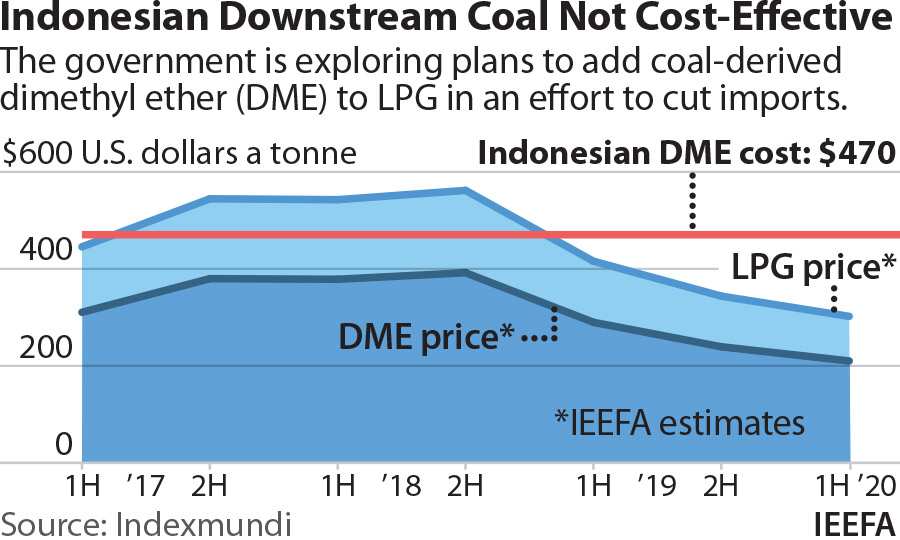

“Our calculations show the production cost of DME will be nearly twice that of current LPG import price,” says Peh.

“The total per tonne cost of the DME plant would be US$470/tonne – nearly twice what Indonesia pays for LPG imports, which is used mainly for household cooking.

“The Indonesian government, already bearing the brunt of calls for economic relief and bail-out from the coal industry, does not need another project taking its bank balance into the red.”

We estimate annual losses of US$377 million

Peh notes the proposed DME project has already generated discussions around its economic viability in a webinar ‘Indonesia Coal Downstream outlook – Where to go?’ held last week and organised by Coal Asia and Petromindo.

“IEEFA would like to add to the debate,” says Peh. “Although technically viable, we estimate annual losses of US$377 million. The DME project is not economically viable.

“Technical viability is not the same as economic viability. The DME project doesn’t make economic sense.”

Read the report: Proposed DME Project in Indonesia (D)oes Not (M)ake (E)conomic Sense – Annual Losses Will Be US$377 million, Costing More Than LPG Import Savings

Media contact: Kate Finlayson ([email protected]) +61 418 254 237

Author contact: Ghee Peh ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)