IEEFA: Coal lock-in in Southeast Asia presents a challenge for the Asian Development Bank’s coal retirement plan

10 December (IEEFA Asia): In August, the Asian Development Bank (ADB) announced an ambitious plan to buy high emissions coal-fired power plants in Southeast Asia and retire them within 15 years through an energy transition mechanism (ETM). According to the Institute for Energy Economics and Financial Analysis’ (IEEFA) latest report, if the ETM is not designed correctly, it could potentially prolong the life of – and the emissions from – these coal-fired power plants.

“Coal retirement will be crucial to Southeast Asia’s energy transition. However, this will be difficult without far-reaching market shifts, and there are numerous issues that policymakers and market participants must address to design any effective decarbonization plan,” says report author and IEEFA Research Associate, Haneea Isaad.

“IEEFA has long been focused on the issue of coal lock-in, particularly how the reliance on long-term power purchase agreements (PPAs) to support coal power investments restricts the ability of regional governments to shed high-emissions coal assets without severe financial damage.”

The issue of coal lock-in can be defined as a state of an energy system where high capacities of coal-fired power plants are present in the energy system, backed by long-term financial agreements which cannot prematurely end. This discourages alternate forms of power generation, even if they are more economically viable.

“If the ETM is not designed properly, there is a high risk that it would merely provide cash flows to ageing power plants nearing retirement already, or worse, prolong the life of polluting assets by giving them an additional grace period to retire,” says Isaad.

Coal retirement will be crucial to Southeast Asia’s energy transition

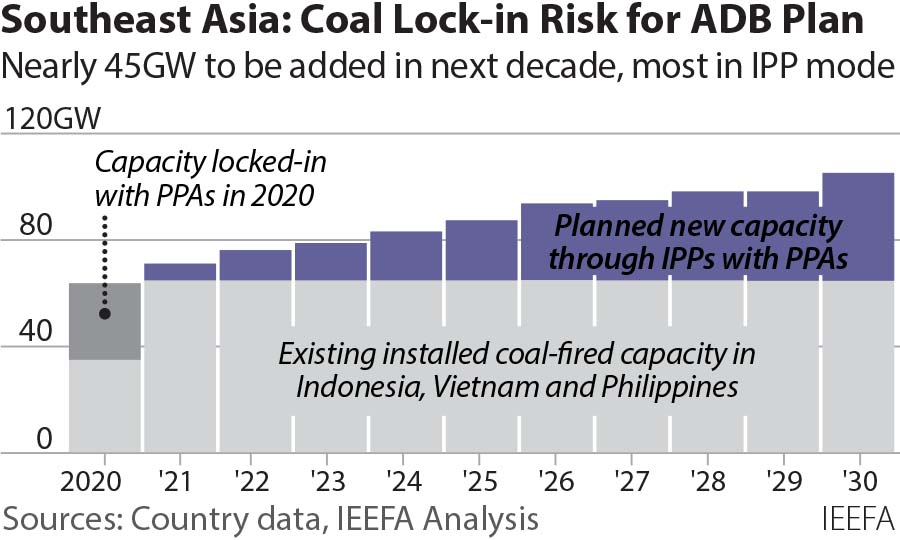

Vietnam, Indonesia, and the Philippines have come into the spotlight as the first three countries chosen by the ADB to pilot its ETM. However, these three countries must navigate a challenging course, given the complex nature of their coal lock-in.

IEEFA’s latest report analyses the current coal-fired capacity in Vietnam, Indonesia, and the Philippines, and maps out how this coal lock-in could occur. The report also investigates sources of financing for these coal-fired power plants in these three countries, and analyses what this lock-in could mean for early retirement programs like the ADB’s ETM.

“The scale of coal pipelines in Southeast Asia illustrates the reality that coal lock-in will only get worse if business continues as usual,” says Isaad.

“The nature of the lock-in itself, with support from sovereign guarantees and long-term off-take requirements baked into power purchase agreements, will ensure that these coal power plants live out their technical lifetime.”

The high ambitions set out by the ETM are to be appreciated

“Governments and multilateral banks, such as the ADB, have been ramping up their efforts to deliver innovative market mechanisms to accelerate retirement. Still, these schemes look easier to execute on paper than in reality.”

The ADB’s mechanism envisions the retirement of almost 50% of the coal-fired power plants in Indonesia, Vietnam, and the Philippines. The high ambitions set out by the ETM are to be appreciated, but the fact that Southeast Asia is not a homogeneous region and has diverse individual power markets cannot be ignored. In Vietnam and Indonesia, state-owned power companies have their own vested interests in continued coal power development.

The three countries also have a high share of coal in their power generation mix. In 2020, fossil fuels dominated Indonesia’s power generation, with coal accounting for 62.8% of the total power produced. In Vietnam, coal produced 48.1% of the total power generated in 2020, while in the Philippines, the figure was 57%.

Both Vietnam and Indonesia have domestic sources of coal. The Philippines also continues to rely on coal to serve its baseload power needs, importing 75% of the coal consumed from Australia and Indonesia.

Indonesia, Vietnam, and the Philippines have substantial coal pipelines

The long-standing dependence of the three countries on coal-fired generation has been compounded by the recent addition of large sub-critical units over the past decade, especially in Vietnam.

The high mix of sub-critical facilities has negative implications for carbon emissions and air pollution, because they lack the technological improvements of more recent ultra-supercritical facilities.

IEEFA’s analysis reveals that 17.5 gigawatts (GW) of coal-fired capacity in Vietnam is less than ten years old, accounting for 83% of the total installed coal capacity. In Indonesia, 66% (20.7GW) of the total installed coal-fired capacity is less than ten years old, and in the Philippines, the figure is 58% (6.4GW).

All three countries have substantial coal pipelines expected to come online in the next decade, with direct support from their governments. Combined, they have a coal pipeline of almost 45GW, frontloaded towards the first half of the decade.

Vietnam will have the largest additions in terms of absolute capacity, with almost 29GW of planned coal-fired capacity expected by 2030. Most of this planned capacity will be brought online through independent power producers, resulting in further lock-in through binding power purchase agreements and sovereign guarantees.

This entrenched coal lock-in may not be simple to navigate around

“IEEFA’s analysis reveals that in 2025, much of the planned capacity will be realized if plants currently under construction are brought into operation on schedule in Indonesia and Vietnam,” says Isaad.

“The scale of the lock-in becomes significantly larger, as the fleet’s size under ten years exceeds 25GW in Vietnam, 22GW in Indonesia, and 8GW in the Philippines.”

The Technical Assistance Report prepared for the ADB ETM prioritizes mature assets aged 6-15 years for retirement. Owners of identified assets are likely to opt for a full valuation of their remaining lifetimes when transferring it to a third party for retirement.

This has direct implications for the optics of the ADB’s ETM scheme in terms of worsening the lock-in. Governments, such as Indonesia, will seek concessionary financing for coal retirement, while they could commission and, in some instances, subsidize new long-lived coal power assets.

As older and mature coal-fired power plants would be retired through the ADB ETM mechanism, a new cohort of younger plants aged less than five years would enter the generation mix, backed by long-term power purchase agreements, and there to stay for at least the next two decades.

“This entrenched coal lock-in may not be simple to navigate around,” says Isaad.

“A thorough study of these markets is needed to ensure that early retirement programs are transactional and deliver the desired result, targeting appropriate assets and meeting the expectations of various stakeholders involved.

Read the report: Coal Lock-In in Southeast Asia

View the presentation here.

Media contact: Paige Nguyen ([email protected]) Ph: +61 433 048 877

Author contact: Haneea Isaad, Research Associate ([email protected])

*Author is available for media interviews and background briefings*

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)