IEEFA: China, Japan and South Korea stand to gain most from increased scrap steel recycling

17 December (IEEFA Australia): Investors are increasingly pressuring global steel companies to set out credible decarbonisation plans and these demands will only intensify. A significant trend that will lower emissions will be the expansion of scrap steel recycling, says a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

“Steel recycling is mature and cost-competitive,” say the report’s authors, IEEFA analysts Simon Nicholas and Soroush Basirat.

“The quality of steel made from recycled scrap is on the rise even as carbon emissions from the process are poised to drop further with the continuing roll-out of renewable energy.”

In 2020, global crude steel production was 1.88 billion tonnes – nearly three-quarters of that came from the energy- and carbon-intensive integrated blast furnace and basic oxygen furnace process (BF-BOF).

Recycled scrap steel can be used in electric arc furnaces (EAFs) to produce new steel. The scrap-EAF method, also called secondary steelmaking, does away with the need for iron ore or coking coal. An electric arc furnace is charged with steel scrap where it is melted to form new steel. The electricity required can be sourced from renewable energy, reducing carbon emissions for the process to almost zero.

In 2020, steel produced from EAFs amounted to 26% of total global crude steel production, the bulk of it from the secondary scrap-EAF process.

The steel sector directly emits an estimated 7% of global pollution. There has been much recent focus on the potential use of green hydrogen to produce direct reduced iron (DRI) to decarbonise production but, the analysts say, cost-competitive green hydrogen to use at scale is years away.

The energy consumption of BF-BOF processes is almost 10 times that of scrap-EAF

“Meanwhile, the use of scrap steel in electric arc furnaces is already a widely practised, lower-emission steel production method,” their report says.

“It is not on its own a solution to fully decarbonise the steel sector,” Nicholas says, “but it is poised to help the global steel sector reduce emissions for the rest of the 2020s and in following decades.”

Basirat says: “The energy consumption of BF-BOF processes is almost 10 times that of scrap-EAF. In addition, the direct emissions of a BF-BOF process using iron ore and coal are 30 times higher than a scrap-based process.”

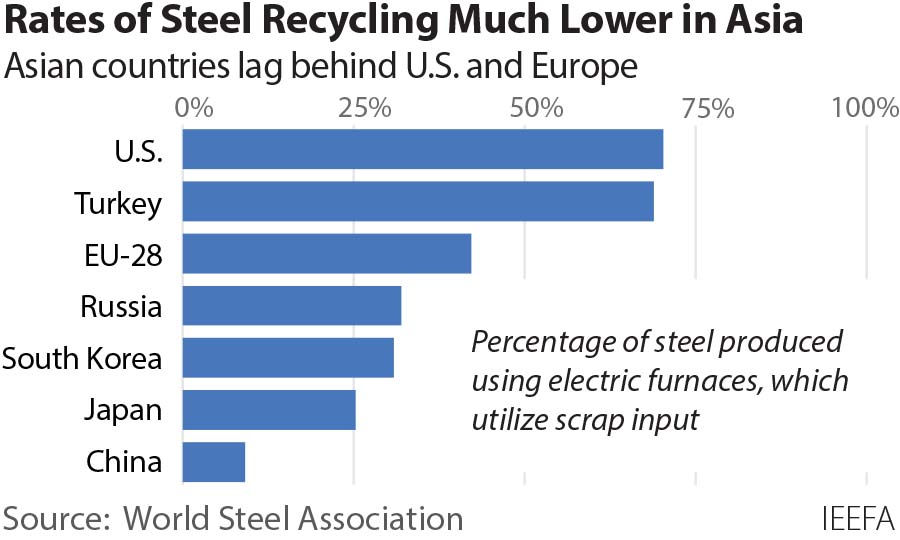

Steel production by the scrap-EAF route is by far the largest source of new steel in the U.S., assisted by the high availability of scrap in such a large and mature economy. In 2020, 71% of total crude steel production in the U.S. was via EAFs. In the EU, the figure was 42%.

This strongly hints at the potential for more scrap use in economies such as China, Japan and South Korea where steel recycling rates are much lower than the U.S. and the EU.

The analysts examine the prospects for China, which is by far the world’s largest steel producer.

By 2060, China aims to produce the majority of its steel via the scrap-EFA route

In 2020, China produced 57% of the world’s crude steel with 91% manufactured via the BF-BOF process. Just 9% was produced via EAFs.

By adopting steel recycling, China would improve its resource security by reducing its reliance on Australia’s iron ore and coking coal. Beijing already has a ban on Australian coal imports in place and has recently resumed scrap steel imports. Scrap steel consumption surged 47% to 138 million tonnes in the first half of 2021.

Under the International Energy Agency’s Announced Pledges Scenario (APS) – which reflects China’s targets to reach net zero emissions in 2060 and peak carbon emissions before 2030 – output from scrap-based EAFs nearly doubles by 2030 and more than triples by 2060. By 2060, the majority of steel in China would be produced via the scrap-EAF route under this scenario.

The IEA also sees crude steel production in China peaking in the mid-2020s and dropping 40% by 2060 compared to 2020 levels. China’s current policy of capping steel production within the previous year’s level looks set to continue – so China already could have reached peak production, in 2020.

Steelmaking via scrap-EAF does not use iron ore or coking coal … Australia is the largest exporter of both

As steelmaking via scrap-EAF processes does not use iron ore or coking coal, Nicholas and Basirat say, there are clear, long-term implications for exporters of these resources. Australia is by far the largest exporter of both.

There is debate over the potential for using scrap steel in producing some of the highest-quality grades, due to impurities such as copper, but these grades comprise a small portion of overall steel mill production.

In 2020, the share of the automotive sector – the most quality-sensitive category – was only 12% of total global steel consumption. The bulk of global steel production is for building and infrastructure products where impurities are less of an issue and these can be manufactured via scrap-EAF processes.

In addition, technology advancements mean that the scrap-EAF steelmaking process is now being used to make even the highest-quality automotive steel in the U.S.

Read the report: New from Old: The Global Potential for More Scrap Steel Recycling

Media contact: Roz Hutt ([email protected]) +61 406 676 318

Author contacts: Simon Nicholas ([email protected]) and Soroush Basirat ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org