Peabody Energy’s much-publicized announcement that both its incoming and outgoing chief executives will take 10 percent pay cuts this year is mostly a public-relations stunt—and a transparent one at that.

In a filing with the Securities and Exchange Commission dated April 20, the company said the two men—CEO Gregory H. Boyce and CEO-Elect Glenn L. Kellow—recently asked Peabody to lower their base salaries “in light of current business conditions and to align on a personal level.”

It’s not much of an alignment, as we note in a briefing paper we published today, amounting to the grand sum of $218,000 when all is said and done, a drop in the total Boyce-Kellow compensation bucket. Both of the executives get the vast proportion of their multi-million dollar payouts—deserved or not—in stock and stock options, deferred compensation and bonus money.

The $123,000 reduction in Boyce’s base salary amounts to less than 1 percent of the total $10,994,083 he was paid last year. Kellow’s compensation package is similarly structured, so the bottom line is that both Boyce and Kellow are foregoing far less than 10 percent of their total compensation.

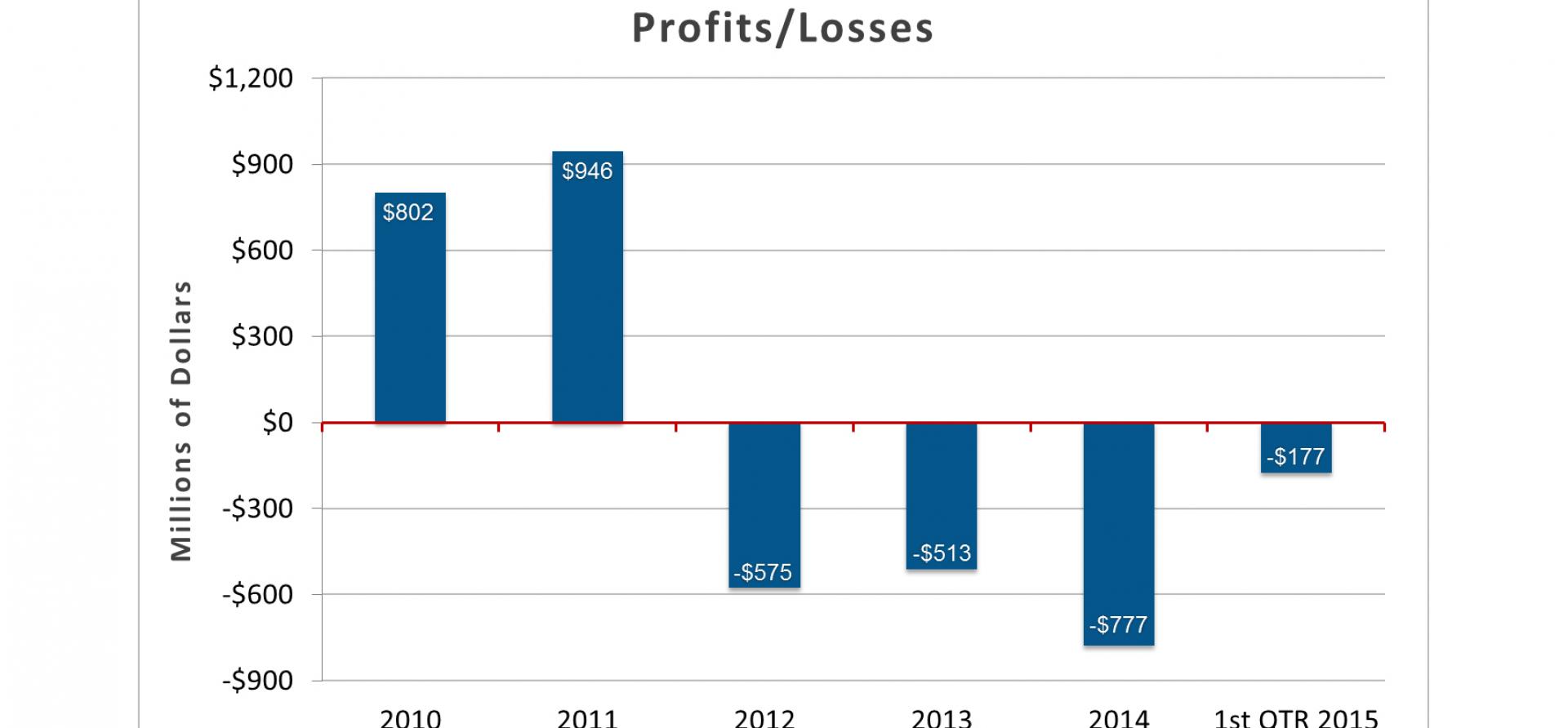

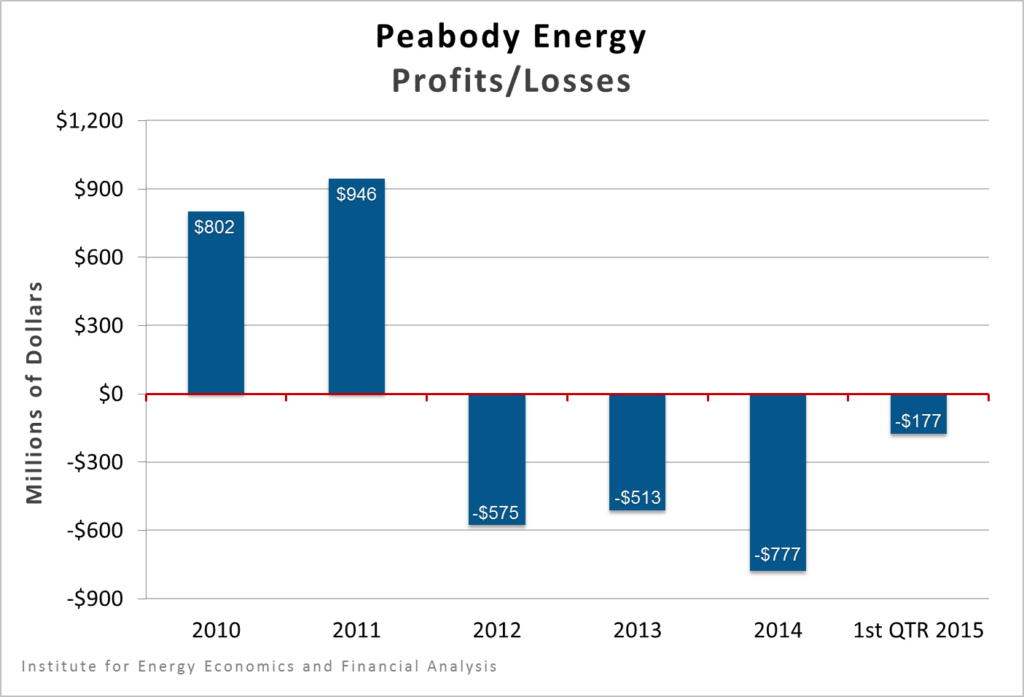

Meantime, the company has hit the skids and continues to decline:

- It has reported more than $2 billion dollars in net losses since 2011.

- Its $176.6 million loss in the first quarter of this year was more than three times the losses it reported in the first quarter of last year.

- Its stock has dropped 93 percent in value from $63.98 per share since the end of 2010 to $4.49 at Friday’s closing bell.

As the carnage has unfolded, investors have lost more than $16 billion.

And while Boyce and Kellow reap millions, Peabody employees face the potential loss of their jobs, not to mention their retirement and insurance benefits.

In its third-quarter earnings report last week Peabody said it has reduced its global workforce by more than 20 percent over the past three years and that it will continue to drive down operating costs in hopes of increasing productivity. These moves will most likely translate into layoffs, especially in light of Peabody’s new projection that its U.S. domestic coal sales this year will be 10 million tons lower than forecast. The company is saying now, too, that it seeks a leaner structure through office closures and other changes that suggest more layoffs.

Moreover, the promises Peabody has made to provide health care and life insurance benefits to retired employees and their dependents remain entirely unfunded. The company has failed to set aside $839.1 million in retirement-benefit obligations (as of the most recent numbers, from the end of 2014), and the neglect extends to Peabody Investment Corp., a subsidiary that has failed to fund $167.7 million of its pension obligations to Peabody retirees.

Retired employees will be left on their own if the company either goes bankrupt or offloads the obligations to a new corporate entity that would try to avoid making good. That’s what happened when Peabody spun off Patriot Coal Corp. in 2007.

We’re hardly alone in our assessment—and our skepticism. This spring, the proxy advisory firm Glass Lewis & Co. gave Peabody an F on its 2014 pay-for-performance compensation plan. The firm is recommending due to “pay and performance disconnect” that shareholders vote no during Peabody’s annual meeting next week on the company’s executive compensation plan. Glass Lewis & Co. notes also that Peabody has been paying its CEO more than the median CEO compensation of peer while the company’s performance lags peers.

The long and the short of it is that Peabody’s top executives grow wealthier staging self-sacrifice charades while investors, current employees and retirees face extreme risks from which Boyce and Kellow are well buffered.

David Schlissel is IEEFA’s director of resource planning analysis.