‘Renewable gas’ campaigns leave Victorian gas distribution networks and consumers at risk

Download Full Report

View Press Release

Key Findings

Campaigns to promote ‘renewable gas’ could leave Victoria’s gas distribution networks exposed to significant reputational and legal risk, which should be considered by financiers.

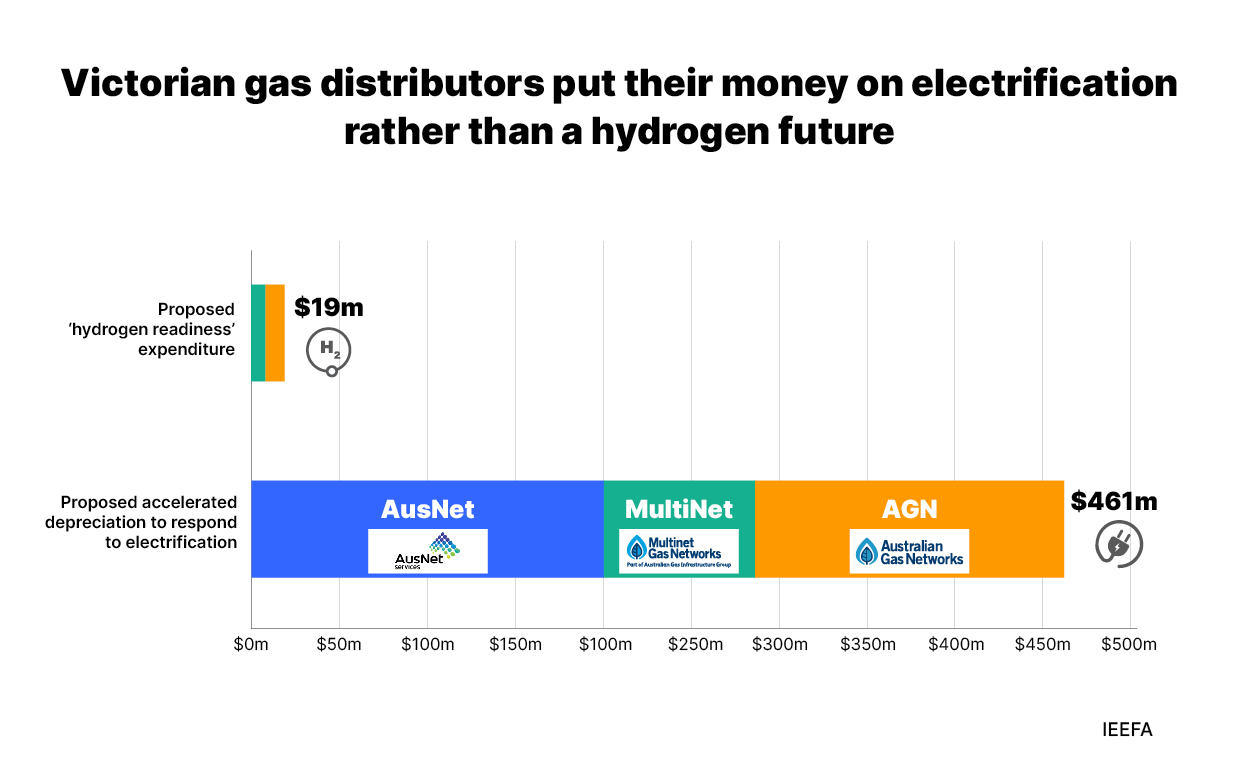

The ‘renewable gas’ future the gas distributors promote is at odds with proposed plans they have submitted to the regulator, which include A$461 million in risk mitigation for an electrified future, compared with A$19 million for ‘hydrogen readiness’ activities.

Australia’s governments and regulators should work to protect consumers from potential stranded investments in gas appliances and in gas distribution network assets.

Gas distribution networks and their industry representative bodies have been promoting the message to households that their gas network infrastructure will continue to be used under a transition to net zero emissions. They have asserted that gas distribution networks will likely be repurposed to deliver ‘renewable gas’ to homes, derived from either biomethane or hydrogen, instead of the current supply of fossil gas.

These campaigns are inconsistent with the compelling evidence that electrification is the best option for decarbonising household fossil use.

These campaigns are inconsistent with the compelling evidence that electrification is the best option for decarbonising household fossil use. Electrification would cost less than switching to biomethane or hydrogen. Moreover, there are serious technical constraints to relying on biomethane or hydrogen for household energy use; by contrast, electric appliances for cooking, space heating and water heating are mature and already widely used by many Australian households.

Especially concerning is the fact that the messages presented in Victorian gas distribution networks’ ‘renewable gas’ campaigns appear inconsistent with their own statements to regulators, their investment plans, the opinion of the regulator and energy market consumer representatives.

Victoria’s gas distribution networks have requested to recover an additional A$461 million in accelerated depreciation costs from consumers over the next five years, of which A$333 million was granted by the Australian Energy Regulator (AER), equal to nearly 7% of their total asset base. Accelerated depreciation in gas networks was first argued for in 2020 by the Australian Gas Infrastructure Group (AGIG) for its Dampier Bunbury gas pipeline in Western Australia. AGIG argued that the improving economics of renewable electricity, combined with government emissions policies, were likely to lead to a decline in demand for fossil gas supplied through their network, leading to asset stranding risk.

Meanwhile, the networks have proposed only very modest expenditure, A$19 million, on preparing their networks for hydrogen, which the regulator allowed despite finding that it was non-conforming with respect to the National Gas Laws. An additional A$6 million in proposed operating expenditure is on ‘renewable gas’ promotional campaigns, to be partially charged back to consumers.

The Institute for Energy Economics and Financial Analysis (IEEFA) believes that gas distribution networks may be exposing themselves to substantial risks by encouraging consumers to continue to purchase gas appliances under the belief they will be useful under a low-emissions future due to ‘renewable gas’. Promotional campaigns have not clearly acknowledged the low likelihood of a significant role for ‘renewable gas’ in distribution networks, and that the dominant policy direction is towards electrification in homes. The Australian Consumer and Competition Commission (ACCC) has issued warnings for businesses engaging in misleading conduct, and Victoria’s gas distribution networks could be at risk of an investigation into their ‘renewable gas’ campaigns.

Furthermore, the size of investments made by customers who continue to buy gas appliances is likely to number in the billions of dollars. In the likely event that a ‘renewable gas’ future does not eventuate, attempts to recover some of these sunk costs by legal means could have highly material financial consequences for the network businesses. In IEEFA’s opinion, financiers should consider these risks in their allocation of capital.

Governments and regulators should also act to protect consumers, by ensuring that the networks’ campaigning activities are lawful under Australian consumer law, and that expenditure on ‘renewable gas’ activities is not approved where it is not in the long-term interests of energy consumers.