‘Renewable gas’ in Victoria - does it add up?

Consumers risk being saddled with excess costs amid muddled messaging from gas distribution networks

Key Takeaways:

Campaigns to promote ‘renewable gas’ could leave Victoria’s gas distribution networks exposed to significant reputational and legal risk, which should be considered by financiers.

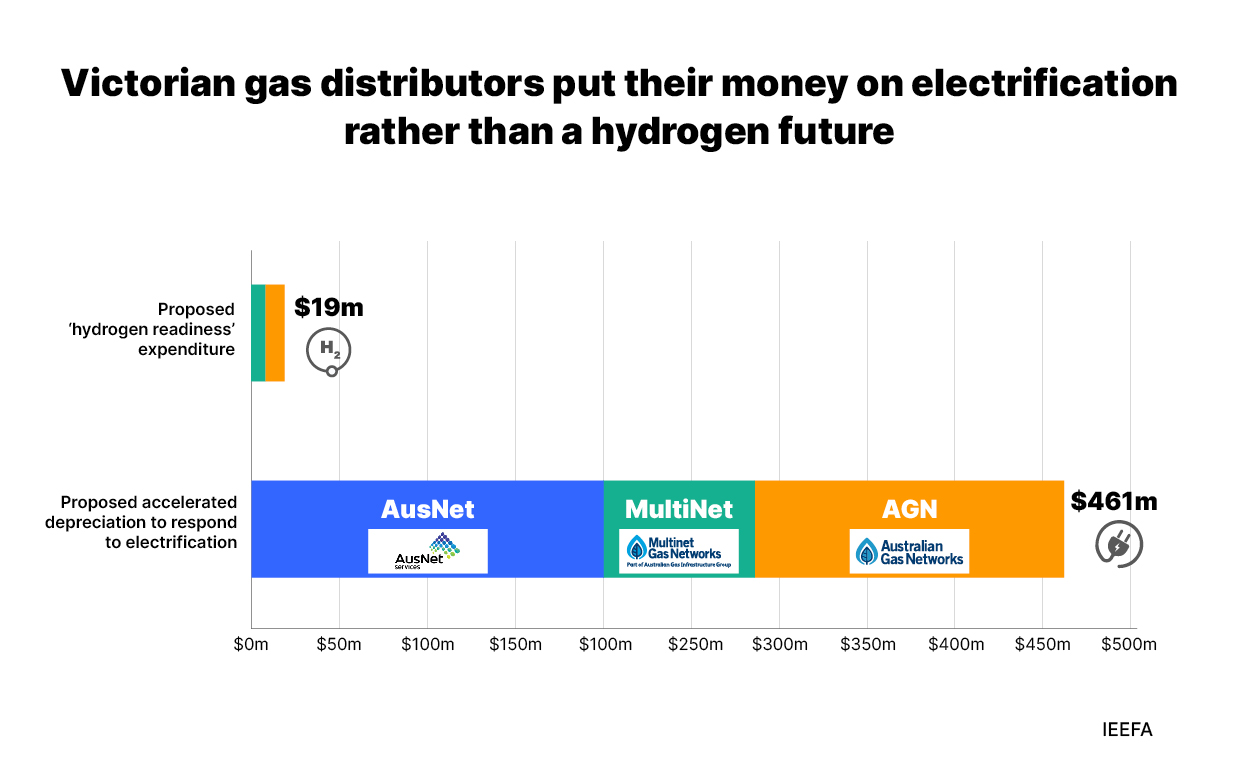

The ‘renewable gas’ future the gas distributors promote is at odds with proposed plans they have submitted to the regulator, which include A$461 million in risk mitigation for an electrified future, compared with A$19 million for ‘hydrogen readiness’ activities.

Australia’s governments and regulators should work to protect consumers from potential stranded investments in gas appliances and in gas distribution network assets.

17 August 2023 IEEFA Australia: Victoria’s gas distribution networks have been promoting ‘renewable gas’ to residential customers as a viable future energy supply option under a transition to net zero emissions. However, according to the Institute for Energy Economics & Financial Analysis (IEEFA), the networks’ own financial plans are at odds with this messaging, and leave consumers at risk.

The gas distribution networks are claiming their infrastructure can be repurposed to deliver ‘renewable gas’, derived from either biomethane or hydrogen, instead of the fossil gas currently used, but IEEFA research reveals a disparity between these claims and the networks’ actual financial plans. A mere A$19 million has been allocated to expenditure on ‘hydrogen readiness’, with a further A$6 million proposed for ‘renewable gas’ promotional campaigns. Meanwhile the networks have requested to recover A$461 million in accelerated depreciation costs over the next five years, in what appears to be a move to recover their costs before significant numbers of customers disconnect in favour of electricity.

Jay Gordon, IEEFA Research Analyst and co-author of the report, says, “The messages presented in the Victorian gas network campaigns appear to be inconsistent with their own investment plans and their statements to regulators. The networks have proposed only modest investment to prepare their networks for hydrogen. This proposed expenditure is dwarfed by the additional cost recovery they have asked for via accelerated depreciation, to mitigate their asset stranding risks. Moreover, a quarter of their proposed expenditure is on ‘renewable gas’ campaigns, which would be partially charged back to consumers.”

The campaigns are also at odds with the networks’ statements to the Australian Energy Regulator (AER), which suggest an awareness that electrification is the most likely path for household energy supply in a net-zero future. While biomethane and hydrogen may play a targeted role in certain industrial applications, both of them face serious practical and technological constraints that would impede their use as a household energy source. Switching to all-electric appliances in the home would be significantly cheaper and more efficient, as well as having none of the health concerns associated with domestic gas use.

While the gas distribution networks are already making plans to cover their losses resulting from the energy transition, their promotion of ‘renewable gas’ leaves consumers and other network stakeholders exposed to unnecessary risk. For residential customers in particular, the campaigns could serve to encourage them to continue to purchase gas appliances in the belief that there is a long-term future for their domestic gas supply. These appliances, most of which would not be compatible with hydrogen anyway, would likely become obsolete before the end of their life.

The networks themselves could also face legal and reputational risk as a result of their promotion of ‘renewable gas’. The Australian Consumer and Competition Commission (ACCC) has issued warnings for businesses engaging in misleading conduct, and the networks could be at risk of investigation into their ‘renewable gas’ campaigns. In addition, should the networks fail to deliver on their ‘renewable gas’ promises, consumers who purchased appliances under the advice of those campaigns will be left with significant sunk costs, which they may seek to recover via legal means.

IEEFA argues that investors should consider these risks in their allocation of capital. In addition, it calls on governments and regulators to act to protect consumers’ interests.

Kevin Morrison, IEEFA oil and gas analyst and co-author of the report, says, “So far governments and regulators have done little to protect consumers against overly optimistic information about the long-term future of gas networks. They should act now to ensure that the networks’ campaigning activities comply with Australian consumer law, and that expenditure on ‘renewable gas’ activities is not approved where it is not in the long-term interests of energy consumers.”

Read the report: ‘Renewable gas’ campaigns leave Victorian gas distribution networks and consumers at risk

Media contact: Amy Leiper [email protected] 61 (0) 414 643 446

Author contacts: Kevin Morrison [email protected] and Jay Gordon [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)