Letter to U.S. Dept. of Labor on retirement savings and climate-related financial risks

Download Full Version

Key Findings

Pension funds should be required to consider and disclose a defensive asset allocation strategy to address climate change, according to IEEFA.

May 10, 2022

Office of Regulations and Interpretations

Employee Benefits Security Administration, Room N-5655

U.S. Department of Labor

200 Constitution Avenue, NW

Washington, D.C. 20210

Re: Z-RIN 1210-ZA30

Request for Information on Possible Agency Actions

The Department of Labor (DOL) is seeking information in furtherance of its work related to retirement savings and climate-related financial risks. The Department is acting through the Employee Benefits Security Administration (EBSA) under authority created by the Employee Retirement Income Security Act of 1974 (ERISA) and the Federal Employees Retirement System Act of 1986 (FERSA) and other pension- and savings-related law. FERSA is the governing statute that guides the Federal Retirement Investment Board (FRTIB) and the Thrift Savings Plan (TSP).

EBSA poses 22 areas for comment for plan sponsors and other interested parties related to the management of climate change risk by plan sponsors, and the investment funds and surrogates who are under contract to assist with investment decisions.

The working assumption of Executive Order 14030 is that climate change poses a material risk to the value of investment portfolios with holdings that constitute the retirement savings of America’s employees and their families. This includes portfolios managed for the benefit of the nation’s federal workforce.

The salient point is that plan sponsors need to understand the risks from climate change and that action is necessary. The fact that climate change poses a material risk is the same for all plan sponsors. How each plan sponsor responds to the risk will vary.

IEEFA provides the following general comments in response to the DOL’s Request for Information, followed by specific responses to selected questions.

General Comments

DOL, working in consultation with all agencies covered by Executive Order 14030, should publish a substantive, authoritative, scientifically based guidance to plan sponsors and other members of the finance community that defines how climate change poses material financial risks for investment portfolios. The provision of a uniform perspective on climate change and financial risk—a common language and sourcing—has been missing for too long.

What DOL should NOT do is require every individual plan sponsor to research and document climate-related financial risk. The data in this area are well known. The DOL will waste resources and undermine confidence in an evolving consensus that action is needed urgently. In effect, DOL should refrain from asking all sponsors to effectively prove what is already known.

Instead, DOL’s role at this point would serve the public interest best if it spelled out authoritatively the risks to the nation’s retirement savings from climate change.

The guidance to plan sponsors should establish fundamental aspects of climate-related financial risks and should clearly articulate:

- The evidentiary basis or facts about climate change and related financial risk. This part should include a review of the authoritative research in the major areas of science, technology, law and government and finance that articulates the scope and impact of climate change and its connection to investment portfolios, particularly those involving retirement savings. This entails a discussion of the broad implications of a low-carbon economy, rise of regulatory interventions and changes from technological innovation and increased competition to fossil fuel companies, as well as a discussion of the challenges posed by changes from the physical environment triggered by climate change, e.g., frequency and intensity of extreme weather events.

- A review of what the finance community, broadly construed, is doing to address climate change. The review should emphasize the direct investment actions taken to defend against value loss from holding oil and gas assets. To the degree governance actions are considered, they should be second-tier actions with only indirect impacts on climate-related financial risk. Any review and/or endorsement of strategies by DOL should be accompanied by a financial rationale and be based in historical practice and results. For example, there is a long history of shareholder actions directed at oil and gas companies typically employing “good faith” activities such as meetings, letters, reports, shareholder resolutions and other governance related methodologies. The history is unfortunately one of “bad faith” responses by many oil, gas and coal companies. On the other hand, climate-related shareholder initiatives at non oil-, gas- and coal-producing companies have met with considerable success. Guidance by DOL devoid of this historical perspective will be ill-advised.

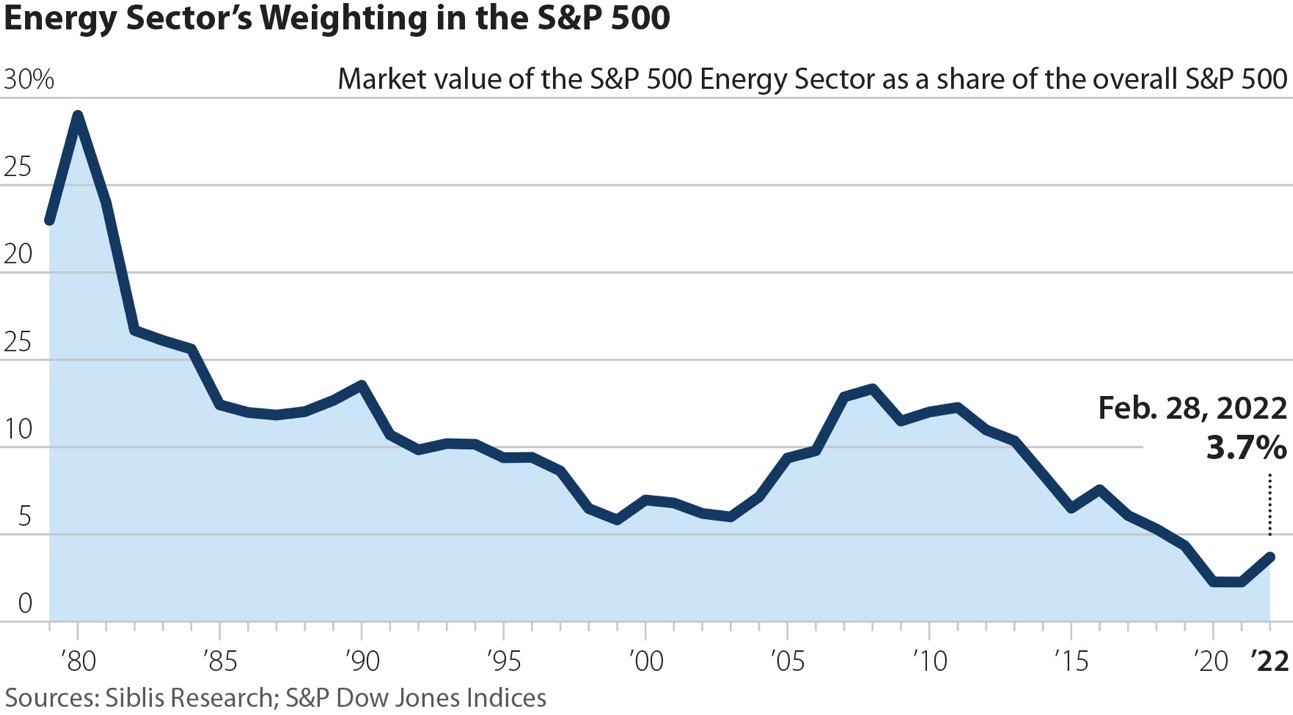

- An outlook of sector weightings for portfolios—the typical weights in investment portfolios currently and the likely changes, including changes in sector weightings within the broader equities market. For example, the energy sector (ground zero for the current discussion of markets and climate change) has declined precipitously from 28 percent of the Standard & Poor’s 500-stock index to 3.7% of the index. It hit a low of 2.3% in 2021 and has since increased slightly. The current spike is driven by highly disruptive geopolitical actions that are, in part, responding to the downward decline and negative outlook of the sector.

This overarching guidance on climate risk needs to set the stage for a series of specific disclosure mandates related to: 1) investment policy, and 2) corporate governance. Action is required in both areas.

The operational question is: What is the proper uniform system of disclosure that demonstrates an appropriate risk management response to climate risk?

Regulatory disclosures by plan sponsors need to provide the framework for taking investment actions that are responsive to the current knowledge on climate change. Specifically, the funds must be required to consider and disclose a defensive asset allocation strategy to address climate change. This strategy should include, but not be limited to:

- A fossil-free asset allocation plan that is consistent with a fund’s financial targets, including but not limited to:

- Current asset allocations including sector weightings for all asset classes;

- Current weightings versus a “fossil-free” weighted index/portfolio;

- What sector weights a fund anticipates for any equity index held by the investment fund, given a set of likely economic and financial scenarios that flow from the DOL statement of climate risk. (For example, the current weight of S&P 500 is just under 3.7% for the energy sector, whereas the MSCI fossil-free index weighting for the energy sector is 0.8%.);

- Investment performance of fossil-free indexes;

- Where possible, investment performance of funds that have adopted divestment strategies;

- A timetable for divestment that offers maximum protection to share value; and

- Standards for corrective actions to the plan.

- Investment impediments that might exist to achieving the goal of fossil fuel divestment

- A statement as to the likelihood of the fund adopting a partial or complete fossil-free asset allocation plan. What are the factors that would improve the chances of fossil-free plan adoption and what factors would slow it down? What alternative steps are being taken by the fund to defend the holdings from the risks of climate change?

- A statement that outlines the criteria to be used for administrative review of company performance with regard to climate-related financial risk and the standards to be employed for removing companies from any exclusion lists and reinvesting in them, consistent with portfolio investment standards.

Overall, the plans required to address climate change need not be adopted by funds if they so choose. However, as a fiduciary matter, it would be a lapse in expected diligence to not ask and answer the questions, “What would a portfolio look like when it is fossil free? And can such a portfolio meet investment targets?” The failure to develop this level of consideration is tantamount to ignoring climate change.

This regulatory exercise is taking place at a particular point in time. It is commonly understood that climate change is a material risk to investment portfolios. DOL should clarify the nature of the risk specifically. Then, funds and the fiduciaries that govern them need to develop plans to defend every fund against the risk. A fossil-free investment portfolio is a reasonable standard to defend against the fossil fuel risk. It need not be the only way to achieve the goal, but it is a reasonable standard against which any plan should be judged.

The rest of this letter constitutes answers to the questions posed by DOL in the Request for Information. IEEFA has answered only those questions where it felt we could make a contribution.

Answers to DOL questions 1-3, 5-7, 9, 11-16.

- Question 1: See general comments above.

- Question 2: The most significant climate-related financial risks to retirement savings are:

- Paris-aligned scenarios that are adopted by national governments and pressure corporations to adopt new policies;

- Regulatory changes, e.g., carbon pricing and bans on extraction, consumer products, design and content restrictions;

- Cost competitive, market-based technologies that challenge market share and/or strand existing assets.

- Question 3: EBSA should collect data from scientific, technical, financial, legal and fiduciary sources. More importantly, it needs to spearhead an interagency effort to summarize and synthesize the world literature on the topic into an authoritative statement by the government of the United States on the related financial risks from climate change. This should serve as the basis for the filing of fiduciarily sound plans that demonstrate how each fund would reduce fossil fuel holdings to zero by a set date. (See general comments, above.)

- Question 5: Any information collection should be in the furtherance of the authoritative guidance on climate change and instruction to plan sponsors on how to develop proper strategies, as discussed in general comments above. It is not necessary to "conduct an information request/survey on plan sponsor or employee awareness" of climate-related financial risks, since such risks are already well-documented.

- Question 6: Administrators of ERISA plans should be required to develop and publicly disclose strategies to address climate-related financial risk, as described in general comments, above. Such plans should be required to explain how the sponsors will defend their funds from the risks created by fossil fuels. Any strategy should include consideration of a plan to reduce or eliminate fossil fuel holdings, including timetables and standards for corrective action.

- Question 7: The process of creating an authoritative statement by the U.S. government to plan sponsors should also result in an ongoing clearinghouse for best practices that would provide plan sponsors with an increased number of metrics and tools allowing for additional analyses of investments. The clearinghouse function can be housed in DOL or as a separate quasi-governmental entity.

- Question 9: FRTIB needs to take immediate action to protect the value of funds under its care from financial risks related to climate change. In October 2018, BlackRock CEO Larry Fink told FRTIB that eventually all investment activity would be subjected to the rigors of ESG considerations. Climate-related financial risk is perhaps the most significant issue to confront investors and offers the biggest challenge ever to the strengths and limitations of the ESG method.

- Question 11: Any plan that eliminates companies that are directly involved with the extraction, processing, transportation and business services to oil, gas and coal companies must also include an ongoing engagement plan and policies to support companies addressing the transition and physical risks accompanying climate change. Similarly exclusion lists and engagement plans should encompass those banks and other investment houses that provide financing for oil, gas and coal companies and more broadly the financing of Scope 1, 2 and 3 emissions. There are a wide range of tools available to shareholders that support communication with the board and senior management of companies. Those tools include direct communication with companies using meetings, letter writing, information requests, shareholder resolutions, derivative lawsuits, proxy voting on board members and class-action litigation. Indirect actions are also available to fund sponsors and their stakeholders, including public dialogue on critical issues, lobbying, participation in issue- and industry-related associations, sponsorships, and participation in public and private events.

Consistent with Fink’s forward-looking observation, FRTIB needs to adopt a set of proxy voting guidelines that allows it to fully exercise it shareholder rights and responsibilities.

Further to the point, the Norwegian sovereign wealth fund offers several analytical tools that could inform DOL’s disclosure requirements. The fund has published an expanded statement on climate-related financial risks. It has also outlined how it is responding to the risk analysis performed by the manager of the Norges Bank. The fund has a robust climate program that includes shareholder initiatives, along with an active use of the divestment tool to provide a supportive next step as the risk profile of certain categories of fossil fuel production and use have become unacceptable.

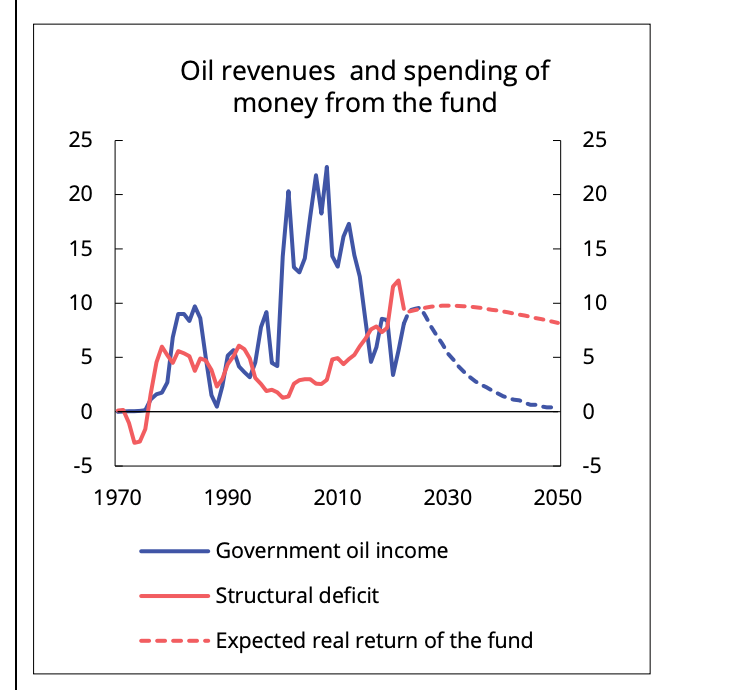

Figure 2: Norwegian Budget Analysis: Long-Term Relationship of Annual Oil Revenues to Norway’s Annual Fiscal Deficits

As the Department of Labor considers its path on climate-related financial risk, the Norwegian government budget provides an important informational resource. The Norwegian budget, unlike the United States, is highly dependent on the revenue derived from its state-owned oil and gas reserves. Table II is a table that the Norwegian government publishes annually. Government oil income from 1991 through 2016 was robust and sufficient to cover the annual budget deficit of the country. From 2016 through 2020 government oil income dropped and often was not been able to cover annual budget deficits. Going forward through 2050, the Norwegian government projects decreasing oil income and rising government deficits— a substantial structural imbalance in the country’s fiscal position.

The Norwegian government’s dependence on oil and gas revenue makes it one of the authoritative sources in the world on the future of the oil and gas sector. Its stark projection reflects the extraordinary dependence of the economy and fiscal condition of the country on oil and gas. Most investment funds in the United States, (with the exception of federal, state and local employee retirement savings funds) do not have their returns so closely tied to the fiscal base of operating governments. And, of course, the fossil fuel exposure is also not as great.

However, all institutional funds with any fossil fuel holdings are exposed to the fundamental dynamic of declining value from oil and gas assets. As the Norwegians have learned, climate change is here right now. It is not a future consideration. The oil and gas sector worldwide carries with it a decidedly negative financial outlook.

- Question 13: Asset managers need to have policies and procedures that address a wide range of needs presented by their customers. Asset managers need to demonstrate competency in the major climate-related issues facing investors. Any asset manager or investment advisor should be ready to provide this information to FRTIB.

- Question 14: See general comments, above.

- Question 15: The Government Accountability Office has stated that the fund is not acting prudently with regard to climate change. "The Federal Retirement Thrift Investment Board, which oversees the TSP, hasn't assessed climate change-related investment risks—leaving participants potentially vulnerable. We recommended it do so."

- Question 16: The process of creating a fossil-free plan for TSP necessarily involves a review of existing fossil-free indexes. All major investment houses offer a variety of such investments. For example, the MSCI ACWI ex Fossil Fuels is widely recognized and reflects a diversified portfolio of stocks consistent with the MSCI Global Indexes. These indices are constructed to meet fiduciary standards. In addition, the DOL RFI alone establishes the fact that climate change-related risk needs to be addressed by FRTIB and DOL. The GAO audit underscores the particular gap in climate-related policy at the FRTIB. The DOL climate statement would go a long way to establishing the prudency of actions taken to address climate change. If the FRTIB board makes a decision after prudent examination and consistent with the statute (an FRTIB attorney opinion), then adoption of the kind of plan outlined in the above general comments provides a clear pathway forward for the fund to divest.

Sincerely,

Tom Sanzillo

Director of Financial Analysis

Institute for Energy Economics and Financial Analysis (IEEFA.org)

See pdf for annotated letter.