Kentucky bankers sue state over right to classify climate risk as financial risk

Key Findings

The Kentucky Bankers Association is suing the state’s attorney general

Kentucky is one of 19 states with anti-ESG investment laws

The anti-ESG laws discourage banks from refraining to lend money to fossil fuel projects

The Kentucky Bankers Association recently sued the state’s attorney general, challenging his investigation into banks that seek to mitigate climate change risk by restricting investments to fossil fuel companies. The issues raised in the association’s court action need to be examined out of court as well.

Longstanding corporate practice and law require boards and senior managers to stay abreast of issues that may impact a company’s bottom line. Many disparate issues can blindside corporate leaders who take a narrow view of their operating environments. Over time, these issues have formed a body of practice and law under the rubric of environmental, social and governance (ESG) factors. Climate change falls under that umbrella.

Recently, several state governments have decided to punish banks and investment houses that restrict investments in fossil fuel companies. Convinced of the science and rationale related to climate change, these institutions see climate risk as financial risk and seek to protect the assets under their management from its negative consequences. Some states strongly disagree and have designed laws to ban such banks from managing state pension dollars or securing state contracts despite their financial qualifications, if they are deemed to have “anti-fossil fuel” policies. Kentucky has such a law. Kentucky Attorney General Daniel Cameron is investigating the banks under state consumer protection law and seeking to assist the state treasurer in her attempts to enforce Kentucky’s anti-ESG statute.

Cameron issued subpoenas to six banks (Morgan Stanley, Goldman Sachs, Bank of America, JPMorgan Chase, Wells Fargo and Citigroup) in October. A month later, the attorney general served similar subpoenas on Vanguard and State Street. Each demand for information cited alleged antitrust and consumer protection law violations by the eight investment entities related to ESG investment practices.

Climate change is a particularly relevant and active part of investment strategy for banks

The Kentucky attorney general, echoing 18 other states seeking to enforce recently enacted anti-ESG laws, asserts that banks and investment houses that implemented climate initiatives restricting investments may have combined illegally to restrain these companies’ access to capital. Such an action the AG contends would be in violation of the Kentucky Consumer Protection Act. Cameron is demanding documents related to each banks global climate initiatives—and the banks’ relationships with the Net-Zero Banking Alliance, United Nations Principles of Responsible Investment, Task Force on Climate Related Financial Disclosures (TCFD) and Sustainability Accounting Standards Board (SASB)—to determine if facts warrant further action. The demand for documents is extensive, reaching beyond policy to what appears to be information related to specific companies in the automobile, energy and power generation businesses.

The Kentucky Bankers Association and HOPE, a Kentucky based non-profit housing corporation, filed a complaint in November to stop the investigation. The complaint alleges the attorney general has:

- Made an unreasonable and burdensome request;

- Exceeded his authority; and

- Violated the First Amendment rights of the Kentucky Bankers Association.

The complaint notes that banking regulation in Kentucky is set out in state law and overseen by the Kentucky Department of Financial Institutions, the Federal Deposit Insurance Corporation and the Federal Reserve System. A recent Kentucky ESG measure (SB 205) has left the administration of bank behavior in this area to the state treasurer, not the attorney general.

Central to the complaint is the Kentucky Bank Association’s assertion that its member organizations address ESG issues as a matter of course. Climate change is a particularly relevant and active part of investment strategy for banks and housing developers. ESG rules in general are a widely recognized set of guidelines used to make decisions. The decision by the Kentucky attorney general to object to these risk management strategies, the Kentucky Bank Association argues, is intrusive and burdensome.

In a November motion to dismiss the complaint, Cameron contended that the plaintiffs lack standing and that the information demands are proper. Most notably, he argued that his office is gathering information that may be supplied to the state treasurer. The state treasurer and attorney general have been cooperating in their efforts to challenge the application of ESG rules at the state pension fund and procurement practices.

This discussion is not a legal analysis of the issues involved in the lawsuit. It is intended to explore institutional issues on the financial and policy trajectory that have been set in motion in Kentucky.

The Kentucky attorney general’s investigation of the auto industry is contrary to state interests

Most major companies in the world have decided to take steps to defend against climate risk

The Kentucky investigation into the relationships of bank and investment houses with the auto industry is quite peculiar. The Kentucky government is strongly supporting the industry’s transition activities to replace the internal combustion engine with electric vehicles. Its support is justifiable, given the role of the auto industry in Kentucky employment. Some of the state’s largest job-creating firms are investing heavily in electric vehicles, including Federal Express, Amazon, DHL, UPS, Kroger and Walmart. All have business growth plans that feature electric vehicle transportation. Electric vehicles are proving to be cheaper, more reliable and more environmentally sound than gasoline-powered vehicles. It is unclear why Cameron believes the automobile industry is somehow engaged with banks and investment houses in anti-trust activities related to an anti-fossil fuel agenda, or that such an agenda would be detrimental to Kentucky’s consumers. The state’s economic development leaders are supporting policies that are diametrically opposed to such a view.

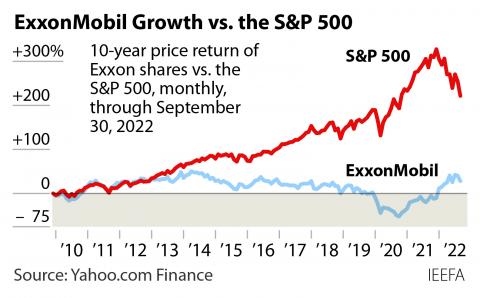

Most major companies in the world have decided to take steps to defend against climate risk and developed new strategies for growth. These companies have all decided that the next wave of technological change in the transport sector, for example, will create less demand for fossil fuels. ExxonMobil CEO Darren Woods has made it clear that the oil giant sees the complete elimination of gasoline production for automobiles by 2040. Woods now sees the growth of the electric car industry as a substantial opportunity for the company’s future. Each of the banks and investment houses targeted by the Kentucky attorney general has investments in ExxonMobil. From a policy perspective, Cameron is working at cross-purposes with job-generators in the state, as well as state economic development initiatives. From a political standpoint, his actions are a clumsy attempt to support the fossil fuel industry.

The Kentucky attorney general’s attack on global governance and international trade will harm Kentucky’s export economy

The Kentucky attorney general’s criticisms of bank and investment house relationships with the United Nations Principles of Responsible Investing, NetZero Banking Alliance and Glasgow Financial Alliance for Net Zero are not in Kentucky’s best interest. These are private, industry-led initiatives that provide pathways for successful investment and new businesses. Each represent industry and government initiatives to address climate change at a global level.

It is unfathomable that the Kentucky attorney general would introduce this element of confusion into the state’s economic development activities

The growth of Kentucky’s economy is inextricably linked to international trade. Fifteen percent of Kentucky’s economy is driven by exports—products and services that originate in Kentucky but are shipped to the rest of the world. The ability of the Kentucky economy to smoothly manage the decline of its tobacco industry was largely due to its reliance on manufacturing and international commerce.

It is understandable for state leaders to be concerned about Kentucky’s role in the global marketplace during the energy transition. Climate change is a global phenomenon, and it presents a financial risk to the smooth functioning of global markets. This is the major reason that global governance structures have been developed—including the Paris Agreement and the United Nations Framework Convention on Climate Change (UNFCCC)—to support the energy and economic transition necessary to address the risk.

Yet, the thrust of the Kentucky probe seems intentionally geared to object to global governance structures designed to promote long-term, economically sustainable market transitions. It is unfathomable that the Kentucky attorney general would introduce this element of confusion into the state’s economic development activities, potentially subverting its work to create more jobs.

The Kentucky attorney general’s legal arguments have created strange bedfellows

Cameron has offered a formal opinion that ESG is not consistent with Kentucky law. The opinion asserts some evidence exists that politically biased investment strategies lose money for pension investment funds. The Kentucky attorney general uses Christopher Bancroft Burnham—a former Connecticut state treasurer who currently chairs the board of EN+ Group, a Russian company—as a source. In that role, Burnham heads a company that is embroiled in issues related to Russia’s invasion of Ukraine. The European Union did not place EN+ Group on its sanctions list, although the corporation’s founder, Oleg Deripaska, was placed on the sanctions list and today no longer controls the organization.

Kentucky Bankers play David to the Kentucky attorney general’s Goliath. Big banks need to step up.

The Kentucky Bankers Association litigation is responsible, but it would be of greater value if some of the major banks that have been subpoenaed or harmed by anti-ESG laws take on these issues in the courts directly. The Kentucky attorney general’s office asserts that none of the subpoenaed banks have brought a complaint. One can suspect that the targeted banks and investment firms may be reluctant to bring a lawsuit not because of the legal merits, but because of the concern that an ideologically biased court could ignore long-standing jurisprudence in investment law and set abroad-based precedent overturning essential principles of fiduciary duty. Some may perceive it a more prudent legal strategy to fight the matter in the court of public opinion or in a legislature. These investment houses, which have made a fiduciarily sound decision that climate risk is financial risk, are harmed directly since anti-ESG laws cause them to lose business opportunities.

The case brought by the Kentucky Bankers Association may also have public opinion value, regardless of the legal outcome. The case challenges a plainly improper set of laws through reasonable arguments and facts. As such, it can face down a group of 19 attorneys general who seem to serve now more as consiglieres to an ideologically based political movement than counselors to the public interest of their states.

To right-size the legal fight, one or more of the large banks harmed under the guise of these arbitrary and capricious state laws needs to stand up and directly defend its fiduciary interest. The banks have more resources than the Kentucky Bankers Association and are strongly positioned to defend the premise that climate risk is financial risk. A banker or investor must do something to address the risk, including opposing those who would try to prevent it from protecting its customers’ interests. Failure by banks to see their risk analysis through to the end may itself be a breach of fiduciary duty.

The case challenges a plainly improper set of laws through reasonable arguments

Pensions and Investments, an institutional investor trade publication, reports that the state’s teachers’ retirement fund, responding to the same issues, has restated its position that the application of ESG principles to its investment portfolio is in its best interests. The teachers’ response is being reviewed by the attorney general and the other relevant pension boards. Fundamentally, the issue here is whether or not the attorney general or the state legislature has a right to interfere with the investment decisions of the fund, and if so, on what grounds. Similarly, the big banks involved face a similar issue. They have decided that climate risk is a financial risk. The actions they are taking along with other investment houses and private associations are defensive measures to protect the assets of its customers. Does the Kentucky attorney general or legislature have a right to interfere with the fiduciary obligations of these banks, and if so, on what grounds? These are the issues at stake.

These issues should be brought before the courts by pension funds and banks, since the laws seem to prejudge the decisions by banks and pension funds, assuming their conclusions about climate change are violations of their fiduciary obligations. Additionally, there is a whole thicket of issues that arise outside the courts.

Conclusion

The Kentucky Bankers Association’s legal challenge to Cameron’s actions raise issues that deserve the full sunlight of investigation in the public arena as well as in court. Banking policies that seek to mitigate climate change risk are based on financial risk, sound principles of financial diligence and effective business growth. The Kentucky attorney general’s action is contrary to the legitimate interests of the banks and runs afoul of state interests in economic development and jobs creation. Banks and investment firms can and should do more to protect the integrity of their decision-making process, as they exercise their responsibilities and fiduciary duty against improper political interference.

Tom Sanzillo ([email protected]) is IEEFA director of financial analysis