Iron ore quality a potential headwind to green steelmaking – Technology and mining options are available to hit net-zero steel targets

Download Full Report

Key Findings

Some steel companies in Europe especially are planning new direct reduced iron production capacity, a technology that can reduce emissions significantly when run using green hydrogen. As a result, demand for direct reduction-grade (DR-grade) iron ore is set to rise.

The challenge imposed by limited DR-grade iron ore supply on plans for a large global scale-up of DRI production is significant.

To avoid locking in further coal-based steelmaking capacity for decades, some technology switching to DRI processes will be required before 2030 to achieve net zero by 2050.

Given long mining lead times and technology development requirements, the focus on potential solutions must increase immediately.

Executive Summary

Switching from blast furnaces that consume coal to green hydrogen-based direct reduced iron (DRI) processes is widely considered a key step in the global steel sector’s decarbonisation pathway. However, insufficient supply of suitable iron ore is a potential challenge to a global shift towards zero-emissions DRI processes.

Such a shortfall could handicap a faster switch to DRI technology this decade as well as delaying longer term targets to significantly ramp up DRI operations to reach net-zero emissions targets by 2050.

The global steel sector is still largely focused on existing coal-consuming blast furnace operations, giving iron ore miners an incentive to continue producing blast furnace-grade iron ore, rather than ores with higher iron content used for direct reduction (DR-grade). Options to address the issue include increased focus on the development of mines that can produce high-quality iron ores, further processing of existing ores to improve the grade (beneficiation) and technology solutions that enable the use of lower grade iron ore in DRI processes.

Steel Sector Decarbonisation Focused on Green Hydrogen

Green hydrogen has gained increasing interest globally as a zero-emissions fuel with the potential to play a significant role in the decarbonisation of many sectors. Green hydrogen can replace fossil fuel-derived hydrogen and carbon monoxide in the DRI steelmaking process, eliminating carbon dioxide emissions. Steel manufacturers are starting to plan pilot or larger scale green hydrogen DRI projects and stating the technology will be an important factor in achieving 2050 net-zero emissions goals.

Steel manufacturers are starting to plan pilot or larger scale green hydrogen DRI projects

Given that green hydrogen is currently costlier than fossil fuel-based hydrogen, much of the attention given to the future of zero-carbon DRI technology is on green hydrogen cost, scaling up of production and the approaching date at which it becomes cost-competitive.

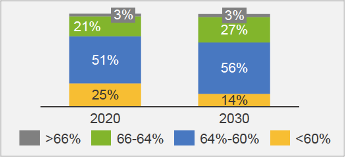

Another factor has received less attention. DRI steelmaking requires a higher grade of iron ore than blast furnaces, the dominant global process. DR-grade iron ore ideally has an iron (Fe) content of 67% or more and such deposits are scarce --only a small percentage of global seaborne iron ore comes close to DR-grade.

Seaborne Iron Ore Supply by Fe Content (%)

Source: Vale

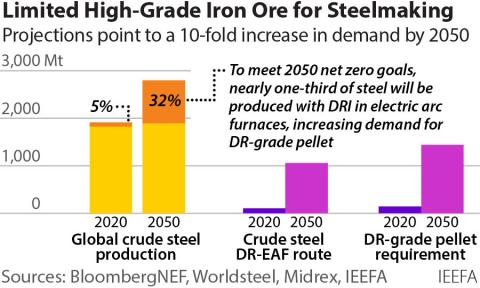

DRI processes currently account for only a small fraction of global crude steel production. A significant scaling up of global DRI capacity using green hydrogen to reach net-zero emissions in 2050 will require much more iron ore suitable for DRI.

Many net-zero emissions pathways for the steel sector foresee much of the decarbonisation process happening after 2030. However, about 71% of existing global blast furnace capacity will reach the end of its operational life before 2030. To avoid locking in further coal-based steelmaking capacity for decades, some technology switching to DRI-electric arc furnace (EAF) processes will be required before 2030 to achieve net zero by 2050. Agora Industry has already tracked 59Mt of new DRI capacity announcements since 2019, requiring about 80Mtpa of iron ore if all proceed.

The amount of additional DR-grade iron ore capacity to be operational by 2030 is far from certain. In its 2021 iron ore project review, Wood Mackenzie provides data on planned mine projects that are earmarked to start producing ore this decade with Fe content of 67% or higher. This list totals 213Mtpa of new capacity, almost all of them magnetite projects. However, Wood Mackenzie considers only 41Mt of this potential new iron ore capacity to be “probable” or “highly probable” with the remaining four-fifths considered only “possible”.

Potential new DR-grade iron ore capacity by 2030 ranges from 40Mtpa to an optimistic high of 100Mtpa. However, according to Wood Mackenzie, there is additional DR-grade ore supply available beyond this should higher demand translate into investment and shift “possible” projects to “probable.”

After 2030, DRI capacity expansion will need to accelerate to maintain a net-zero pathway. Bloomberg New Energy Finance (BNEF) anticipates 56% of primary steel production coming from DRI-EAF processes using hydrogen and 3% from DRI-EAF processes based on natural gas by 2050 under a net-zero steel sector scenario. This would mean 840Mt of steel production from DRI-EAF-hydrogen processes and 49Mt from DRI-EAF-natural gas processes by 2050, requiring a tenfold rise in DR-grade supply unless technology innovations allow DRI processes to use lower-grade ore.

The very long lead times for new iron ore projects limit the ability of miners to quickly change their product quality mix.

Big Four Iron Ore Miners Largely Focused on Supplying Blast Furnaces

BHP CEO Mike Henry stated in October 2021 that hydrogen-based steelmaking may still be 20 to 30 years away and that steel sector decarbonisation must remain focused on lower emissions from blast furnaces. BHP has stated “there is simply not enough high-quality iron ore suitable for efficient DRI/EAF production to meet the global steel demand...DRI production must use the very highest quality iron ore, with an average iron content in the range of 67%. Such deposits are scarce.”

Rio Tinto sees the decarbonisation of the steel industry happening in at least three phases. Phase 2 involves the roll out of DRI technology using hydrogen. However, the first phase –and the focus of Rio’s current attention –is to reduce the emissions of blast furnaces, technology that can use its relatively lower-grade but highly profitable Pilbara iron ores.

In addition to being one of the biggest overall producers, Vale is also the world’s largest supplier of high-grade iron ore pellets for DRI plants and blast furnace operations. Vale has stated: “Main ore bodies available face depletion and beneficiation challenges, thus making it difficult to increase supply of high-grade ores.” Vale forecasts that, although there will be a shift towards higher quality iron ore over the rest of this decade, there will be no change in the proportion of seaborne iron ore supply over 66% Fe by 2030, remaining at just 3% of the total as it was in 2020.

Fortescue Metals Group (FMG) is committed to developing magnetite orereserves at its Iron Bridge project, which could potentially add to DR-grade iron ore supply. However, the company has also highlighted that the Iron Bridge product maybe blended with its lower quality iron ores to meet market demand. In that case, the resulted blended product will be below DR-grade and intended for blast furnaces.

Outside of the big four, iron ore projects that could potentially increase supply of DR-grade ore are in early stages of development.

Options to Enable Global DRI Expansion Going Forward

The availability of DR-grade iron ore is a potential challenge to the global expansion of DRI technology. Among options to address this issue is a significant switch in iron ore mining focus from hematite towards magnetite. Magnetite ores tend to have a much lower Fe content but are often suitable for significant beneficiation, in part because magnetite is magnetic, enabling easier separation. These can often be beneficiated to DR-grade. Another option is to improve the quality of hematite iron ores through beneficiation. Some beneficiation has been introduced to Pilbara ores but despite this, the trend in Fe content of Pilbara ores has been to decline as volumes increased. There is renewed interest in making Pilbara iron ores suitable for low-emissions steel --the Heavy Industry Low-carbon Transition Cooperative Research Centre (HILT-CRC) has a program on the production of green iron products from Pilbara iron ores.

ThyssenKrupp is planning to begin replacing blast furnaces with DRI plants with integrated melting units from 2025

As a result of long lead times for new magnetite project proposals and beneficiation challenges, more DRI may need to be made using lower-grade iron ore. This will necessitate melting the reduced iron before being charged into a basic oxygen furnace.This type of technology combination is being investigated by Rio Tinto in partnership with BlueScope Steel as well as ArcelorMittal. ThyssenKrupp is planning to begin replacing blast furnaces with DRI plants with integrated melting units from 2025.

Outside of DRI technology, there is also the longer-term potential for new steelmaking processes that are not impacted by the quality of iron ore. Iron ore electrolysis, an early-stage technology that BNEF foresees as reaching commercial readiness by 2035, is not limited to using high-grade ore.

Further support for green steel demand will likely be needed if steelmakers are to accelerate their low-emissions technology transition and iron ore miners are to increase focus on developing higher grade ore projects. Technology enabling low-or zero-emissions steelmaking using lower grade ore is in the early stages of development but such transitions have a habit of happening faster than expected. Evidence of this is the fast maturation of wind and solar power, which were expensive a decade ago but are now set to dominate power generation additions.

When it comes to carbon emissions, steel has a reputation as a “hard to abate” sector. The challenge imposed by limited DR-grade iron ore supply on plans for a large global scale-up of DRI production is significant. Given long mining lead times and technology development requirements, the focus on potential solutions must increase immediately.