IEEFA/JMK: Electric vehicle surge in India will drive indigenous lithium-ion battery manufacturing

India is poised to become the third largest global automotive market by 2026 and is targeting 30% of new vehicle sales to be electric by 2030, putting the country on the path to becoming an automotive superpower through sustainable means.

Promoting a clean and green environment, the Government of India has given a special push to electric vehicles (EV) in Budget 2022.

The budget announcements aim to boost the entire EV sector – creating special mobility zones for EVs, implementing a battery swapping policy and formalising interoperability standards for batteries. These announcements, if implemented efficiently, will push EV penetration significantly in India, especially in public transport.

Battery swapping presents an efficient solution for the space-crunched charging infrastructure segment while leading to increased electrification of the fleet for “last mile” connectivity. Considering that EVs will account for ~90% of the annual lithium-ion battery (LiB) demand in India by 2030, the budget initiatives also pave the way for simultaneous battery adoption.

After EVs, renewables and data centres shape up as the next biggest demand centres for LiB

In India, start-ups are increasing their presence in the EV industry. The government has extended tax incentives to start-ups, from three years after incorporation to four years.

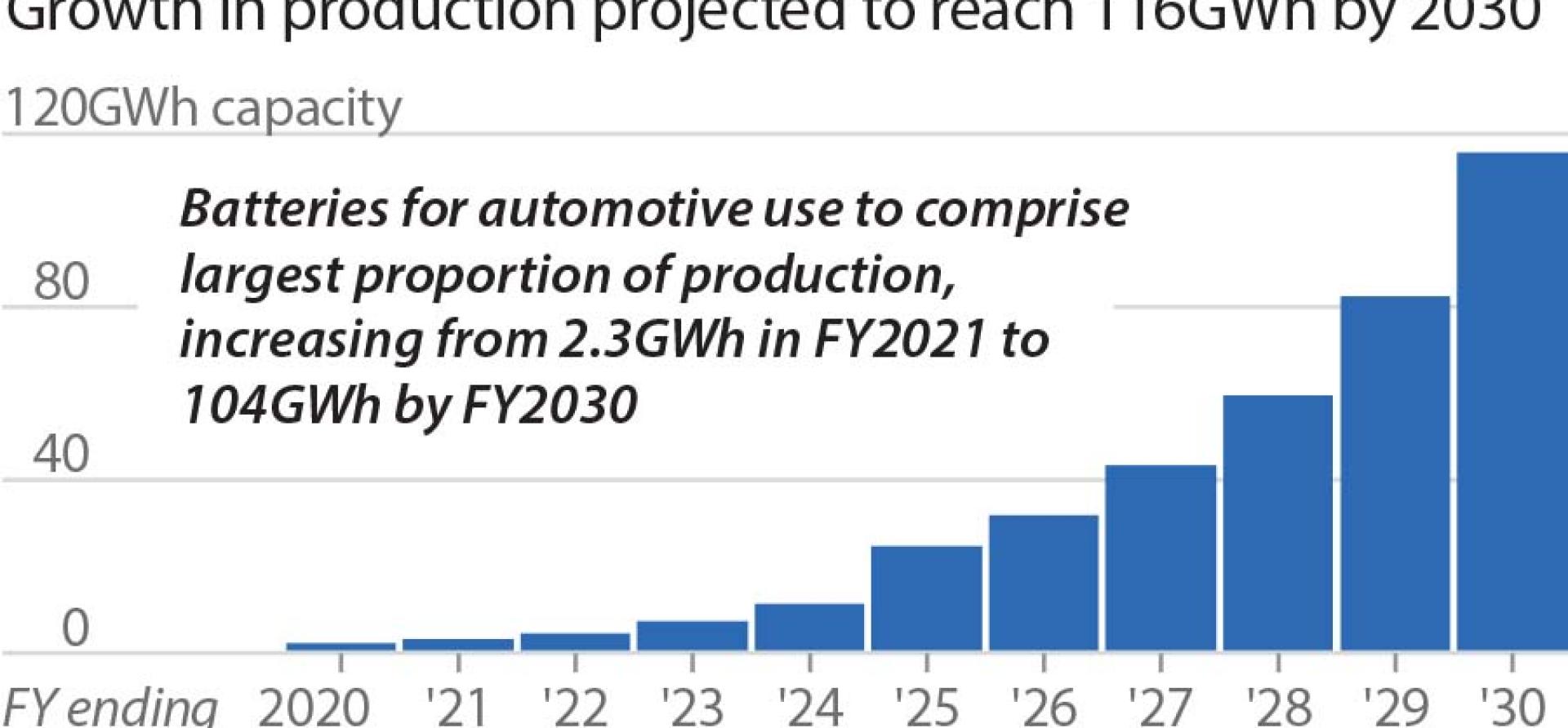

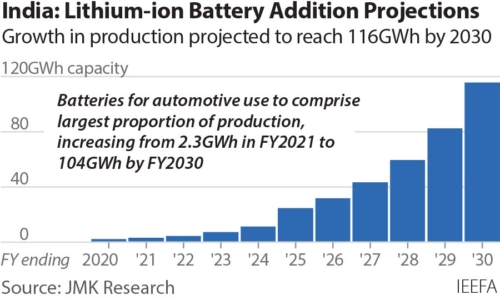

Granting infrastructure status to data centres and energy storage systems (ESS), including grid-scale batteries and charging infrastructure, will assist these segments in gaining easy access to credit. As renewable energy and data centres shape up as the next biggest demand segments (after EVs) for LiB, the future looks bright for these batteries in India. JMK Research estimates the annual capacity addition of LiB will increase from 2.6GWh in FY2021 to 116GWh by FY2030.

India so far has been completely dependent on imported cells from neighbouring countries such as China, due to the unavailability of key raw materials and technological know-how. The industry has assembled battery packs from cells imported from China but till now has not been able to manufacture these cells indigenously.

Battery pack assemblers as a result had to bear the brunt of high cell prices, hoarding of cells in the hands of a few Chinese suppliers, availability of lower-grade cells, and non-availability of cells that can withstand higher temperatures specific to India.

An India-specific cell must withstand temperatures of ~45-50°C and cost less than imports

An India-specific cell must withstand temperatures of ~45-50°C, cost less than imports and avoid supply chain issues such as those with China. Given these factors, it becomes imperative to manufacture cells in India only.

India has huge cost opportunities in terms of cheap labour and power. Cell manufacturing costs in India, as of 2020, were the lowest (US$92.8/kWh) when compared with the United States, European nations, and even China (US$98.2/kWh) and South Korea (US$98.1/kWh).

The dearth of local technological know-how and absence of government support were primary reasons for India keeping out of cell manufacturing. The government’s recent announcement of the Production-Linked Incentive (PLI) Advanced Chemistry Cell (ACC) scheme to encourage domestic production of cells is a step in the right direction.

The scheme has attracted bids from 10 major companies. Such big names as Reliance, Hyundai, L&T, Exide, Amara Raja are already in the race to build capacities for cell manufacturing in India.

Thanks to the industry’s ever-growing investment in research and development (R&D) for effective battery management system (BMS) design and battery chemistries suited to India, the battery pack and cell manufacturing industry is expected to reach great heights.

This article first appeared in Renewable Watch

JMK Research: Jyoti Gulia, Founder; Neha Gupta, Head, Electric Mobility; and Ayoosh Jadhav, Research Associate

Related articles:

IEEFA: Lithium-ion battery manufacturing in India has got the power — for EVs and the grid

IEEFA India: Restrictive banking provisions hampering renewable sector growth