IEEFA update: Where are the customers for the Navajo Generating Station?

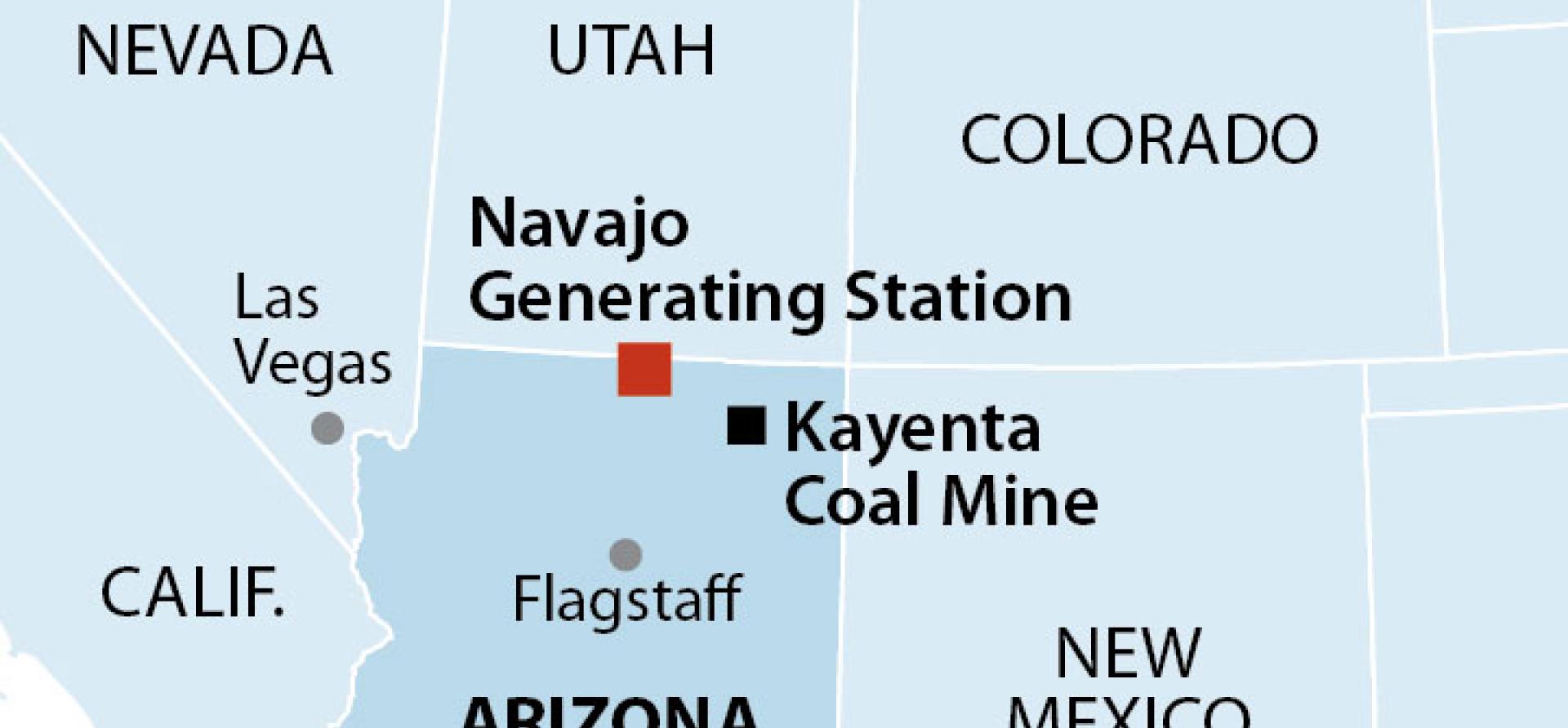

As debate intensifies around the merits of Navajo Transitional Energy Company’s (NTEC) plan to acquire the Navajo Generating Station (NGS) power plant and associated Kayenta mine, fundamental questions about its ability to attract customers and cover liabilities connected with the enterprise remain unanswered.

As debate intensifies around the merits of Navajo Transitional Energy Company’s (NTEC) plan to acquire the Navajo Generating Station (NGS) power plant and associated Kayenta mine, fundamental questions about its ability to attract customers and cover liabilities connected with the enterprise remain unanswered.

A closer look at the evolution of the deal, however, offers several clues as to what some of those answers might be.

In 2017 and 2018, Peabody Energy was seeking buyers to keep the NGS power station operating, in order to guarantee a market for the coal from its Kayenta mine beyond 2019, when the plant was slated for closure.

Peabody hired investment firm Lazard Ltd. to look for new potential owners for the plant.

In testimony before a Congressional committee in April 2018, George W. Bilicic, Vice Chairman of Investment Banking at Lazard, emphasized the importance of finding a buyer who would keep NGS operational and competitive over the long term and be able to secure Power Purchase Agreements (PPA) to provide “revenue certainty:”

…willingness from the current owners to contract power from NGS at market competitive prices will be required. Based on preliminary discussions between the current owners and the Potential Investor, it appears that the current owners are willing to purchase power from NGS, albeit at lower volumes than historically procured and for a shorter tenure (i.e., 3-5 years) than what potential new owners believe would be ideal. This represents the area of most uncertainty… [Emphasis added]

However, we now know that there were no investors willing to take on the risks associated with NGS, and no customers willing to sign long-term PPAs for power from the plant. In April 2018, Bilicic referred to an unnamed “potential investor” that was considering purchasing the plant, which was later revealed to be Middle River Power. But in September, Middle River Power announced that it was ending its bid to buy NGS because it had been unable to secure commitments from other parties to purchase a sufficient amount of power to enable a workable enterprise.

Former potential NGS buyer could not find customers

Now Peabody, instead of seeking to continue to own Kayenta Mine, is trying to transfer the mine, and all of its liabilities to NTEC.

However, Billicic’s April 2018 testimony serves as a warning sign for any investor thinking of acquiring the plant to make sure to secure some form of revenue certainty. And it is doubtful that NTEC can meet that requirement since Middle River Power failed to entice potential customers at an even lower price ($26.84 per MWh) than NTEC is now claiming it can provide ($28.05 per MWh).

Which begs the question: If potential customers were not willing to pay the lower price that Middle River Power was offering, why would they now be willing to buy the same power at a higher price from NTEC?

NTEC’s plan appears to rely on selling NGS power into the energy market. And that can be financially risky given that actual market prices can be significantly lower than today’s forward prices would suggest – especially as increasing amounts of low-cost renewable resources are added to the grid in California and the Southwest, and as natural gas prices remain low.

As we showed in our February report, NTEC’s Plant/Mine Acquisition Plan Puts Navajo Nation at Serious Risk, at best, NTEC’s plan would produce very marginal profits for NTEC and the Navajo Nation and would produce significant losses if plant production costs are higher than NTEC now claims it can achieve and/or if energy market prices are lower.

So the question remains: Where are the customers who are going to provide revenue certainty for NTEC and the Navajo Nation if NTEC is successful in its bid to acquire and continue to operate NGS? The answer most likely is nowhere, since there appear to be no customers who will commit to buying sufficient amounts of power from NGS to make continued operation economically viable.

Covering deferred maintenance costs will ensure that NGS will be a losing proposition for NTEC and the Navajo Nation

A further argument against moving forward with the deal are the deferred maintenance costs that the current owners stopped paying when they decided to retire the plant in December 2019. According to SRP, which operates the plant, the deferred maintenance totaled between $150 and $200 million for all three units at NGS, or between $50 and $67 million, on average, per unit.

The decision whether to pay for this deferred maintenance will be critical for NTEC. If it decides not to go through with needed repairs and maintenance work, it increases the risk that NGS will not operate reliably or economically in future years, and makes it more likely that the plant could be shut down for lengthy and/or expensive outages.

But paying for these considerable deferred costs will certainly extinguish any hope NTEC might have of making continued operation of NGS economically viable.

For example, updating the analyses from our February report shows that paying for the deferred maintenance for two of NGS’s units, would make NTEC lose between $20 and $53 million, just during the five years 2020-2024. And this assumes that NTEC is able to reduce average NGS productions costs to $28.05 per MWh from the $41.72 per MWh that SRP has projected, something that is highly doubtful, and that energy market prices remain as low as forward prices now suggest.

David Schlissel is IEEFA’s director of resource planning analysis, [email protected]

Related items

IEEFA report: NTEC Plan Presents Unknown, Potentially Limitless Liabilities

IEEFA report: NTEC’s Plant/Mine Acquisition Plan Puts Navajo Nation at Serious Financial Risk

IEEFA update: The hurdles to an economically viable Navajo Generating Station remain