IEEFA update: India coal plant cancellations are coming faster than expected

The latest data from the Global Coal Plant Tracker (GCPT) shows that India’s coal-fired pre-construction project pipeline has shrunk by a quarter, that is 24 GW in the last six months alone. India’s thermal power giant NTPC Ltd has reportedly shelved 10.5 GW of its planned coal-fired power projects year-to-date. Project cancellations are coming faster as financial viability remains dubious and India increases its low-cost renewable installations.

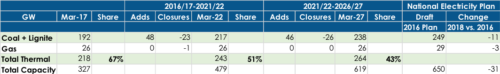

India’s National Electricity Plan (NEP) 2018 assumes 94 GW of new coal-fired capacity will be added between 2017/18 and 2026/27. With the renewables program accelerating, IEEFA views this as too high an estimate if UDAY is successful in bringing AT&C losses down. Further, IEEFA believes that many of these project proposals, based on outdated subcritical technology, will become stranded assets even before they are built, resulting in a waste of land, capital, and political effort.

THE COAL-FIRED POWER SECTOR ALSO ACCOUNTS FOR A SIGNIFICANT SHARE OF NON-PERFORMING ASSETS (NPAs) THAT CONTINUE TO TROUBLE THE INDIAN BANKING SECTOR. The government estimates there are about 40.1 GW of stranded coal-fired power projects, of which 15.7 GW are not even commissioned.

Earlier this year, the Parliamentary Standing Committee on Energy report highlighted issues responsible for the financial stress in India’s coal-fired sector. An absence of coal supply contracts due to the cancellation of assigned coal blocks, poor locations distant from coal sources, use of outdated imported equipment, lack of long-term power purchase agreements (PPAs) and delays in land acquisition resulting in cost overruns were some of the key issues identified by the committee.

Some of these projects had signed PPAs at aggressively low tariffs that make debt servicing difficult. In the meantime, variable cost related to coal-fired generation has gone up due to increases in coal prices (particularly for coastal plants suffering from a doubling in import coal prices) as well as the cost of freight charges for coal transportation.

As per India’s Central Electricity Authority (CEA) estimates, the tariff for a new emission controls compliant pit-head supercritical coal-fired power plant should be Rs4.39/kWh (for a PLF of 60%). With super competitive renewable energy PPAs with zero indexation now regularly priced in the Rs2.50-3.00/kWh range, new coal power plants are struggling for viability across India.

India’s coal-fired power sector woes reflect the combination of excessive financial leverage, operational inefficiencies and competition arising from accelerated deflation in renewable energy tariffs, all of which make investors sceptical of the sector. India’s financial sector is ill-equipped to force promoters to write-off their equity investment in stranded assets, resulting in delays and ultimately bigger losses to debt providers, given interest expense continues to accrue on long stalled projects.

While coal sector lenders are trying to restructure and resolve some US$40 bn in stranded assets,[i] an accelerating number of developers are walking away from their planned but now long stranded coal power plans.

NTPC Ltd has displayed prudence by deciding to turn away from a growing number of stalled coal-fired power project proposals that have not moved in years in the wake of record low coal utilisation rates and rising demand for cheaper renewables.

In June 2018, NTPC decided to drop its 4 GW greenfield coal-fired Pudimadaka Ultra Mega Power Project. The plant was planned in 2011 with a PPA signed with the government of Andhra Pradesh. The project over the years had several failed attempts to organise a domestic coal linkage and even was denied a captive port to handle imported coal by the Ministry of Defence when it pursued that option.

July 2018 saw NTPC confirm it has no intention to pursue two other planned coal power plant developments – the 1,980 MW Nabinagar-2 and 1,600 MW Katwa thermal power generating units in Bihar and West Bengal, respectively. The plants originally had arranged PPAs with multiple states including West Bengal, Jharkhand, Odisha, Sikkim and Bihar. Odisha’s energy minister had requested to cancel the PPA with Nabinagar Plant as the lower cost of renewables and the move to power surplus meant demand growth was insufficient to justify these expansions.

NTPC in February 2018 shelved the 1,600 MW expansion of Kaniha stage 3 Unit 1&2 in Talcher, Odisha on the back of surplus generation capacity in the state and the shift to renewable generation across the country. GCPT also put NTPC’s 1,320 MW Simhadri power plant in Andhra Pradesh in the shelved category this year, as the project has not received any required permits.

This is not to say NTPC is abandoning coal power generation any time soon. NTPC has 47 GW of existing coal generation and it has been selectively acquiring equity stakes in financially distressed state coal power plants such as the Nabinagar Power Generating Company and Kanti Bijlee Utpadan Nigam Limited in Bihar in June 2018.

India’s coal-fired power sector woes reflect the combination of excessive financial leverage, operational inefficiencies and competition arising from accelerated deflation in renewable energy tariffs

NTPC started 2017/18 with a development pipeline of 25 GW of new coal plants. Shelving 10.5 GW since February 2018 represents a dramatic recognition of the dynamic state of the Indian electricity sector and size of the disruption from renewables. But it is not the end of thermal coal, not least given Indian thermal power plants have an average 25-40 year lifespan and the majority were only commissioned in the last decade.

India’s remarkably ambitious renewables investment program should be sufficient to accommodate almost all the incremental electricity demand growth that will result from 6-8% annual GDP (net of energy efficiency, grid efficiency plus nuclear and hydropower additions).

With the National Electricity Plan (NEP) 2018 showing 48 GW of planned end of life coal plant closures by 2027/28, India likely will need some additional coal power to offset those closures. However, this does not mean new coal plants are necessarily needed to fill the gap – the record low coal plant utilisation rates of just 57.4% in 2017/18 provide scope for 20-30% more generation via better utilisation of existing assets.

Slower than expected electricity demand growth has given states reason to avoid signing long-term PPAs to avoid paying extravagant capacity charges even if the plants are not generating power, particularly in the knowledge that medium term renewable energy tariffs are likely to be materially lower.

The effect of surplus capacity, slowing demand, increased coal input costs and competition with cheaper renewable sources has left coal-fired power project development languishing in India.

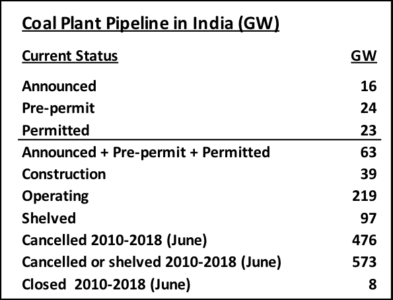

GCPT data reports that 573 GW of coal-fired power projects in India has been cancelled or shelved between 2010 and June 2018. GCPT deems a project as cancelled if there is no development progress on the project for four years and shelved after two years. Projects vanishing from company documents is another sign of companies quietly walking away from the projects.

India’s Coal-fired Power Project Status

Source: Global Coal Plant Tracker (GCPT) July 2018

Source: Global Coal Plant Tracker (GCPT) July 2018

Note: GCPT also includes behind-the-meter captive power plants of capacity above 30 MW

With 39 GW already under construction, much of the 63 GW in planned capacity in various stages of pre-construction development will simply add to existing surplus capacity, increasing distressed assets. In such a situation, the generation facilities will compete within the coal-fired sector and result in sustained sub-optimal capacity utilisation rates.

As per CEA’s reporting, out of the last five quarters, three quarters have seen net negative additions of coal-fired power capacity as 2.6 GW of capacity was retired in this 15-month period.[ii] Plant retirements projected in the NEP seem to be coming along as planned.

India Declining Thermal Capacity Share – NEP 2018 Additions & Retirements

Source: Central Electricity Authority of India (CEA), IEEFA estimates.

Source: Central Electricity Authority of India (CEA), IEEFA estimates.

For states without their own in-state coal mining capacity, relying on expensive interstate or imported coal-fired power is increasingly a money losing option that threatens affordable energy security and slows distribution company reforms.

NTPC has been judicious in cancelling surplus planned projects and reducing its stranded asset risks. This represents a clear example for investors in terms of a sustainable transition to progressively pivot toward lower cost, lower emissions electricity generation, jettisoning the drag of now surplus, expensive coal-fired project proposals that have been stalled for years.

Tim Buckley is IEEFA’s director of energy finance studies, Australasia. Kashish Shah is an IEEFA research associate.

[i] The Parliamentary Standing Committee report of March 2018 references 55,557 crore (US$8 bn) of restructured standard advances and Rs34,244 crore (US$5 bn) as NPAs as of June 2017. However, with 40 GW of thermal power plants stranded, the total investment at risk is approaching US$40 bn.

[ii] Net new coal power capacity additions reported by the CEA have slowed materially in recent quarters to just 3.6 GW in Q1 FY18, -1 GW in Q2 FY18, -0.5 GW in Q3 FY18, 4.2 GW in Q4 FY18, -0.2GW in Q1 FY19.