IEEFA: Power bills in Australia take a hit from surging global fossil fuel prices

Key Findings

Wholesale electricity prices shot up 141% from first quarter 2021 levels to $87 per megawatt hour in first quarter 2022

Higher coal prices could lead to losses for coal generators, or further rises in electricity prices

This raises the prospect of unexpected exits by coal generators--which, history shows, creates a heightened level of discomfort for the Australian government

After years of gradually declining wholesale electricity costs in Australia, prices have more than doubled due to unreliability of coal-fired power stations, rising demand driven by higher temperatures and increased international coal and gas charges.

Since the exit of the Hazelwood coal power plant in 2017, average wholesale electricity prices – the generation component of electricity bills - were on an overall downward trend in Australia’s National Electricity Market.

The cheaper prices, mainly attributed to an increasing supply of cheap renewables and low coal and gas costs, reduced the cost of supplying electricity to an 8 year low at the end of 2021.

Now, that trend has reversed.

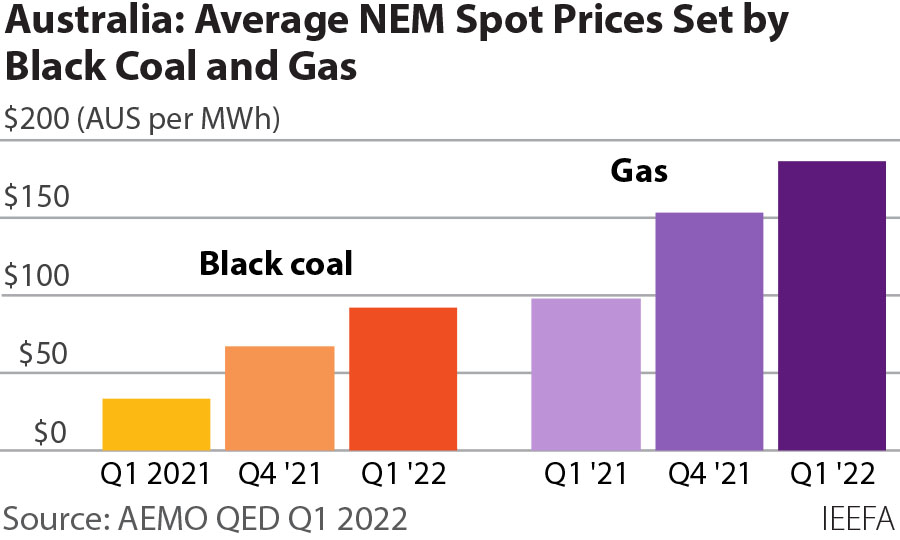

Wholesale electricity prices shot up 141% from first quarter (Q1) 2021 levels to $87 per megawatt hour (MWh) in Q1 2022.

Factors inflating international coal and gas prices include tight energy supply in Europe and Asia, demand increase post the pandemic and sanctions on Russia. The high coal and gas prices resulted in astronomical wholesale electricity prices worldwide last year.

High international coal and gas prices are impacting consumer’s bills

ICE Newcastle thermal coal futures reached A$600/tonne in early March 2022, a sixfold increase from March 2021. And in April 2022, LNG Netback prices peaked at A$45/gigajoule in April 2022, a 650% increase over April 2021.

High international black coal prices are having an impact throughout the National Electricity Market.

The states with the highest proportion of black coal in their generation mix – Queensland and New South Wales – are recording higher generation prices than other states.

In Q1 2022, Queensland had the highest wholesale price of $150/MWh.

Next was NSW at $87/MWh, South Australia at $71/MWh, Tasmania $70/MWh and Victoria $57/MWh.

Black coal generators set the price for electricity more frequently in Q1 2022 compared with Q1 2021 and those prices set by black coal trebled quarter on quarter. Availability of black coal generators was also 3% lower, mainly due to increased outages. Meanwhile, average National Electricity Market operational demand was higher than the same quarter last year. This resulted in high prices in the northern states that rely on black coal.

Ideally Queensland and NSW could protect local energy consumers by importing cheaper electricity from other states. However, constraints on the transmission network connecting southern states into the north hobbled this opportunity.

South Australia and Tasmania have a significant proportion of renewables in their generation mix so are not as exposed to high international coal and gas prices. Prices have been lower in these states.

Although Victoria still has a significant amount of brown coal in its generation mix, the state does not export it so is not exposed to international energy price volatility. Victoria had the lowest average wholesale price of all National Electricity Market regions in Q1 2022.

Prices could stay high or rise further in states still reliant on black coal

All states in the National Electricity Market have faced wholesale electricity price increases since Q1 2021 to a greater or lesser degree.

Electricity prices in states that depend most on fossil fuels could stay high or rise even further if international gas and coal prices continue their upward trend.

NSW and Queensland are more exposed to high international black coal prices as they buy black coal from producers who can also sell it internationally, mainly to Asia.

Contracts between generators and producers could temporarily shield certain black coal generators from global price fluctuations but prices could be raised in renewed contracts. Further, coal generators running at higher output than usual, requiring coal above their contracted amount, would have to pay high spot market prices for additional coal.

For instance, if an average NSW black coal generator paid the past six-month average ICE Newcastle coal price of A$322/tonne, the short run marginal cost of the generator would be A$136/MWh – above the state’s Q1 2022 average wholesale price in all half hourly intervals of the day.

This indicates higher coal prices could lead to losses for coal generators, or further rises in electricity prices.

Alongside this financial viability risk is a reliability risk. There have been recent outages at black coal generators including Victoria’s Loy Yang A, Queensland’s Callide C unit 4 and Kogan Creek, and Victoria’s brown coal generator Yallourn.

A generator facing both reduced profitability and repairs that require significant investment to repair may not find it worthwhile to restart.

This raises the prospect of unexpected exits by coal generators--which, history shows, creates a heightened level of discomfort for the Australian government.

The exit of coal can be – and must be - carefully planned to prevent any unexpected exits.

The risk can be mitigated

Reliance on coal and gas for electricity generation in Australia is becoming increasingly risky, as this ties the National Electricity Market to volatile international energy prices. Burning fossil fuels also poses a significant climate risk.

To insulate against volatile coal and gas prices and reduce emissions, Australia should reduce its reliance on fossil fuels.

This can be done by growing the share of clean cheap renewable energy in the generation mix and installing energy storage to complement the renewables. Thermal generators should be scheduled for exit and everything that still runs on fossil fuels must be electrified.

Households could also reduce their energy consumption, use more energy efficient appliances, and switch to solar and batteries to insulate against high global coal and gas prices.