Anti-renewable policies are going to cost consumers

Key Findings

The White House’s opposition to renewable energy is increasing the costs of developing all new energy resources.

Given gas turbine manufacturing constraints, renewable energy and dispatchable storage are the only options for new generation before 2030.

The administration’s stop-work orders on renewable projects will make all new energy projects either more difficult or impossible to finance.

Stop-work orders on renewable energy projects are likely to raise prices for consumers and potentially cause supply shortages.

The administration’s energy dominance agenda will fail, done in by collapsing investor confidence, unless the White House stops issuing stop-work orders for offshore wind. Undercutting these projects, each of which has billions of private investment dollars committed to it, is sending shock waves through all energy project financing, not just the wind industry.

The cost of this political uncertainty will raise the risks—and therefore, the costs—of developing other new power generation resources, including new nuclear facilities (both small modular and conventional large reactors), dispatchable battery storage, solar, and gas-fired plants.

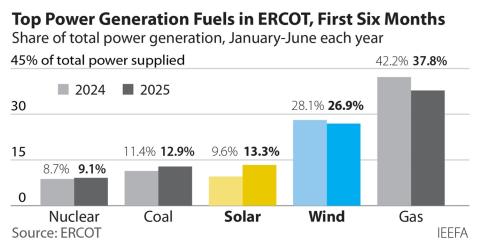

Renewable energy and dispatchable storage are the only option for adding significant amounts of new generation capacity to the U.S. grid for at least the next five years. Adding power from gas-fired plants through 2030 is severely limited by turbine manufacturing constraints, and the administration's efforts to keep aging and unreliable coal plants open will cost consumers dearly.

Meanwhile, any new conventional nuclear could take as long as two decades to finish, and small modular reactors are also years away from coming online; their technology and cost-effectiveness remain unproven. Even so, the administration is injecting political and financial uncertainty into wind and solar development projects.

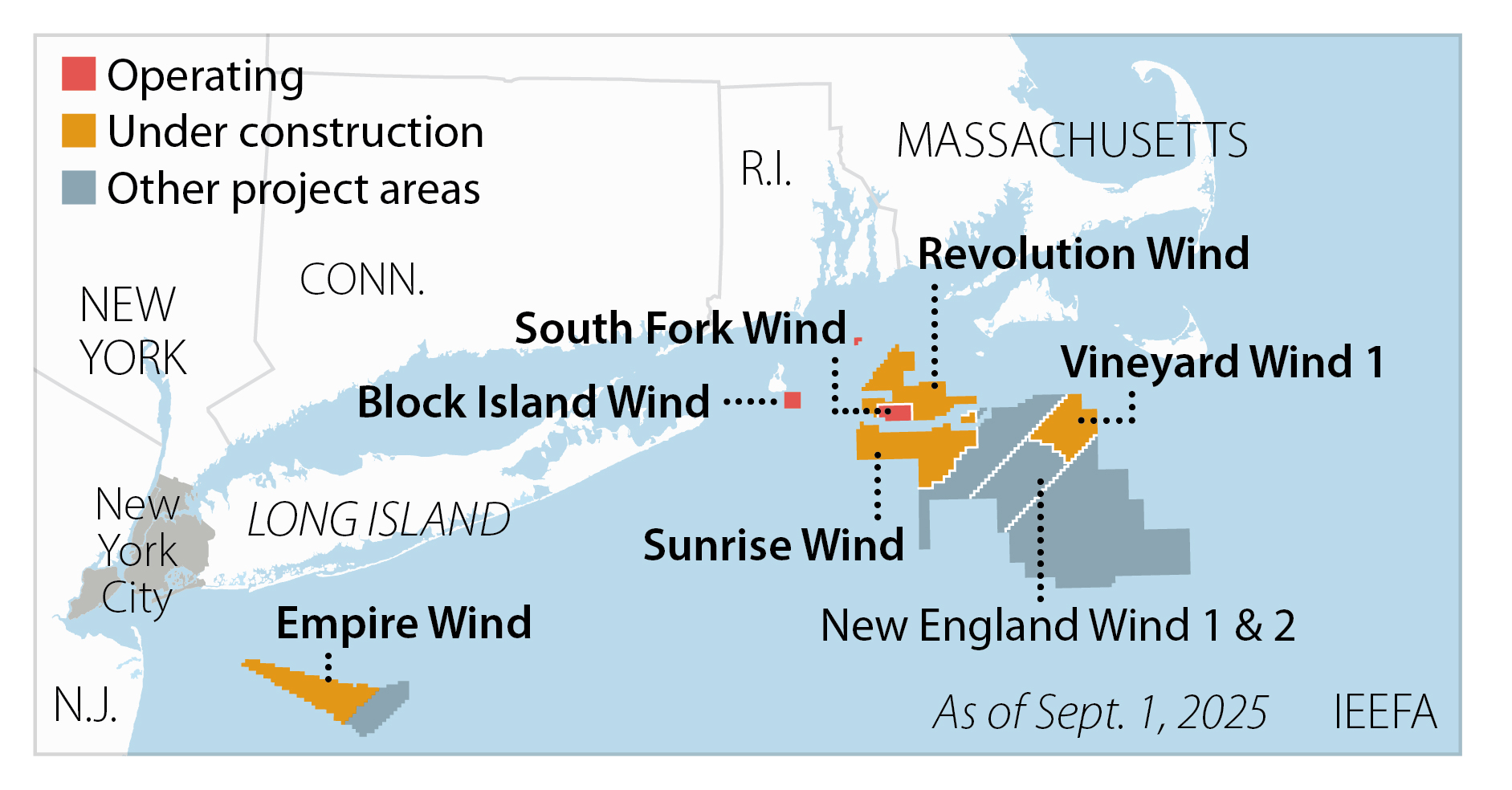

The latest stop-work move occurred Aug. 22, when the Interior Department’s Bureau of Ocean Energy Management ordered Ørsted to stop construction on the almost-finished Revolution Wind project being built off the coast of Rhode Island. The project, a 50-50 joint venture between Ørsted and private equity firm Global Infrastructure Partners, will have a capacity of 704 megawatts (MW) when complete. Ørsted says 45 of the project’s 65 turbines have been installed, with commercial operations slated to begin in 2026. The developers have signed offtake agreements with three New England utilities for the power beginning in 2026 and running through 2046.

The reason for the stop-work order? Undefined “concerns related to the protection of national security interests of the United States.”

The origin of those national security concerns is not explained, and the contractor list involved in building the project is full of U.S. and European firms, including Siemens, a major supplier in the U.S. for both wind and gas-fired turbines.

Earlier this year, in the administration’s initial effort to derail offshore wind development, it temporarily stopped construction of the 816 MW Empire Wind project being built to serve the New York market. The stop work order was ultimately lifted after a deal was reached between New York Gov. Kathy Hochul and the administration, but the stoppage cost developer Equinor roughly $200 million.

Experience shows that offshore wind is a reliable resource in the Atlantic off the East Coast. The largest completed project, Ørsted’s 132 MW South Fork Wind facility east of Long Island, N.Y., has posted a 46.3% capacity factor in its first 11 months of operation. More importantly, during the winter, when gas prices in both New York and New England are typically highest because of competing demands for power generation and home heating, the facility posted a capacity factor of 53.7%. For comparison, the annual capacity factor of U.S. coal-fired generation in 2024 was 42.6%, while gas-fired combined cycle units recorded a system-wide capacity factor of 59.7%.

An IEEFA analysis completed in early 2024 showed that four projects then under construction or in advanced development – Revolution Wind, Vineyard Wind (806 MW) and New England Wind 1 and 2 (1,871 MW) – and scheduled for commercial operation by 2029 could have generated more than 15% of New England’s average daily power demand during the winter months when gas supplies are tight and prices are high.

No Other Short-Term Alternatives

The future of these projects is now in doubt due to the administration’s opposition, but there are no other short-term alternatives. The supply of gas turbines is effectively sold out until 2030, new nuclear is 10 years away and the one remaining coal plant in the region is already 65 years old (ancient by coal standards) and extremely expensive.

In other words, the stop-work orders are going to raise prices for consumers throughout the New York-New England region and potentially cause supply shortages, especially during the winter. This point was made clearly by ISO-New England, the grid operator for the six-state region, in a statement issued Aug. 25:

“Unpredictable risks and threats to resources—regardless of technology—that have made significant capital investments, secured necessary permits, and are close to completion will stifle future investments, increase costs to consumers, and undermine the power grid’s reliability and the region’s economy now and in the future.”

EPA Administrator Lee Zeldin told Fox News after the Revolution Wind stop-work order was issued that “the president is not a fan of wind.” Politicians of all stripes are entitled to their opinions but forcing a work stoppage at a facility where roughly 80 percent of the work is complete calls into question the trustworthiness of pledges made by the U.S. government.

The current administration is clearly pushing an agenda favoring fossil fuels and nuclear power. But a banker being asked to loan money for such a project—whether a multi-billion-dollar interstate gas pipeline or a new nuclear facility—likely will think hard before lending money to a project that could be stopped at the 11th hour by a future administration. And companies looking to build new generation resources are likely to look for more stable investment environments.

At a minimum, the current administration’s actions are likely to raise the financing costs for some projects. Some could be unfinanceable, such as nuclear projects that require long lead times and have extremely high capital costs. If an investor-owned utility is relying on federal government financial support for a nuclear project, state regulators are likely to have second and even third thoughts before approving such a deal, given the massive economic risks it would place on the utility’s ratepayers.

This point, that the government is undercutting the private sector’s trust in federal commitments, has been made by several energy insiders over the past few months. Commenting on the Energy Department’s decision to rescind a conditional $4.9 billion loan to help build an 800-mile-long transmission line from Kansas to Illinois, Sen. Martin Heinrich, D-N.M., said: “I am concerned that the federal government is eroding what little trust the private sector has in our ability to be reliable partners.”

A similar point was made by Neil Chatterjee, former chair of the Federal Energy Regulatory Commission, at a meeting hosted by BloombergNEF in April. Talking then about the administration’s decision to stop work at the Empire Wind project, Chatterjee stated the obvious: “If you're oil and gas, you don't want to set this precedent that you have an approved permit that could potentially be rescinded by a future administration. How do you make those kinds of investments?"

That uncertainty also applies—perhaps more so—for developers looking to build new nuclear plants, whether large or small. "Commercial banks are not going to provide low-cost financing for nuclear reactor construction—especially initial investments in these technologies,” Katy Huff, assistant secretary for nuclear energy in the Biden administration, said this summer. That means, she added, that federal government support will be vital in any nuclear buildout; left unsaid was what happens if developers and bankers no longer trust the government to fulfill its part of the bargain.

The administration is not just targeting offshore wind; it has set its sights on onshore utility-scale solar and wind, as well. One credible estimate projects that the administration’s tightening of rules for the soon-to-expire investment and production tax credits will result in the cancellation of 60,000 MW of new solar generation in the coming five years.

Assuming a 25% capacity factor, the 60,000 MW in lost solar would have generated 131 million megawatt-hours (MWh) annually. Making up for that capacity would require the construction of 25,000 MW of new gas-fired combined cycle capacity operating at a 60% capacity factor. But building additional gas capacity simply is not possible in the next five years, so electricity reserve margins will tighten and prices will rise—all because of the administration’s anti-renewable campaign.

It would be great if wiser counsel could change the administration’s course. The result of not including renewables in a policy of energy dominance means everyone is going to be paying more for electricity in the years ahead. The blame will fall fully and fairly on the decisions made now.