IEEFA update: Low natural gas prices – a negative outlook for energy sector

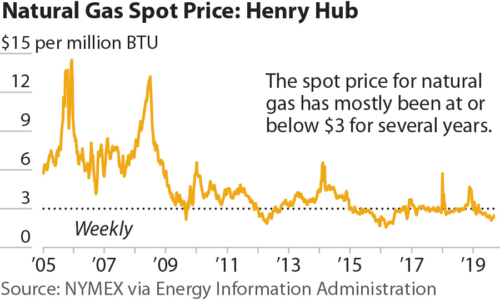

With the news from IHS Markit that natural gas prices in the United States will drop below $2 MMBtu in 2020 and remain low through at least 2024, if not longer, heads must be exploding in the board rooms of oil and gas producers throughout the U.S. and Canada. The profit picture is now imploding. The ramifications run deep, far and wide.

With the news from IHS Markit that natural gas prices in the United States will drop below $2 MMBtu in 2020 and remain low through at least 2024, if not longer, heads must be exploding in the board rooms of oil and gas producers throughout the U.S. and Canada. The profit picture is now imploding. The ramifications run deep, far and wide.

- The mantra that more pipelines will rationalize the market has been upended. This view from the oil and gas industry never made sense. As IHS Markit makes clear, new pipeline capacity contributes to an oversupply of natural gas forcing down prices and profits.

- Smaller exploration and production companies, already suffering, are likely to continue to fail. Recent, modest improvements in cash flows are insufficient to rescue these companies, which represent roughly 30 percent of production.

- Expect significant reductions in new capex. The oil and gas sector is besieged with bankruptcies, and has trimmed capex budgets. Production is stagnating.

- The oil and gas equipment and supply sector will worsen. The sector’s financial performance already trails the oil and gas sector. Expect more bad stock performance from Halliburton, Schlumberger and Baker Hughes.

- U.S. producers’ plans to cash in on export markets must be reconsidered, according to IHS Markit. The global market remains oversupplied, with limited profit potential on the export side. Increased exports from the U.S. will deepen the oversupply.

Oil giants are expected to succeed where smaller, nimbler players have failed

- Integrated oil and gas companies will not succeed, either. The prevailing wisdom is that larger oil giants that eat the smaller, failing producers in the fracking space will succeed where smaller, nimbler players have failed. This will prove false. Expect growing restlessness by once-sleepy investors as bullish spending by ExxonMobil in the Permian Basin continues to run up against the reality of tepid earnings in its U.S. upstream operations. Five more years of capex spending and low profits in the Permian will expose this investment fallacy. A period of low oil prices and increasing competition in the petrochemical sector will further erode the company’s investment rationale that downstream earnings benefit from low oil prices.

- Canadian investors be forewarned. IHS Markit suggests investors are expecting rapid growth of natural gas production and attendant drilling, pipeline capacity and ports. But increased Canadian production will face an oversupplied market in the U.S. and weak prices. Canadian plans to expand its natural gas production have not seriously considered the price changes in the market created by U.S. frackers.

Other factors not mentioned by IHS Markit are also significant:

- The planned expansion of refineries, crackers and plastic production in the Ohio Valley will be increasingly turbulent. A steady, stable source of low-priced natural gas was central to the investment decisions of companies like Shell, which is investing billions to build a cracker plant. Petrochemical expansion plans are at risk. They were based on weak partnerships with the fracking industry, an industry that does not have a viable business model. Low prices and stable supplies, once considered a positive factor for the plastic expansion, have now become a liability.

- The rapid expansion of the natural gas sector has boosted employment levels to almost 400,000 jobs nationwide. The potential for layoffs in several of the subsectors is a real risk.

Argentina’s current political and economic problems will deepen as foreign investors remain skittish

- Argentina’s expansion of unconventional natural gas production will falter. Argentina’s gas price is tied to Henry Hub prices. Persistent low prices will grate sharply against the high production costs in the resource-rich area known as Vaca Muerta, in northern Patagonia. Argentina’s current plan assumes significant investment by global oil and gas players, which is unlikely to materialize. The country’s current political and economic problems will deepen as foreign investors remain skittish.

- Coal consumption will continue its decline in the U.S. as low natural gas prices persist. The Energy Information Administration (EIA) reported that U.S. consumption for its coal-fired power plants will drop below 500 million tons in 2020, a level not seen since 1975. Consumption by power plants peaked in 2007 at just over 1 billion tons per year. Four or five more years of low natural gas prices and increased investment in renewable energy will ensure a continued downward trajectory in U.S. coal consumption.

THE NEWS OF LOWER-FOR-LONGER NATURAL GAS PRICES SETS THE STAGE for more problems in the fossil fuel sector. It has also unleashed a very important financial trend. Low natural gas prices are driving down electricity, home heating and industrial production costs. Consumers and businesses are getting accustomed to stable and perhaps even lower prices.

The low-price environment has all but sealed the fate of the coal sector. The instability of natural gas markets, however, may be its undoing, even as new gas plant production and petrochemical expansions are incentivized to grow. Competitive challenges from the renewable sector and other technological creations are moving to zero-fuel-cost solutions – a factor that will outpace even lower priced natural gas advantages.

Tom Sanzillo ([email protected]) is IEEFA’s director of finance.

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

RELATED ITEMS:

IEEFA report: GE made a massive bet on the future of natural gas and thermal coal, and lost

IEEFA update: Argentina’s financial crisis offers chance to rethink national energy plan

IEEFA update: Risks to Fracking Companies in Appalachia Mount