IEEFA report: China unlikely to come to rescue of overbuilt U.S. LNG industry

July 29, 2020 (IEEFA) — A rebound of the ailing U.S. liquefied natural gas (LNG) industry isn’t likely to come from Chinese demand, according to a new study by the Institute for Energy Economics and Financial Analysis (IEEFA).

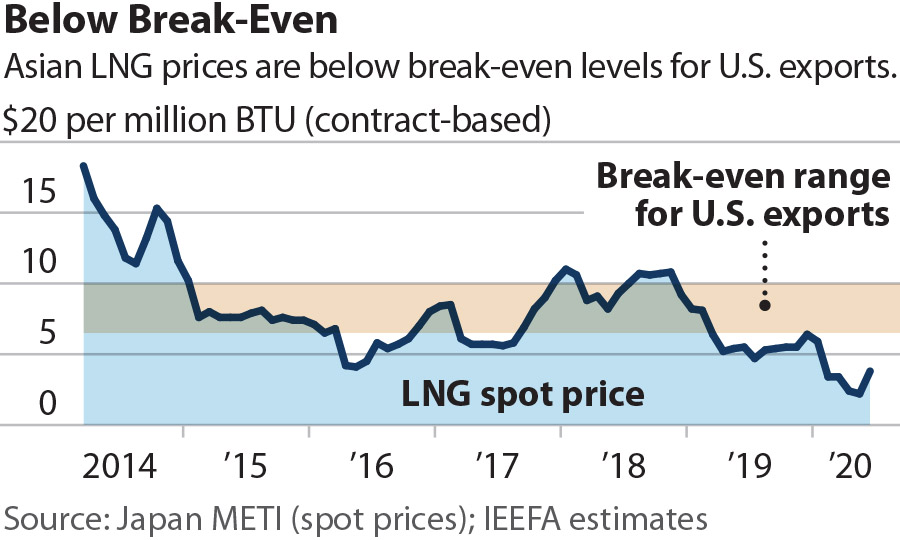

Global LNG markets have been hammered by collapsing prices, falling consumption, and an enormous supply glut in Europe and Asia, even as the U.S. LNG industry continues with expansion plans.

“The U.S. liquefied natural gas industry is suffering through a worse-than-worst case scenario: An international market collapse on a scale that seemed inconceivable when the country’s first export facility was put into service just over four years ago,” said Clark Williams-Derry, an energy finance analyst and co-author of No Upside: The U.S. LNG Buildout Faces Price Resistance from China.

Accentuating the industry’s troubles, Cheniere Energy, the largest U.S. LNG company, is likely to collect most of its revenues this summer from shipment cancellation fees, rather than actual LNG sales.

Although LNG has become the worst-performing global energy commodity during the coronavirus pandemic—worse even than coal or oil—its problems predate the economic downturn. More than 20 U.S. projects in various stages of development, as well as 20 existing commercial-scale plants, are competing with new LNG plants in Russia, Australia, Malaysia and Cameroon. The ensuing glut has convinced many international buyers to obtain LNG from spot markets rather than signing new long-term contracts.

Prior to 2019, China had been the world’s fastest-growing LNG consumer, leading to hopes that it could rescue the planned U.S. LNG buildout. The IEEFA analysis, however, finds that PetroChina, China’s largest natural gas company, has lost money on gas imports every year since 2015, throwing doubt on the Chinese gas market’s ability to absorb new imports.

If China is to expand its LNG imports, it will likely have to secure long-term supplies at prices well under $7/MMBtu, Williams-Derry said. Even with U.S. costs close to historically low levels, the margin for reaching those prices is slim: Shipping LNG from the Gulf of Mexico to East Asia costs about $2/MMBtu for feedstocks, $3/MMBtu for liquefaction, and $1/MMBtu for transportation. Regasification and transportation to Chinese cities would add another $1/MMBtu to the total cost.

The IEEFA study examined gas pricing in seven major Chinese cities with access both to LNG terminals and pipeline gas. Wholesale prices in April 2019 ranged from $7.73/MMBtu to $8.57/MMBtu; at the time, it cost roughly $8/MMBtu to deliver gas from the Gulf of Mexico to China, meaning that U.S. LNG offered little or no economic benefits to Chinese consumers.

“The most optimistic LNG demand scenarios are simply unrecognizable to experienced analysts of the Chinese energy sector,” said Williams-Derry. “Even if China expands its gas use, the country will likely find cheaper sources of gas than U.S. imports, including domestically produced gas, pipeline imports, and LNG from lower-cost global suppliers.”

Full report: No Upside: The U.S. LNG Buildout Faces Price Resistance from China

Author contact

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst.

Ghee Peh ([email protected]) is an IEEFA financial analyst.

Media contact

Vivienne Heston ([email protected]) +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.