IEEFA India: Removing the roadblocks to accelerate renewable energy deployment

India is transforming its national electricity system by incorporating deflationary renewables. In doing so, it is improving energy security, reducing reliance on imported fossil fuels, addressing air pollution, and lowering emissions intensity.

The timing of this transformation is spot on. India’s economy is set to double by 2030. Even with improved energy efficiency and lower grid losses, an investment exceeding US$500 billion is required to deliver a near 70% expansion in total electricity generation.

Clearly the challenges are huge, but so are the opportunities. To meet India’s energy needs and ensure continued economic growth, the Institute for Energy Economics and Financial Analysis (IEEFA) asserts a wider electrification programme coupled with an accelerated deployment of renewable energy capacity is needed.

In this article, we explore trends in electricity demand growth, capacity installations and plant closures, and we examine the financial sector’s capacity to fund development and the resulting energy mix changes.

Current trends in electricity demand growth

India’s electricity production from April-September 2018 (the first six months of this fiscal year) is up 6.2% compared to the same period last year. Assuming a 0.8% reduction in grid losses, this implies electricity demand growth of 6.7% year-on-year, consistent with gross domestic product (GDP) growth of 7.0-7.5%. This includes an increase of 29% for variable renewable generation and 4% for thermal/hydro /nuclear.

Increased financial risk of thermal power plants becoming stranded assets

India’s net thermal power plant (TPP) capacity fell 1.1 gigawatts (GW) in the seven months from April to October 2018, The addition of 600 megawatts (MW) at the Mahan Super Thermal Power Project in Madhya Pradesh (10 years in the planning) was more than offset by the closure of 1,799MW of capacity, principally at two other plants: 705 MW at the Badarpur Thermal Power Station in NCT of Delhi, and 420 MW at the Ropar Coal Power Station in Punjab.

Echoing this trend of TPP closures, India’s newest power sector blueprint – the National Electricity Plan of 2018 (NEP 2018) – forecasts thermal power plant closures of 4GW to 5GW annually over the next five years.

India’s TPP sector is clearly suffering clear stranded asset risk, making access to capital increasingly problematic.

Public sector company NTPC is the only Indian power producer still able to regularly access capital for new TPP development. Their latest corporate presentation estimates TPP commissioning at 4.2GW in Fiscal Year 2018-19 and 5.2 GW in 2019-20 (India’s fiscal year runs from April 1 through March 31). It would be fair, however, to expect delays with NTPC announcing cancellations/delays on 13GW of TPP development to date in 2018-19. IEEFA notes that NTPC may be finding it difficult to justify investment in greenfield TPP developments, particularly when coupled with constraints including fuel access, the high tariffs required, and the long delays being experienced.

Although Global Coal Plant Tracker estimates 103GW of TPPs in the development pipeline in India (including 39 GW under construction), the cancellation of 26 GW between January to June 2018 illustrates that most remaining projects are stalled.

The impact of stalled projects is far reaching. Right now, US$100 billion of distressed TPP loans are clogging the Indian banking system. Further, the travails at Infrastructure Leasing & Financial Services (IL&FS) suggests a real solution is yet to be found.

Stranded assets commonly reflect a myriad of problems including outdated technologies, legal issues around land acquisition, a geographical misfit between proposed plant locations and the distance coal supplies must travel, and unviable tariffs. TPP proposals in India are generally requiring tariffs at increasingly high rates. As a result, Indian”‘discoms”- distribution companies that purchase electricity for supply to consumers – will not accept them given renewable energy tariffs are the low-cost solution. For instance, renewables are now widely available at below Rs3/kWh (US$40/MWh), with zero indexation for 25 years. On the other hand, some TPP proposals are pegging tariffs at rates deemed too low, making financing impossible. Either way, banks are unwilling to finance unviable TPP projects.

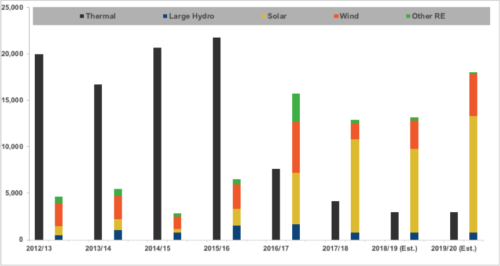

Reviewing the evidence, IEEFA forecasts net thermal power plant installations of just 3GW annually over 2018-19 and 2019-20 (taking into account 7GW of new plants commissioned and 4GW per annum of end-of-life closures).

India’s renewable energy sector has increasing momentum, but roadblocks must be removed

India’s renewable energy momentum entering 2018 has been staggeringly positive. Tariffs of below Rs3/kWh are still being registered relatively consistently. While 10 to 120% higher than the record low tariffs of Rs2.43-2.44/kWh observed in the past two years, this still puts renewable energy as the lowest cost source of new electricity supply for India. Further, an understated positive in the renewables industry is the price of solar modules which have fallen some 30% over 2018 to US25-27¢/w, thereby offsetting the price inflation of import duties.

IEEFA now expects 13GW of net renewable capacity addition in 2018-19, a marginal decline on 2017-18. But 2019-20 is looking a lot stronger with a building pipeline of 26GW in project tenders.

However, a few headwinds have taken some of the momentum out of the renewable sector. Grid integration of variable renewable energy is an increasing challenge. This could be partly addressed by an accelerated deployment of distributed residential, commercial and industrial rooftop solar. Another key avenue would be to minimise land acquisition impacts and maximise affordable distributed energy solutions (e.g. solar irrigation pumps) in the agricultural sector.

Some of the other issues affecting the renewable industry include increasing access difficulties, a 25% solar module import duty, goods and services tax (GST) uncertainties, the depreciation of the currency, higher interest rates, and policy uncertainty.

Tariff guarantees by the Solar Energy Corporation of India Ltd (SECI) and NTPC are largely circumventing the lack of bankability of discoms for now, but the Ujwal DISCOM Assurance Yojana (UDAY) reforms must be completed to resolve this critical headwind.

Figure 1: India thermal and renewable power capacity additions (MW)

Source: Central Electricity Authority, MNRE, IEEFA Estimates

(Renewable estimates in this chart include large scale hydro and exclude ‘behind the meter’ rooftop solar)

Reviewing the energy mix

In the four years to 2015-16, India over-built 20GW annually of net new TPP. This was well ahead of demand growth and meant that coal utilisation rates fell to a decade low of 56.7% in 2016/17. (Capacity utilisation is lower than a plant load factor (PLF), given that the latter ignores downtime relating to coal non-availability).

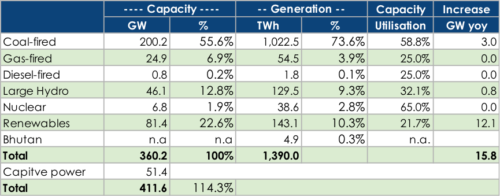

With current underinvestment in new generation capacity, India is now seeing an uptick in coal utilisation rates to an estimated 58.8% in 2018-19 (See Figure 2). Further, with Coal India’s production up 10.4% year-on-year year-to-date to October 2018, coal availability should progressively improve. In the near term, a higher utilisation rate will improve capacity efficiency through the better use of existing investments, in turn reducing financial system stress.

Figure 2: India’s Electricity Capacity and Production 2018-19 (Est.)

Source: Central Electricity Authority, MNRE, IEEFA Estimates

However, combined with an increased system reliance on variable renewable energy, a rising utilisation rate of coal reduces system capacity surplus and if sustained, will reduce India’s grid stability.

Increasing investment in the renewable energy pipeline

There are 26GW of renewable energy projects already in India’s project development pipeline. A renewable energy project development only takes about 12 months, making such projects readily scalable in the near term to meet India’s ongoing demand growth.

Domestic and international capital and finance are available for new renewable projects at prices giving adequate returns to investors, while also bringing down system generation costs and baking in long-term wholesale electricity system deflation.

By contrast. while the TPP pipeline is notionally large, most of these proposals are stale, stuck in litigation, using outdated technology, and poorly located relative to fuel supply. Indian banks are unlikely to provide yet more capital to proceed, leaving most as stranded assets. For the few that do, construction timelines of 3-4 years are likely.

Additionally, and despite significant planning, very few new hydro and nuclear power projects are likely to be commissioned due to legal, financial and land acquisition delays. In fact, IEEFA assumes just 1GW to 2GW per annum.

Reforms are needed to accelerate deployment of renewable energy capacity

India is positioned to deliver sustained, strong economic growth over the coming decade.

To achieve this, a wider electrification program coupled with an accelerated deployment of renewable energy capacity is needed to power this growth, without the unsustainable constraint of ever higher fossil fuel imports.

Grid stability and connectivity needs to be further enhanced, a requirement made harder by the variable nature of renewable energy. An acceleration of existing plans for transmission and distribution investment by Power Grid Corp of India, Adani Transmission, et al, is also required, but well in hand.

Finally, a more progressive peaking power supply price signal is needed to appropriately reward flexible supply, be that fast ramping coal power, gas peakers, batteries, pumped hydro storage, and demand response management.

The increased extreme weather events and rising pollution health costs in India make this strategy both economically sensible, more sustainable, and necessary.

Tim Buckley ([email protected]) is IEEFA’s director of energy finance studies, Australasia. Kashish Shah ([email protected]) is an IEEFA research associate.

A version of this article was first published in ET Energy World.

Related items:

IEEFA update: India coal plant cancellations are coming faster than expected

IEEFA update: Risk to India’s banking sector in rising tide of stranded assets