Latest Norwegian Pension (GPFG) Research

See more >

IEEFA Africa: Is Angola a cautionary tale for Guyana’s oil wealth hopes?

February 10, 2021

Tom Sanzillo, Gerard Kreeft

Insights

IEEFA: After a terrible 2020, the oil industry’s story has turned political

January 08, 2021

Clark Williams-Derry, Tom Sanzillo

Insights

IEEFA update: Norway’s 2020 budget signals hard choices ahead

December 06, 2019

Tom Sanzillo, Kathy Hipple

Insights

IEEFA update: Norway’s recognition of a declining oil and gas sector sends a message

December 21, 2018

Tom Sanzillo

Insights

IEEFA update: Norway moves to invest in unlisted renewable energy

December 17, 2018

Tom Sanzillo

Insights

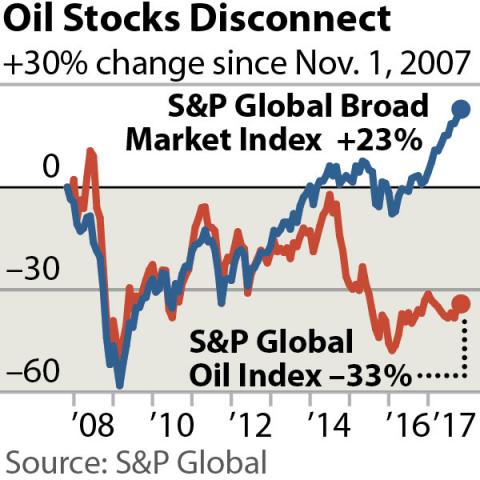

IEEFA Update: Norway Shows What to Do With Fading Oil and Gas Holdings

November 22, 2017

Tom Sanzillo

Insights

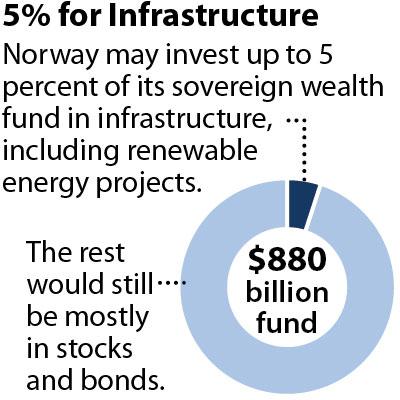

IEEFA Fact Sheet: Why Norway's Government Pension Fund Should Invest in Unlisted Infrastructure

September 01, 2017

Tom Sanzillo

Fact Sheet

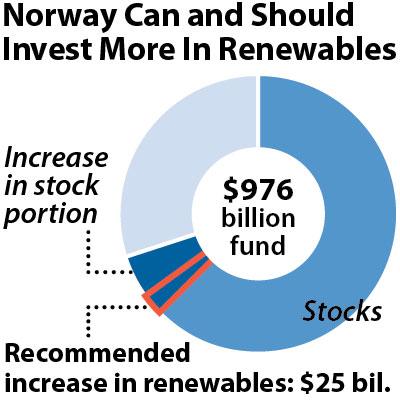

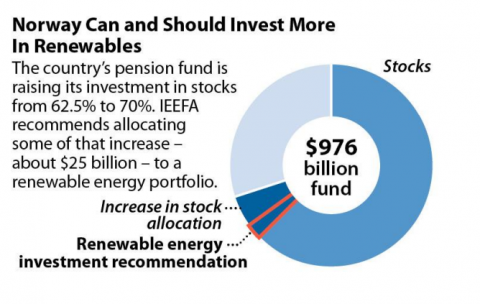

How renewable energy holdings can contribute to the growth of Norway’s pension fund in a time of oil industry uncertainty

August 01, 2017

Tom Sanzillo

Report

Latest Norwegian Pension (GPFG) Reports

See more >Latest Norwegian Pension (GPFG) Press Releases

See more >Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.