IEEFA Philippines: Reshaping the power market by moving towards renewables and energy resilience by 2021

June 24, 2020 (IEEFA Philippines) – The Philippines could come out COVID-19 with cheaper electricity prices and a more competitive and reliable power sector if it swapped its reliance on expensive coal power for cheaper renewables and structured a transition plan using auctions, finds a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

The report ‒ The Philippines Power Sector Can Reach Resilience by 2021 ‒ notes that the focus on baseload coal and reliance on imported fuel have contributed to price increases for consumers that can only be tempered if force majeure is invoked. Without force majeure, per kilowatt-hour rates would increase by 15% in Luzon and 5% in the Visayas. Prior to COVID-19, the Philippines already had one of the most expensive electricity prices in Asia.

“SUPPLY HAS BEEN A SERIOUS ISSUE, YET CONSUMERS HAVE RECEIVED SHOCKING BILLS,” says report author and IEEFA energy finance analyst Sara Jane Ahmed.

“Not surprisingly, large companies in the main grids have been under pressure to ease the burden on consumers.

“Although Meralco says the recent electricity instability is largely attributable to a spike in residential power consumption due to rising temperatures, our research suggests energy system instability may instead be due to an over-reliance on intractable fossil fuel plants that are not flexible or adaptable enough to meet consumer needs.”

Ahmed notes that more recently, in early June, the Luzon grid was under yellow alert, meaning power supply is limited.

“While jumping to the conclusion that there needs to be more baseload power seems logical on the surface, it’s actually the large baseload plants that are perpetuating this lack of power supply,” says Ahmed. “No less than 2,243 megawatts (MW) of coal capacity, 150MW of oil and 115MW of geothermal contributed to the yellow alert.”

THE COUNTRY IS CURRENTLY LOCKED INTO LARGE COAL-POWER CONTRACTS with producers, made more expensive by the need to import coal. This has led to inflexibility in generation and supply, price instability and high prices as well as negative effects on the trade balance.

“The hybrid market has been shaped by regulatory incentives focused almost exclusively on building high generation capacity rather than improving the whole system,” says Ahmed. “This approach has called for heavy capital investment in coal and other fossil fuel plants that require consumers to pay for generating capacity even when they are not being used.

“Moving to ever cheaper wind and solar technologies that are reshaping global energy markets would mean much more reliable and competitively priced power.”

Ahmed notes the Philippines Department of Finance and the National Economic Development Authority can jointly build an economic recovery from the effects of COVID-19 by strengthening the country’s electricity market with efficient new renewable energy technologies while reducing the cost of electricity.

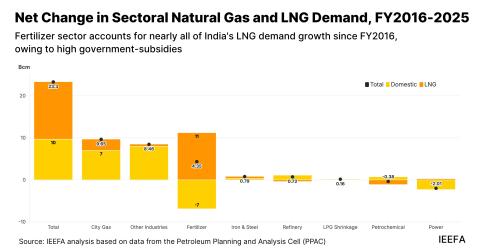

THE DEPARTMENT OF ENERGY IS EXPECTED TO FINALIZE DISCUSSIONS ABOUT IMPORTING FOSSIL GAS, or liquefied natural gas (LNG) this year, but there are serious investment and energy security risks.

“Importing fossil gas is neither an incremental decision due to the support infrastructure required nor is it economical without scale. This may turn into another lock-in scenario,” says Ahmed.

“Before deciding to pursue fossil gas, it is prudent to understand what gas will look like in 8 to 10 years versus other technology options such as deflationary solar and wind energy, and whether the experience of COVID-19 encourages power sector planners to stipulate greater domestic energy security and system flexibility.”

Ahmed’s report outlines a transition plan for stakeholders to introduce flexibility in financing and technology while moving the power sector from the current emergency, to recovery and then resilience as soon as 2021.

SOME OF IEEFA’S SUGGESTED REFORMS INCLUDE:

- Strengthening flexibility and modular systems/grid upgrades (e.g., renewable energy, energy efficiency and grid modernization)

- Implementing the Green Energy Tariff (auction for renewables)

- Effectuating a moratorium on new inflexible power

- Expediting the launch of the Energy Virtual One-Stop Shops to digitize the permitting process

- Introducing competition to include standard force majeure provisions to ensure risk-sharing

- Removing pass-through costs to end-users and mandatory carve-out (curtailment) for inflexible plants

- Improving tariff-setting (including running HOMER software to ensure proper power supply planning and power system design optimization)

- Digitizing system management, meters, and collections

- Changing the Atimonan coal plant to a battery storage system

- Offering short-term liquidity facilities for micro, small, and medium-sized enterprises (MSMEs) such as electric coops (ECs) and small-scale renewable energy developers.

“While the effects of COVID-19 will be long-lasting, there are bound to be more shocks of differing duration and intensity, including extreme heat, into the near future due to the effects of climate change,” says Ahmed.

“There is an opportunity now for stakeholders to implement system-wide reforms for cheaper more reliable power by 2021 that is less reliant on expensive lock-ins of fossil fuel technologies of the past,” she concludes.

Read the report: The Philippines Power Sector Can Reach Resilience by 2021

Media Contact: Kate Finlayson [email protected] +61 418 254 237

Author Contact: Sara Jane Ahmed [email protected]

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.