IEEFA India: Solar tariffs projected to increase by one-fifth over the next year

Surging commodity prices and import duty on solar modules add to project costs

Key Takeaways:

Projections show ~21% increase in solar tariffs in the next 12 months, mainly due to 40% basic customs duty on imported solar modules

A lack of availability of domestic solar modules will be a major challenge for developers

Central and state governments must provide clarity on the timeline and scope for duty on modules

26 May (IEEFA/JMK India): Surging commodity prices and the introduction of a new duty on imported solar modules are expected to push up solar tariffs by more than one-fifth over the next year, finds a new report by JMK Research and the Institute for Energy Economics and Financial Analysis (IEEFA).

“The price and performance of modules are critical factors in project cost and, accordingly, in developers’ bids in solar auctions,” says report co-author JMK Research Founder, Jyoti Gulia.

Hikes in module prices due to a combination of rising prices for key raw materials and increased freight charges have led to higher tariffs discovered at solar auctions from early 2021.

The lowest winning solar bids between January 2021 and March 2022 have increased by an average of 22%, relative to India’s record-low solar tariff of Rs1.99 per kilowatt hour (kWh) (~US$0.03/kWh) in December 2020.

The report projects that solar tariffs will climb even further following the recent imposition of a basic customs duty (BCD) of 40% and 25% on imported solar modules and cells respectively, and the implementation of the Approved List of Models and Manufacturers (ALMM), a non-tariff barrier covering complying solar modules which excludes modules made outside India.

The report urges central and state government regulators to make a joint effort to address these policy hurdles by providing more clarity, for example, on how long BCD will be applicable on imported modules and whether the duty will increase or decrease on a year-on-year basis.

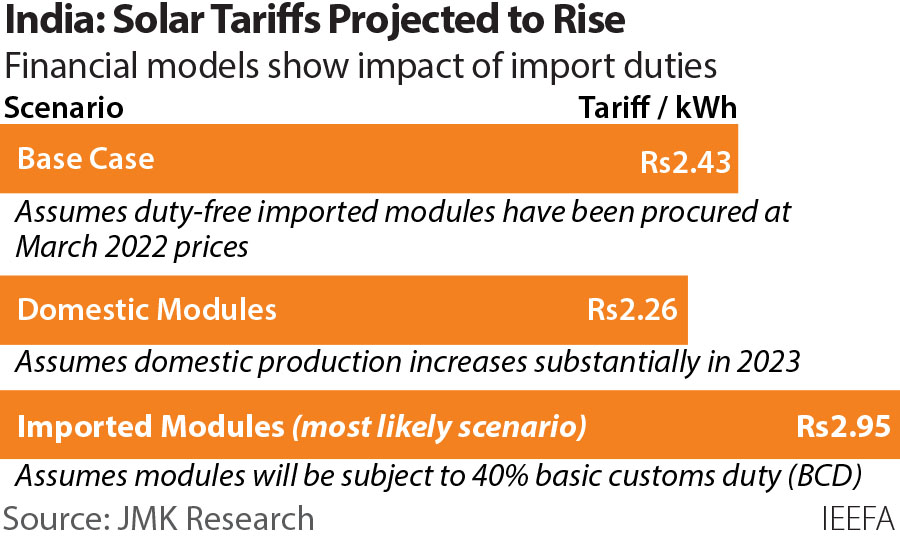

The authors analysed three scenarios to compare the implications for future tariffs of using domestically manufactured and imported modules. In the base case scenario, which assumes application of duty-free imported modules, the tariff is estimated to be Rs2.43/kWh (US$0.0323/kWh).

With imported modules, which are subject to BCD, the tariff would be Rs2.95 (US$0.039/kWh) – about 21% higher than the base case tariff.

If a developer was able to procure domestic modules, the tariff would be Rs2.26 (US$0.030) – a decline of about 7% compared to the base case tariff.

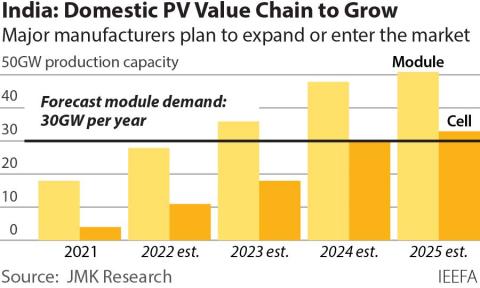

However, the authors say a substantial chunk of projects that are likely to be commissioned by 2024 will not be able to secure a supply of domestic modules due to the huge demand across segments, including rooftop solar, open access, utility scale as well as the off-grid market.

“In this case, developers will have to import modules that will attract 40% BCD,” says co-author JMK Senior Research Associate Akhil Thayillam.

New technology will compensate in part for higher tariffs, playing a major role in maximising plant output. For example, a developer opting for imported bifacial modules along with a single-axis tracker could achieve a 4% to 5% capacity utilisation factor (CUF) gain.

But Thayillam says a lack of availability of domestically manufactured high-wattage modules and bifacial modules will be a critical challenge for developers.

“Prices of domestic modules are also volatile and may surge significantly in the near-term, chiefly due to demand-supply mismatch, an increase in global polysilicon prices, and 25% BCD on solar cells,” he adds.

To reduce dependency on imported equipment and raw materials, the Indian government, as part of its production-linked incentive (PLI) scheme, has allotted a Rs24,000 crore (US$3.2 billion) capital subsidy to set up vertically integrated domestic solar manufacturing facilities.

“These facilities are likely to start production by mid-2023 at the earliest. Even for domestic modules, prices until then are likely to see an upward trend,” says co-author JMK Senior Research Associate Prabhakar Sharma.

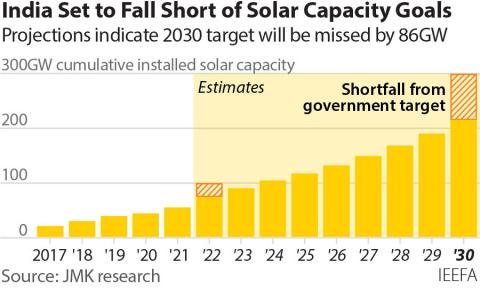

“To achieve our ambitious renewable energy targets for 2030, we must avoid delays in project commissioning caused by the short-term surge in module prices,” says co-author Vibhuti Garg, IEEFA Energy Economist and Lead India.

“Renewable energy is deflationary and future solar projects will still have significantly lower tariffs than thermal projects. Accelerating the deployment of renewable energy systems to meet India’s increasing power demand will strengthen the country’s energy security and avoid future power shortage crises.”

Note to editors: Following the release of the report, JMK Research is hosting a webinar on ‘Solar Tariff Trends in India’ at 3pm IST, 26 May. Click here to register.

Read the report: Solar Tariffs to Rise by ~21% in the Next 12 Months

Media contact: Rosamond Hutt ([email protected]) +61 406 676 318

Author contacts: Jyoti Gulia ([email protected]); Vibhuti Garg ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About JMK Research: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewables, electric mobility, and the battery storage market. www.jmkresearch.com