Enhancing the credibility of sustainability-linked bonds is pivotal to gaining the acceptance of ESG investors

Tightening SLB structures help counter greenwashing claims and reinforce issuers’ climate commitments

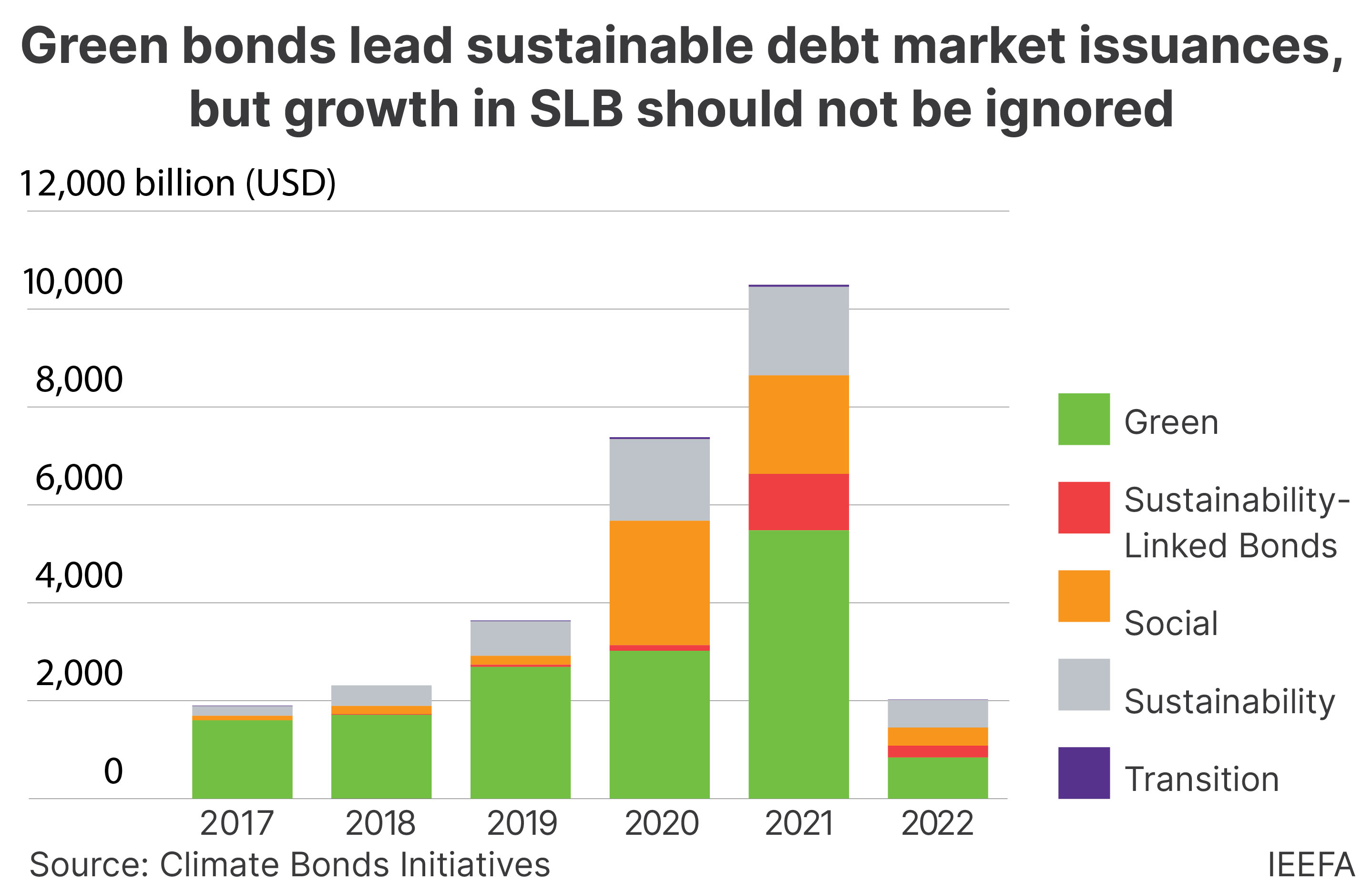

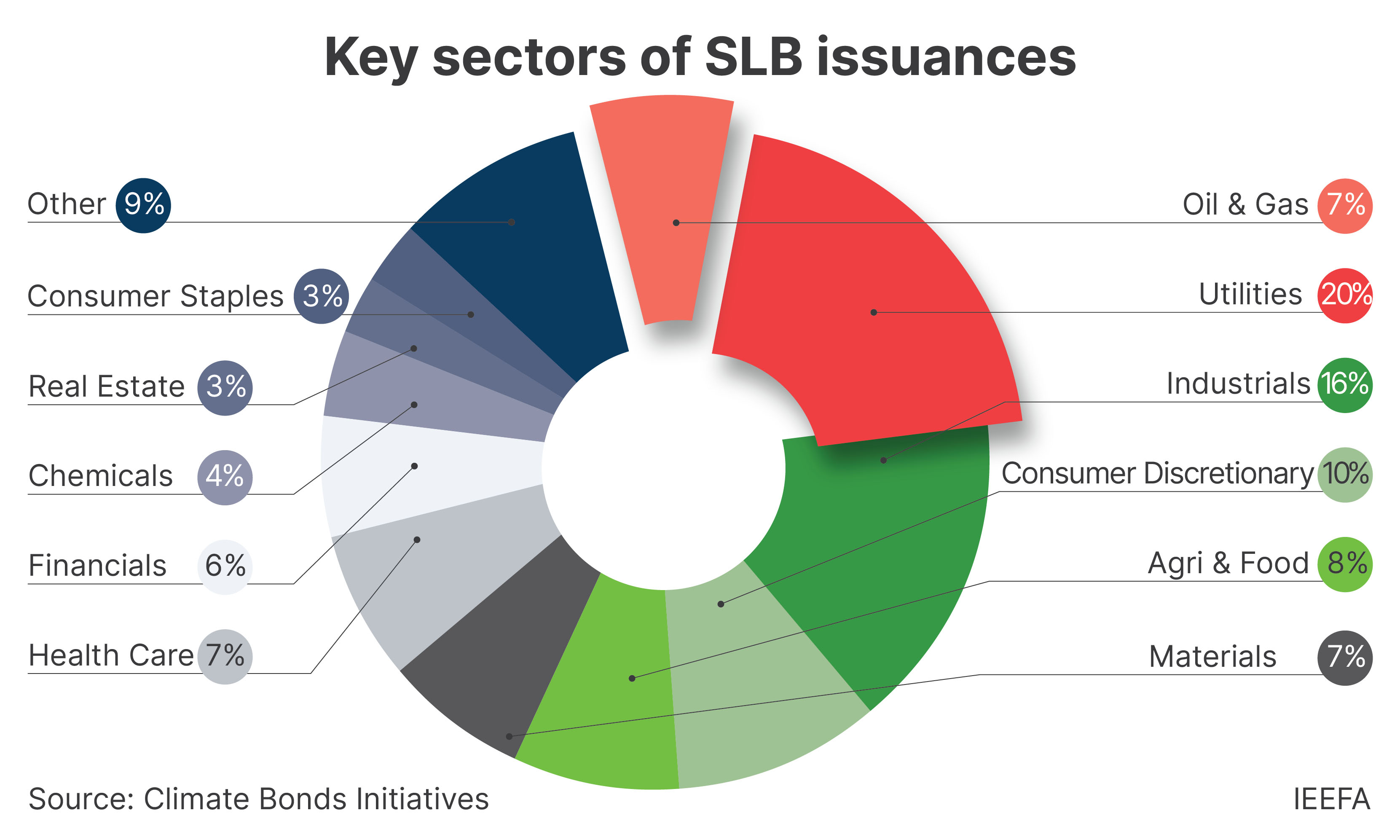

18 August (IEEFA Asia): Following the introduction of the Sustainability-Linked Bond (SLB) Principles by the International Capital Market Association (ICMA) in June 2020, SLB issuances have grown significantly since 2021.

“While SLBs now constitute 5% of the total sustainable debt market, the growth of the SLB segment should not be ignored, instead a further tightening of SLB structures is required,” says energy finance analyst Wai Ming Chang in IEEFA’s latest report.

Green bonds issued now reach USD1.9 trillion and cumulative SLB issuances have since reached USD175 billion as of 1H 2022.

As of 2021, issuers in the Asia Pacific comprised 21% of the total issued amount and Europe at 55.7%.

However, despite their significant volume growth, ESG investors’ views on SLBs are still polarized with greenwashing risks a key concern.

“They continue to demand certainty on whether the money invested in SLBs could deliver positive outcomes to meet the climate objectives of the Paris Agreement,” says Chang.

To enhance SLBs’ credibility, newer structures known as “use of proceeds SLBs” — a hybrid of green bonds and SLBs — have emerged and although still nascent, the instrument provides the best of both worlds: transparency, certainty and accountability.

Innovations in bond structures

SLBs were introduced in 2019 with the objective of broadening the scope of issuers to gain access to sustainable financing. For example, companies in hard-to-abate sectors may have limited green or sustainable capex to issue green bonds, albeit with the aspiration to transition.

As forward-looking performance-based debt instruments, SLB financial structures via coupon rate adjustment depend on the firm’s achievement of a pre-defined sustainability performance target (SPT).

Unlike green bonds, the use of proceeds under SLBs need not be specified and can be utilized for general corporate purposes.

Combining proceeds from green bonds with SLB structures could make these debt instruments more impactful. These hybrid debt instruments could boost the issuer’s climate ambition via forward-looking sustainability commitments.

“Some issuers have also experimented with the ‘use of proceeds SLBs’ as improved efforts to address greenwashing claims,” says Chang.

Chang opines that new hybrid SLBs could have the potential to boost their credibility for greater investor acceptance, which has already received robust demand.

Ensuring long-term impact

In Chang’s report, investors revealed that most SLBs currently have a step-up problem, or an upward adjustment to coupons, when issuers fail to meet sustainability performance targets (SPTs). These penalties in the form of step-ups need to be financially impactful and aligned with the size of the issuer’s business profile.

In addition, weak structures will impact an issuer’s ability to access new pools of capital, especially from leading ESG investors. This could negatively impact longer-term refinancing needs and the issuer’s reputation.

“While SLB structures with loose targets could undermine an issuer’s reputation and future refinancing needs, SLB issuers that can demonstrate consistent and credible sustainability performances against their climate ambition, will have a better advantage in gaining investors’ acceptance and access to capital.”

Suggestions for tracking issuers’ climate commitments and ensuring consistency with respective sustainability strategies include a minimum track record of at least three years for comparability.

As part of the overall evaluation, adopting external references for performance benchmarking is also recommended.

As Chang explains, this allows a more holistic assessment with greater credibility and objectivity for the medium-term tracking of the issuer’s sustainability performance against climate ambitions.

“We highlight that SLB issuers must prepare for a higher level of scrutiny than previously faced from the fixed income market. For SLBs to be credible, structures must be tightened further with robust, financially impactful and material SPTs.”

Read the report: Issuers of Sustainability-linked Bonds Could Step Up Efforts to Enhance Investor Confidence

Report contact:

Wai Ming Chang ([email protected])

Media contact:

Alex Yu ([email protected]) Ph: +852 9614 1051

About the author:

Wai Ming Chang is an energy finance analyst on IEEFA's debt markets team. He has over 16 years of experience in economics, fixed income research and sustainability management. In these fields, he has worked in various capacities as an investment analyst and market strategist for key banking groups in Malaysia. He is passionate about promoting responsible investments and the deployment of investment capital towards cleaner renewable energy projects and infrastructures in driving climate resilience and sustainable economic growth.

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)