IEEFA: Chinese regulators urged to tighten rules for carbon neutral bonds

1 June 2021 (IEEFA): China’s carbon neutral bonds fail to restrict the use of funds to green projects and are adding to the working capital of coal-dominated state-owned enterprises (SOEs), according to a new briefing note from the Institute for Energy Economics and Financial Analysis (IEEFA) which calls for deeper reforms to green finance standards to mobilise investment to fund President Xi Jinping’s carbon neutrality pledge.

IEEFA’s note highlights the risk for environmental, social and governance (ESG) investors who might inadvertently be buying green bonds that are helping to fund fossil fuels.

“Chinese financial market regulators need to take a serious look at how the country’s state-owned enterprises are using the proceeds of their green bonds,” says author Christina Ng, IEEFA's Research and Stakeholder Engagement Leader, Debt Markets.

There’s a risk for ESG investors

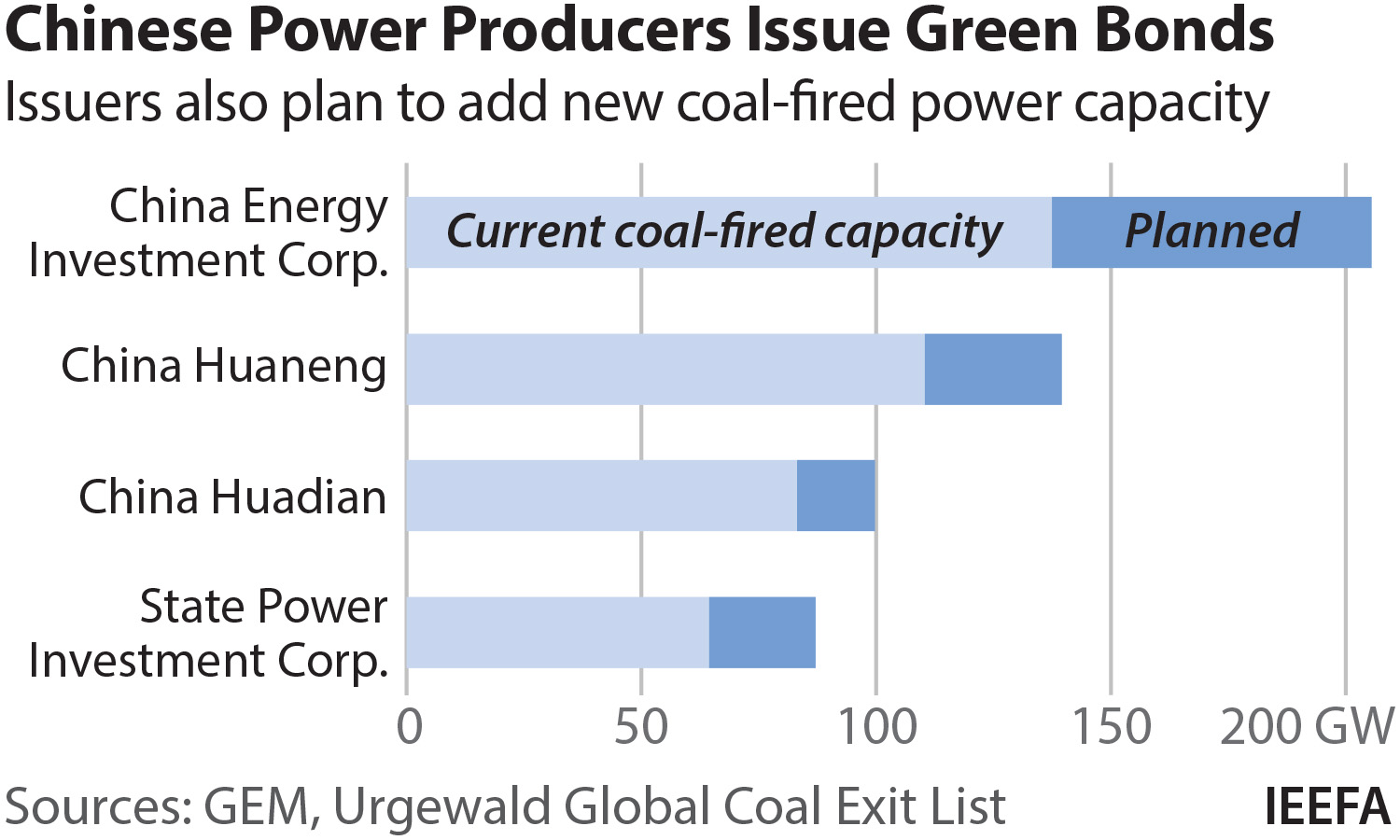

In February 2021 some of the largest state-owned power companies, such as China Energy Investment Corporation, China Huaneng Group and State Power Investment Corporation, issued the first batch of Yuan-denominated carbon neutral bonds, a green debt instrument to raise finance for carbon emissions reduction projects.

According to the bond offering documents examined by IEEFA, 30% of proceeds from these carbon neutral bonds were to be allocated to the working capital of the issuers. In other words, the proceeds are to fund their day-to-day (and not necessarily green) operations.

This carve-out matters because two of China’s leading fossil fuel energy and power SOEs, China Energy Investment Corporation and China Huaneng Group, used this green bond structure to raise CNY 7 billion (USD 1 billion), but ultimately IEEFA estimates that a total of CNY 2.1 billion (USD 326 million) was assigned on an unrestricted basis for working capital.

The bond offering documents stated that both SOEs’ current coal-fired capacity makes up around 75% of their total power assets and that the coal power segment will remain a core part of their businesses. There was limited information about the SOEs’ future energy capacity or plans to phase out fossil fuel energy sources.

How green are China’s SOE carbon neutral bonds?

“The promise of green bonds is that they can help channel capital to energy transition investments,” says Ng. “But potentially the proceeds raised by the SOEs from these bond deals could be spent on maintaining a steady – or growing – coal business, particularly as they have new coal assets in the pipeline.”

‘Clean coal’ has officially been removed from the definition of ‘eligible green project’

The note highlights that Yi Gang, governor of China’s central bank, the People’s Bank of China (PBOC), is taking action to improve green finance standards and climate-related disclosure rules as part of an effort to encourage foreign investors to enter the domestic green bond market to help fund the country’s carbon neutrality goals.

While the issue with China’s carbon neutral bonds doesn’t send the right signal to investors, Ng notes that an important step in the right direction was the release in April of the 2021 Green Bond Endorsed Project Catalogue which officially removed all fossil fuel-related projects, including ‘clean coal’, from the definition of ‘eligible green project’.

But she adds that further critical reforms of green bond market practices are needed, especially for SOE issuers.

“Regulators urgently need to look at tightening the rules on how high carbon SOEs use the proceeds from their green bonds.

“Even with the recent enhancement to the Green Bond Endorsed Project Catalogue, up to 50% of SOE green bond proceeds can still be allocated to working capital.

100% of green bond proceeds should be going to green projects

“100% of green bond proceeds should be going to green projects. We also recommend that standardised reporting of green bond offering documents is introduced to improve transparency of the SOEs’ governance, particularly in relation to the structure and processes for decision-making, controls and accountability of the proceeds and the projects.”

Ng says leading foreign ESG investors are reluctant to fund issuers that lack transparency and that continue to be fossil-fuel focused.

“Increasing market discipline for SOEs will be critical to Governor Yi’s efforts to build confidence in China’s green bond market.”

Read the briefing note: Carbon Neutral Bonds: Has China Set the Bar Too Low?

In Mandarin: 碳中和债券:中国是否把门槛设的 过低?

Media contact: Kate Finlayson ([email protected]) +61 418 254 237

Author contact: Christina Ng ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)