China’s central bank is leading the way with bold green finance policies

31 March (IEEFA Asia): Central banks around the world agree that climate change is a serious financial risk, but there is little clarity or consensus on what they can do about it. According to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA), the People’s Bank of China (PBOC) has been quietly greening China’s financial system. The PBOC’s actions to steer credit into decarbonization efforts are bold and novel compared to other central banks globally.

People’s Bank of China has been quietly greening their financial system

“Beyond risk discovery, central banks’ use of active monetary policy measures to mitigate climate risks has been limited,” says Norman Waite, IEEFA Energy Finance Analyst and the report’s author.

“The majority of central bank actions toward climate change to this point have therefore focused on the fundamental need for improved disclosure and risk discovery.

“This differs from the People’s Bank of China, which has been quietly greening their financial system. Their long-standing practice of guiding credit toward favoured sectors and away from out of favour areas is well known, and those same tools had been used to steer credit toward green borrowers for some time.”

A key measure is the introduction of a facility that would provide discounted central bank credit to banks lending to enterprises engaged in carbon emission reduction.

The PBOC launched the Carbon Emissions Reduction Facility (CERF) a few days after the Conference of the Parties (COP26) Finance meetings last year.

Climate risks are seen as a threat to China’s financial market stability

“The CERF could have a substantial impact on financing China’s carbon reduction,” says Waite.

The CERF offers attractively priced funding to banks, conditional on loans extended to borrowers able to produce proven, audited, and consistent decarbonization results. The CERF provides banks with the option to refinance 60% of qualified loan principal at 1.75% from the PBOC.

This would be an attractive source of one-year credit at the moment, just 25bps above deposit funding at 1.5% and at least 75bps below China’s interbank and bond market funding above 2.5%.

By the end of 2021, within its first month of operation, the PBOC refinanced loans to 2,817 borrowers promising to cut 28.76M tons of annual carbon emissions. That is 0.8% of China’s annual carbon dioxide (CO2) emissions from coal power.

“If the PBOC keeps this pace every month for 2022, the CERF could add significant cuts to the country’s CO2 by year-end,” says Waite.

“This is a strong start, but the CERF’s real test will come as emission reduction results come through, third-party audits are conducted, and the PBOC assesses both for rollover.”

The report highlights that climate risks are seen as a threat to China’s financial market stability, and since President Xi Jinping’s pledge that China would reach carbon dioxide (CO2) emissions peak before 2030, and total greenhouse gas emission neutrality by 2060, efforts to foster more climate-friendly lending have intensified.

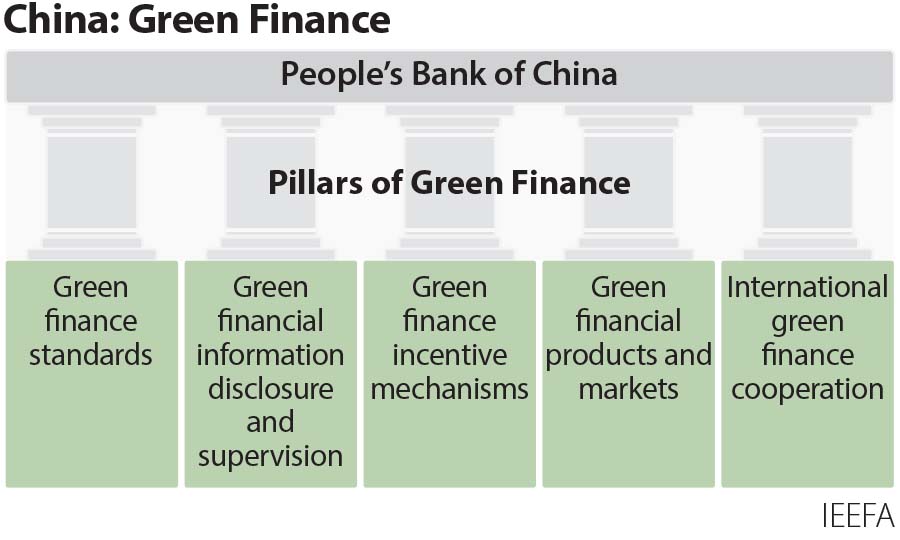

The PBOC introduced the “five pillars” of green finance that it would build to support its climate efforts going forward. The pillars include green finance standardization, green financial information disclosure and supervision, green finance incentive mechanisms, green financial products and markets, and international green finance cooperation.

The PBOC has ratcheted its climate actions higher with conventional, unconventional, and experimental measures in service to fortify those pillars.

“While the PBOC operates within China’s unique economic, political, and financial environment, it would be a mistake to overlook the significance of these policies,” says Waite.

Read the report: Central Banking and Climate Action – China Steers Credit to Decarbonize

Author contact: Norman Waite ([email protected])

Media contact: Paige Nguyen ([email protected]) Ph: +61 433 048 877

*Author is available for media interviews and background briefings*

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)