Sightline/IEEFA update: U.S. fracking sector bleeds red ink in Q1

June 4, 2019 (Sightline/IEEFA) – The North American fracking sector once again spent more on drilling than it realized from sales of oil and gas, according to a briefing note released today by Sightline Institute and the Institute for Energy Economics and Financial Analysis (IEEFA).

June 4, 2019 (Sightline/IEEFA) – The North American fracking sector once again spent more on drilling than it realized from sales of oil and gas, according to a briefing note released today by Sightline Institute and the Institute for Energy Economics and Financial Analysis (IEEFA).

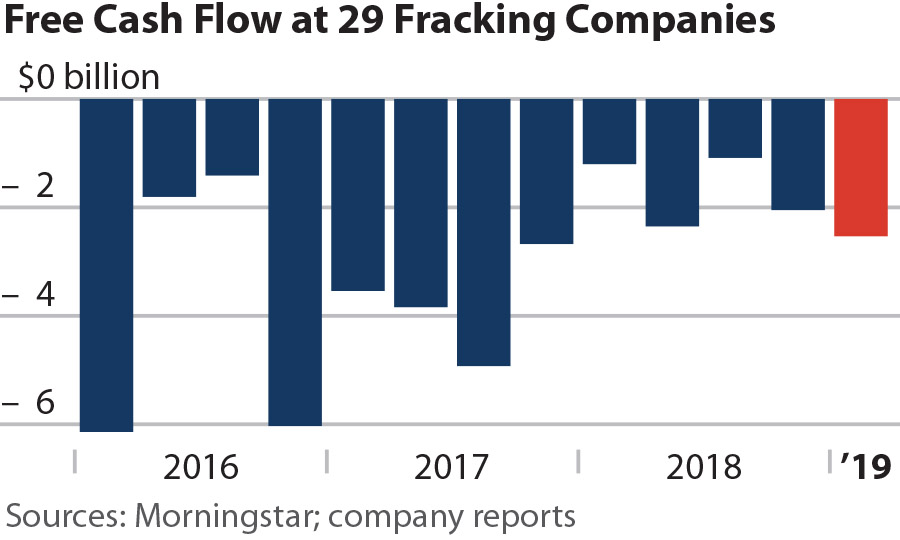

The brief, Red Ink Keeps Flowing for U.S. Fracking Sector, traces a cross-section of 29 oil and gas companies that combined reported more than $2.5 billion in negative free cash flows during the first quarter of 2019.

“These results were even worse than in the fourth quarter of 2018, when the same group notched up $2.1 billion in negative cash flows,” said lead author of the report Clark Williams-Derry of Sightline. “We are seeing a continuation of the overall downward trend that confirms underlying weaknesses in the fracking business model.”

The dismal Q1 cash flow performance came despite a 16 percent quarter‑over‑quarter decline in capital expenditures. But operating cash flows fell even faster, widening the industry’s cash flow gap.

“These companies keep having to dip into cash reserves or sell off assets to remain afloat,” said IEEFA financial analyst Kathy Hipple who co-authored the report. “Investors are taking notice and it has become increasingly difficult for the companies to obtain capital.”

The Sightline/IEEFA analysis found:

- US fracking-focused oil and gas companies continued their decade-long losing streak through the first quarter of 2019.

- A cross-section of small and mid-sized U.S. E&Ps (Exploration and Production companies) reported $2.5 billion in negative cash flows from January through March 2019.

- Negative cash flows have soured investors on the sector, constraining the oil and gas industry’s ability to tap debt and equity markets.

“From 2010 through early 2019, the companies in our sample racked up aggregate negative cash flows of $184 billion, hemorrhaging cash every single year,” said Williams-Derry.

The report noted that oil and gas bankruptcies have continued in 2019. Similarly, the oilfield services sector, which relies heavily on the fracking industry for revenues, has gone through nearly 180 bankruptcies involving more than $64 billion in debt since 2015–including, most recently, the insolvency of Weatherford International.

The report advises investors to view the fracking sector as a “speculative enterprise” with a weak outlook and an unproven business model.

Clark Williams-Derry ([email protected]) is Director of Energy Finance for Sightline Institute.

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

Tom Sanzillo ([email protected]) is IEEFA’s director of finance.

Full Report: Red Ink Keeps Flowing for US Fracking Sector

Media Contact: Vivienne Heston ([email protected]) +1 (914) 439-8921

Anne Christnovich ([email protected]) +1 (206) 498-1887

About Sightline

Sightline Institute is an independent, nonprofit research and communications center. More can be found at www.sightline.org.

About IEEFA

The Institute for Energy Economics and Financial Analysis conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org