U.S. residential gas consumers bear brunt of LNG exports

Download Briefing Note

Key Findings

Increased exports of liquefied natural gas (LNG) have raised prices for U.S. residential customers.

The exports have exposed U.S. customers to the increased volatility of the global natural gas market.

The U.S. Department of Energy has failed to consider the inflationary impact of LNG exports on the domestic market.

Prices for residential consumers have already risen beyond projections made by the department.

Introduction

In 2016, the United States began shipping liquefied natural gas (LNG) exports via LNG carriers, allowing domestic producers to profit from low-priced natural gas. By 2023, amidst increasingly chaotic market conditions, residential prices increased by 9% for U.S. consumers. The continued failure by the U.S. Department of Energy’s (DOE) impact analysis to consider the inflationary impact of LNG exports on U.S. consumers and producers is a major weakness in its economic assessments.

It’s time for a reality check. Previous DOE studies have argued that LNG exports have little influence on domestic natural gas prices. But real-world evidence, bolstered by economic theory, reveals that LNG exports have already linked U.S. natural gas prices to the volatility of the global market. And as the United States exports more LNG, this problem could get worse.

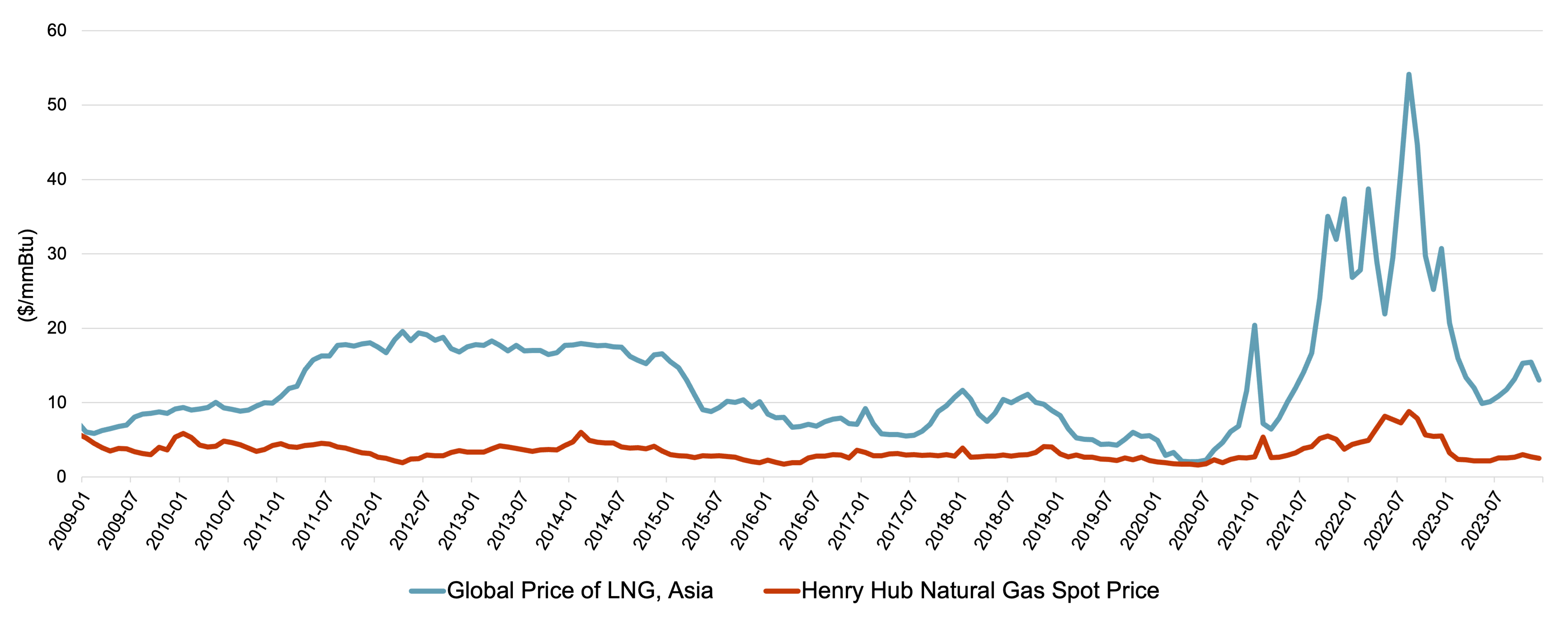

The Asian region has been a dominant LNG export destination, receiving about one-third of all U.S. LNG exports since the buildout of U.S. LNG terminals. As the chart below shows, the U.S. natural gas price benchmark—the Henry Hub price—has been both lower and more stable than Asian prices (the competitive alternative) over the past 15 years (Figure 1). The spread between the two markets is also an example where LNG exporters can capture profits by selling low-priced U.S. gas in high-priced overseas markets.

Figure 1: Comparison of U.S. Natural Gas and Asian LNG Prices

Source: Federal Reserve Bank of St. Louis

But arbitrage has consequences. Exports tend to lift prices in low-priced markets, making regional commodity markets—such as the North American gas market—susceptible to the volatility of global markets. This is exactly what happened in 2021 and 2022, when surging European demand for U.S. LNG lifted U.S. gas prices to their highest levels in more than a decade. It’s also what happened when the U.S. started exporting crude oil in 2015: U.S. oil prices more closely mirrored the movements of international oil markets.

Read more in the full briefing note.