Tata Power: "Renewables to power growth"

Download Full Report

Key Findings

Tata Power’s shift mirrors the transition underway within the Indian power sector, driven by least cost renewable energy.

Tata Power is currently a significant player in the coal-fired power, renewables, transmission and distribution sectors.

Executive Summary

Tata Power recently made it publicly clear that it will not be building any new coal-fired power capacity going forward.

Furthermore, the company has committed to driving the great majority of its power capacity expansion via lower cost renewable energy.

The majority of Tata Power’s thermal capacity is centred on its Mundra coal-fired power plant which is financially unviable and making consistent, significant losses that are dragging back the company’s overall financial performance. Since the Mundra plant was commissioned in fiscal year (FY) 2012-13, thermal power has made up only 3% of net capacity additions whilst wind and solar make up 87% and hydro 11%.

This represents a significant departure from the accepted wisdom of just a few years ago that a major expansion of coal-fired power would be required to serve India’s growing electricity demand.

Tata Power’s shift mirrors the transition underway within the Indian power sector as a whole, driven by least cost renewable energy.

Over the first 11 months of FY2018-19, only 20 megawatts (MW) (net) of thermal power has been added in India after taking closures into account. Renewable energy additions over the same period totalled 6,740 MW.

Tata Power’s shift mirrors the transition underway within the Indian power sector, driven by least cost renewable energy.

The dramatic turnaround in the generation growth plan of India’s largest integrated power company is encapsulated in the title of Tata Power’s most recent 2018 annual report, “Renewables to Power Growth”. The introduction to the annual report states that “the Company has embarked on a journey of growth by focusing on renewables, distribution and transmission of power.”

Tata Power is currently a significant player in the coal-fired power, renewables, transmission and distribution sectors. The company also has a presence in electric vehicle (EV) charging infrastructure, solar photovoltaic manufacturing and is India’s largest installer of rooftop solar.

Thermal power at present makes up 70% of the company’s total capacity. This is however, a product of Tata Power’s longer-term history prior to 2013 when renewable energy was still relatively expensive.

This report examines the significant recent shift in Tata Power’s plans for its future which move it away from a reliance on coal-fired power, making the company a leading example of the ongoing transition in the Indian power sector.

The developments exemplifying this include:

- Since FY2012-13, Tata Power has added only 68 MW of thermal power net of decommissioning of old plants. Over the same period, the company has added more than 2,000 MW of wind and solar power and 246 MW of hydro power. Non-thermal power additions consist of 97% of all additions over this period.

- The company’s 4,150 MW imported coal-fired power plant at Mundra represents the majority of its coal-fired power capacity. Higher-than-expected cost of imported coal led to this plant reporting a net loss of US$-241m in FY2017-18, higher than the US$-119m loss from the prior year.

- With the Mundra plant’s loss reaching US$-191m for the first three-quarters of FY2018-19, a bailout of the plant is being planned which will increase the tariff burden on consumers and realise a debt write-down for bank lenders. Tata Power’s CEO has stated that this bailout will only halve the losses at Mundra.

- Tata Power’s renewables operations recorded earnings before interest, depreciation and amortisation (EBITDA) of US$249m in FY2017-18, an EBITDA margin of 89% and representing 13.9% of assets deployed. Profit after tax was US$41m.

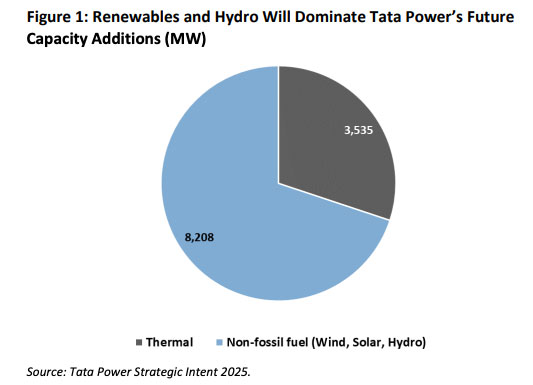

- The company’s plan, ‘Strategic Intent 2025’ calls for up to 70% of new capacity additions to come from solar, wind and hydro through to 2025 (Figure 1). By then, Tata Power’s power capacity composition will have significantly transitioned, mirroring the transition encapsulated in the Government of India’s National Electricity Plan (NEP 2018). Tata Power will need to increase its rate of renewable addition significantly in order to reach this target.

- In February 2019, Tata Power Delhi Distribution Ltd (Tata Power-DDL) collaborated with Mitsubishi Corporation and AES India to install India’s first grid-scale battery storage system.

- Tata Power-DDL is also rolling out smart meters across its network and moving into electric vehicle (EV) charging with a vision of integrating EV charging and energy storage with Tata Power’s leading rooftop solar position.

- With more than 40 GW of existing coal-fired power plants under financial stress in India, Tata Power is seeking to only add new coal-fired power capacity via fire-sale acquisition, at 30%-40% of historical investment. It no longer plans to build new coal-fired power plants.

- Tata Power has identified key risks specific to the company that may impact its business including the availability of cheap coal imports, price and exchange rate risk on coal imports, and pressure on the company’s existing generation assets from increasing concern over emissions and water and the possibility of new regulations.

India has helped drive its transition with ambitious renewable energy installation targets including an aim to reach 275 GW of renewable capacity by 2027. Over the same period, net coal-fired power additions are planned to slow significantly.

However, the current Indian fiscal year has seen net coal-fired power additions come close to ceasing altogether – the shift away from new coal-fired power is moving faster than anyone had predicted.

Tata Power is not alone in demonstrating the transition now happening in India’s power system, but it is one of the best examples of that transformation in action.