Reforming the economic regulation of Australian electricity distribution networks

Download Full Report

View Press Release

Key Findings

The economic regulation of electricity distribution networks has a significant impact on electricity bills for households and businesses, and more broadly on Australia's economic productivity, but the current system has failed to deliver efficient costs for distribution network services.

The current system is based on the assumption that distribution networks are the monopoly providers of network services. However, increasingly, distributed energy resources (DER) owned by households and businesses can provide network services, including easing congestion to avoid augmentation or replacement of network infrastructure.

Internationally, momentum is growing towards reform of the economic regulation of electricity networks, with overseas jurisdictions introducing contestability and payments for DER to provide network services, totex regulation and performance incentives for decarbonisation.

IEEFA recommends the Productivity Commission undertake a first-principles review of the economic regulation of distribution networks, which would identify ways to ensure efficient costs of network services in a high-DER world.

Executive Summary

The cost of building, replacing and maintaining the poles, wires and substations of the electricity distribution networks impacts all households and businesses that pay electricity bills. Collectively the value of the regulatory asset base (RAB) of all distribution businesses in the National Electricity Market (NEM) is now AU$82.7 billion, and distribution network charges typically account for 25%-35% of electricity bills. The way distribution networks are remunerated – their economic regulation – therefore has consequences for Australia’s economic productivity.

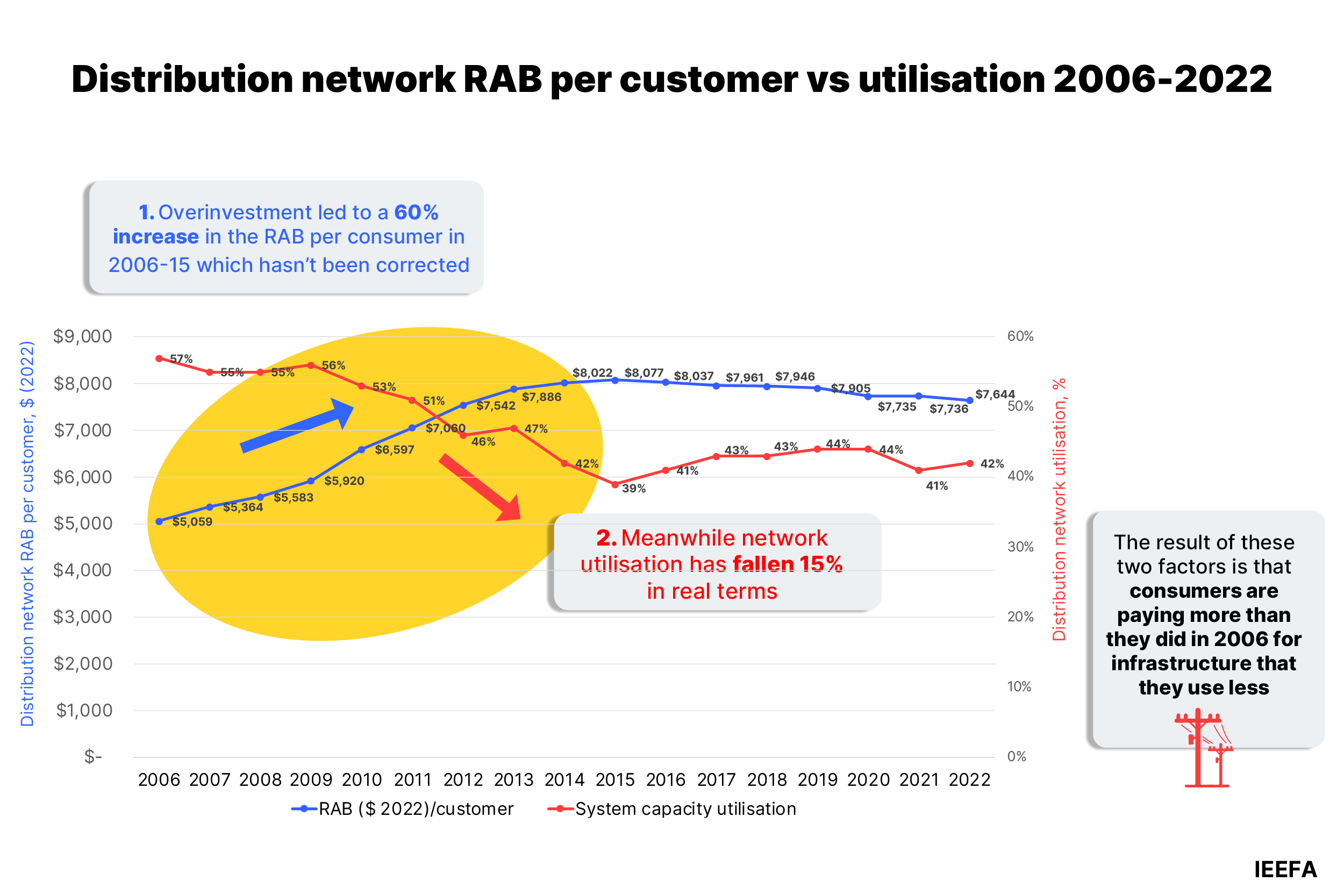

The per-customer value of the RAB was AU$5,059 in 2006. It rose dramatically by 60% to a peak of AU$8,077 in 2015, before falling 5% to AU$7,644 in 2022. The surge in the value of the RAB per customer coincided with a slump in distribution network utilisation, from 57% in 2006 to 39% in 2015. This has subsequently levelled out at around 41% but has never recovered to 2006 levels. While the trends since 2015 may be interpreted as positive stabilisation, over 2006-2022, the per-customer RAB rose 34%, while network utilisation fell 15% in absolute terms. Consumers are now paying much more for a service they are using less than in 2006, with no correction to the RAB value.

Source: IEEFA. All figures in real $, 2022.

This analysis suggests that while the earlier RAB over-investment ceased due to reforms in 2012-2013, the economic regulation has not delivered efficient costs for distribution network services.

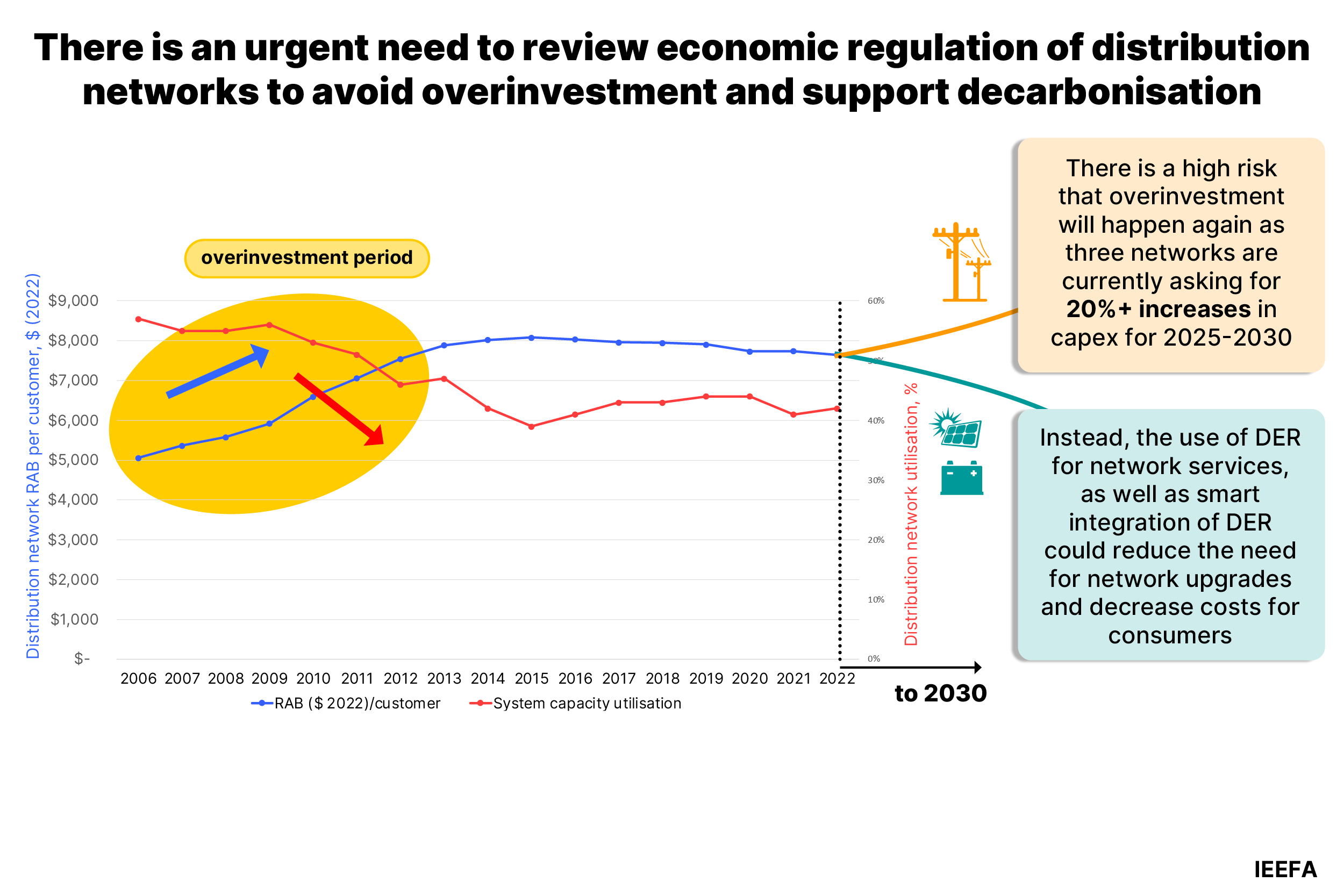

Moreover, there is an emerging, concerning risk of future over-investment comparable to that seen around 2006-2015, with distribution networks requesting higher capital allowances, which will result in increases in both the value of the RAB and electricity bills. Three distribution network service providers (DNSPs) submitted 2025-2030 revenue proposals to the Australian Energy Regulator (AER) in January 2024, all of which have over 45% of households with rooftop solar, and a growing number with batteries in their regions. All three (SA Power Networks, Ergon and Energex) are proposing 20-22% increases in capital expenditure (capex), compared with the 2020-2025 regulatory period. Most of these increases seem to be for replacement of aging assets or for augmentation. It is unclear why the increases are so large when network utilisation is so low, and rooftop solar and battery uptake is increasing.

Source: IEEFA based on AER data.

This report argues that, alongside the over-investment risk, a large opportunity exists to cut network costs by reforming the economic regulation of distribution networks, especially to enable distributed energy resources (DER) like solar batteries and smart appliances to provide network services. Network services that DER can provide commonly include congestion management, voltage control, reliability enhancement and network deferral. If DER can substitute for costly augmentation or replacement infrastructure – poles and wires and substation capex investment – this should reduce bills. Based on now conservative figures for DER uptake, Baringa has estimated that AU$10 billion in distribution network investment could be avoided by 2040 through efficient DER integration, including the use of DER to provide some network services.

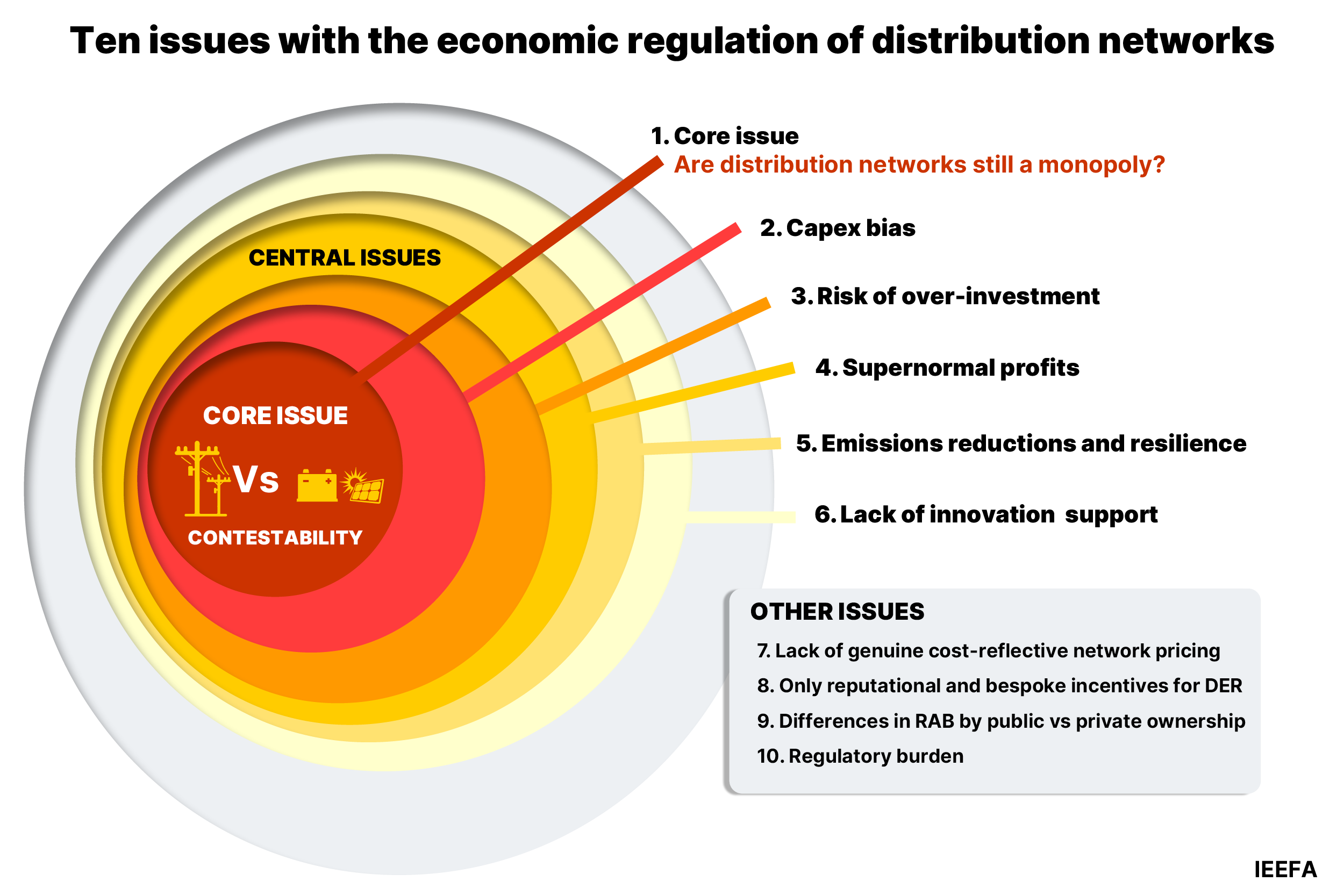

The economic regulation of distribution networks effectively dates from 1980s Great Britain, with a few tweaks. This report sets out ten reasons to reform distribution network revenue regulation, to help Australia meet its 82% renewables by 2030 target at an efficient cost.

In terms of regulatory economics theory and for the purposes of this report, the core issue is whether distribution networks are still a monopoly service or whether they are contestable. This report details examples of two use cases in which DER can compete with networks. The first is through the substitution of remote and regional networks with standalone power systems and microgrids. In south-west Western Australia, Western Power has decided to convert more than 52% of its remote and regional network serving 3% of its customer base to stand-alone power systems (SAPS) and microgrids. In 2004, Great Britain introduced contestability for ‘the last mile’ for new network investment in brownfields and greenfield sites in, and now 80% of new residential connections are made through independent (commercial) network providers.

The second use case is for DER to provide network services, especially easing congestion in existing grids, to reduce the need for augmentation and replacement of parts of the network. There have been a number of successful Australian trials that show DER can provide network services, including in Projects Networks Renewed, CONSORT, Edge, Edith and Symphony. In Great Britain, where about 20% of network areas are constrained, ‘flexibility services’ are being procured by each of the six distribution networks, earning DER owners up to GBP33/kW/year in some locations. For example, a 10kW home battery can early up to GBP331/year. Flexibility services are also procured from businesses such as water utilities which have control over their pumping and other electricity uses. By August 2023, 2.4GW of flexibility services had already been contracted by distribution networks in Great Britain for the 2023/24 year.

Internationally there is momentum towards reform of the economic regulation of electricity networks, with Great Britain the most advanced. This report looks at international case studies of network revenue reform across three themes and what Australia can learn from them:

- Totex regulation (total expenditure, combining capex and opex – operating expenditure) is widespread in Europe as a way of mitigating the risk of capex bias, but has not been taken up in the US.

- Network services procurement through DER and otherwise. It is widely recognised that DER can and will provide a greater proportion of network services. In Great Britain and Europe, network services provided by third-party DER (and larger-scale assets) are called ‘flexibility services’, while in North America, they are called non-wires solutions (or non-wires alternatives (NWA)).

- Performance incentive mechanisms (PIMs), including to support DER integration. These incentives are aligned with decarbonisation in many EU and US jurisdictions, but not in Australia.

Given the ten issues outlined with the current regulatory regime, and innovative overseas examples yielding improved outcomes for customers, IEEFA recommends the Productivity Commission undertake a first-principles review of the economic regulation of distribution networks in the NEM.

We recommend the review look to develop a form of economic regulation of distribution networks to achieve the following outcomes:

- The best outcomes for consumers in terms of the lowest possible prices.

- Economically efficient outcomes for our economy, including an end to capex bias.

- Fast decarbonisation, including electrification, to achieve Australia’s legislated emissions reduction goals.

- A level-playing field between infrastructure and DER-provided network services.

- Improved climate resilience.

IEEFA recommends the following questions be central to such a review:

- What is the nature of contestability in distribution network services?

- What outcomes should distribution networks be remunerated to provide?

- How can and should distribution networks be rewarded for accelerating decarbonisation?

- How can and should distribution networks be rewarded for innovation (including within and outside economic regulation)?

- What processes can be used to efficiently determine network revenue, and in what timeframe given the fast-paced nature of the energy transition?

- How can supernormal profits be avoided?

- Should performance monitoring of network regulation and the regulator be introduced, and if so, what form should this take?

A review would identify ways to ensure efficient costs of distribution network services in a high-DER world. The significant medium-term benefit on offer would be lower proportional costs for consumers and improved economic efficiency, with consequences for Australia’s overall economic productivity. If consumers were compensated for providing network services via DER, they could gain an enhanced return on their DER investments. Moreover, assuming the DER network costs are lower cost than infrastructure investment, costs would be reduced for all consumers. As Great Britain shows, contestable procurement of network services can be supported and facilitated by distribution network businesses.

High costs for electricity consumers have cost-of-living impacts and make Australian industry less internationally competitive. The combination of lower-cost renewable energy and more efficient network costs would be expected provide the lower-cost electricity essential to Australia’s future economic prosperity.