Presentation: The Ukraine crisis and its impact on Asian LNG markets

Download PDF

Key Findings

In Asia, high LNG prices and unreliable supplies are weakening demand growth. In some cases, that may be permanent.

Demand in China is down 16% YTD, due in part to strict COVID-19 lockdowns. But pipeline imports are up 60%, with plans to expand Russian connections.

Many expect NE Asian countries to resume purchases in the summer to refill storage. But long-term plans in Japan indicate shift away from LNG.

Summary

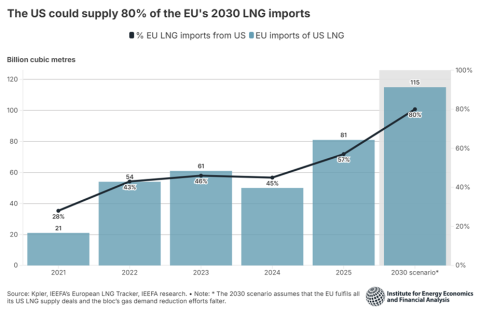

The fallout from the Russian invasion of Ukraine has disrupted the world’s liquefied natural gas (LNG) market, driving prices to record levels while likely positioning the industry for a significant downturn as emerging Asian markets are priced out of the market, according to a panel of IEEFA experts.

IEEFA’s analysts find that the disruption in the LNG markets has been truly global. Russia, which faces a series of international sanctions, is the world’s second-largest natural gas producer, its third-largest oil producer, and its sixth-largest coal producer. In addition, Russia provides Europe with more than one-third of its gas supply.

Press release: IEEFA experts trace the fallout from Russia’s invasion of Ukraine on global liquefied natural gas markets

Link to webinar: How is the Ukraine crisis and its fallout affecting global LNG markets?