Key Findings

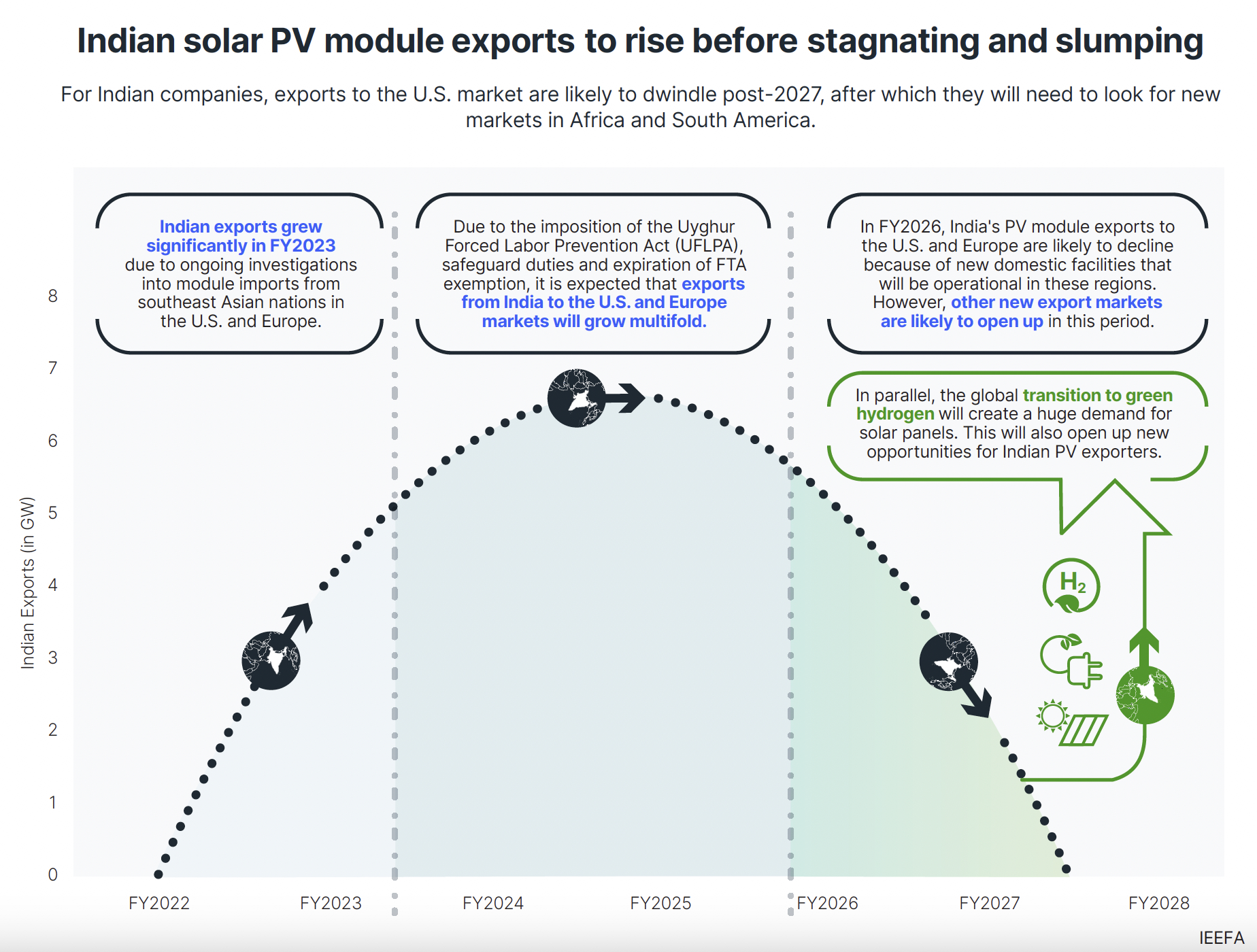

In the backdrop of huge capacities likely to be set up in the U.S. under the Inflation Reduction Act (IRA), Indian photovoltaic (PV) module exports to the U.S. may experience a period of stagnation from 2025 and decline from 2027.

Between 2022 and 2023, the global PV module manufacturing capacity has increased from 358GW to 640GW, highlighting the enhanced global demand for solar.

Future iterations of the Product Linked Incentive (PLI ) scheme may have specific provisions inspired by the IRA, such as layered incentives, an extended policy period, etc.

To take advantage of the IRA while minimising the associated risks of manufacturing upstream components in the U.S., several Indian manufacturers are looking to set up module lines in the U.S. and cell or ingot/wafer lines in India.

Executive Summary

At present, around 80-90% of the global photovoltaic (PV) manufacturing infrastructure is based in China. With a significant increase in solar installations underway globally (BloombergNEF estimates that installations in 2023 are set to grow 46% year-on-year to 392 gigawatts (GW), a corresponding increase is needed in PV manufacturing capacity across regions. Post-COVID-19 and the disruption of supply chains resulting from Putin’s invasion of Ukraine, several countries, including India, the United States of America (U.S.) and Europe, are aggressively developing their domestic PV manufacturing ecosystem. Self-sustenance and insulation from global supply chain shocks are some of the key reasons why these countries are pursuing PV manufacturing.

In August 2022, the U.S. passed the Inflation Reduction Act (IRA), the most detailed policy document ever issued by a single country to target economic decarbonisation. One of the focus areas under IRA is the manufacture of renewable energy products like solar PV modules, inverters, trackers and batteries. Within the solar PV modules segment, the IRA provides separate layered incentives for producing upstream components, i.e., polysilicon, ingot/wafer and cell. In addition to a production incentive, the IRA aids the capital investment of manufacturers through an investment tax credit incentive.

The response to the scheme has been exemplary and many companies worldwide are vying to set up manufacturing facilities in the U.S. Many PV manufacturers recently announced setting up new PV capacities in the U.S. If these announcements come to fruition, solar module manufacturing facilities, with a total capacity of 50GW, could become operational in the U.S. by 2026. However, manufacturing upstream components will be more challenging than manufacturing modules due to their complex and expensive manufacturing process. Considering this, most players plan to set up only module manufacturing facilities in the U.S.

The European Union (EU), similar to the U.S., is also working on a detailed incentive bill along the lines of the IRA, under the ambit of a larger climate action plan, building on the “EU Green Deal” that was launched by the EU Commission in 2019. According to recent announcements by players looking to set up new facilities in Europe, more than 31GW of new module manufacturing capacity will likely be added in this region in the next few years. Despite the announcements, until the clear outlining of production incentives and enactment of firm trade barriers, the actual inflow of investments and on-ground construction progress in Europe is likely to be tepid.

The U.S. and the EU will play an important role in the growth of the Indian PV manufacturing sector, especially exports. The U.S. has traditionally been the largest export destination for Indian PV products. The PV module exports from India to the U.S. have increased exponentially in the fiscal year (FY) 2023 (16x from FY2022 by value). In the backdrop of huge manufacturing capacities being set up in the U.S. under IRA, Indian PV module exports to the U.S. may experience a period of stagnation from 2025 and later decline from 2027 onwards.

The IRA has ushered in a substantial export opportunity for Indian companies involved in the manufacturing of upstream components. With capacities under the Production Linked Incentive (PLI-l) tranche already awarded in November 2021, Indian players have a head start of at least one year compared to companies setting up facilities in the U.S. To take advantage of the IRA while minimising the associated risks of manufacturing upstream components in the U.S., several Indian manufacturers are looking to set up module lines in the U.S. and cell or ingot/wafer lines in India.

The success of the IRA will certainly influence the future PV manufacturing policy design by Indian regulators. Future iterations of PLI may include layered incentives, an extended policy impact period, easier eligibility criteria to avail incentives, etc.