Indian solar PV exports to the U.S. to keep rising till FY2025 despite the implementation of the Inflation Reduction Act

It will take two to three years to establish solar photovoltaic (PV) module manufacturing capacity in the United States of America (the U.S.). But after that, Indian players must explore other overseas export markets, including Africa and South America.

Key Takeaways:

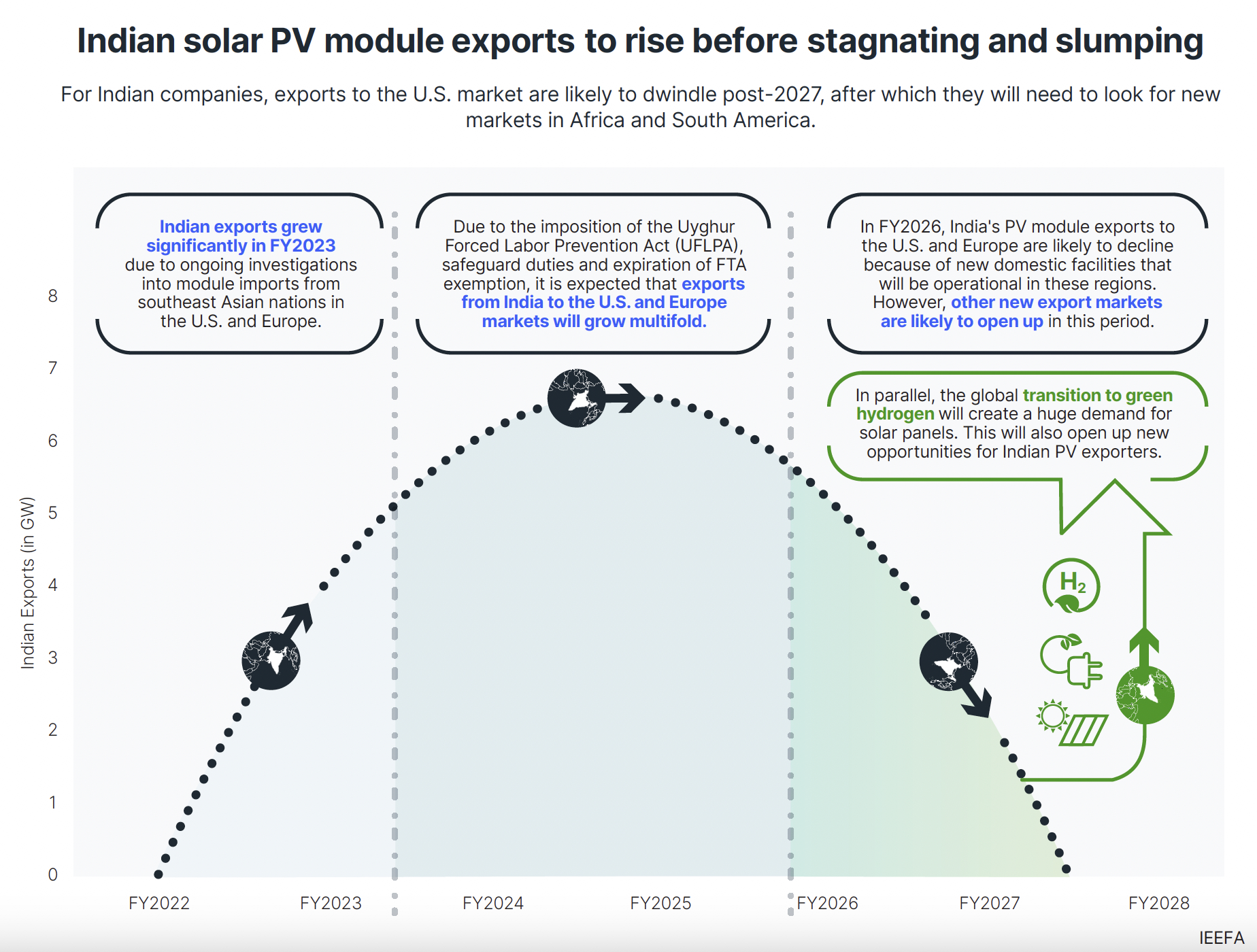

In the backdrop of huge capacities likely to be set up in the U.S. under the Inflation Reduction Act (IRA), Indian solar PV module exports to the U.S. may experience a period of stagnation from 2025 and decline from 2027.

To take advantage of the IRA while minimising the associated risks of manufacturing upstream components in the U.S., several Indian manufacturers are looking to set up module lines in the U.S. and cell or ingot/wafer lines in India.

Future iterations of the Product Linked Incentive (PLI ) scheme may have specific provisions inspired by the IRA, such as layered incentives, an extended policy period, etc.

Between 2022 and 2023, the global PV module manufacturing capacity has increased from 358 gigawatts (GW) to 640GW, highlighting the enhanced global demand for solar.

India’s solar photovoltaic (PV) module exports to the United States of America (the U.S.) are likely to keep rising for another couple of years before stagnating from 2025 and declining from 2027, a new joint report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics finds.

The report finds that after the implementation of the Inflation Reduction Act (IRA) in the U.S. and the Green Deal in the European Union (EU), establishing domestic solar PV manufacturing lines catering to their needs will take two to three years. But, once their domestic manufacturing develops, Indian exports will start declining.

“With annual global solar installations forecast to reach at least 1 terawatt (TW) by 2030, it is clear that there will be no dearth of PV demand in the future. Thus, Indian manufacturers must focus equally on domestic and international markets. Companies Indian PV products will also need to compete in global markets with other large PV manufacturing countries in terms of quality and scale,” says the report’s co-author, Vibhuti Garg, Director, South Asia, IEEFA.

The report notes that PV module exports from India to the U.S. have increased exponentially in the fiscal year (FY) 2023 (16x from FY2022 by value).

“The U.S. has traditionally been the largest export destination for Indian PV products. Therefore, after 2027, Indian companies will need to explore the African and South American markets for maintaining the momentum in exports,” says the report’s co-author, Jyoti Gulia, Founder, JMK Research.

“By FY2027, the global transition to green hydrogen will create a huge demand for solar PV panels. This will also open up a considerable market for PV manufacturers for their products,” she adds.

Based on public announcements, the report assesses that the IRA will help add 50 gigawatts (GW) of module manufacturing capacity in the U.S. while the Green Deal will help add 31GW of module manufacturing capacity in the EU.

“Manufacturing upstream components will be more challenging than making modules due to their complex and expensive production process. As a result, the IRA also opens up export opportunities for Indian companies producing upstream components. Indian companies have also had a headstart of at least one year compared to companies setting up facilities in the U.S. because of the capacities under the Production Linked Incentive (PLI-l) tranche already awarded in November 2021,” says the report’s co-author, Prabhakar Sharma, Consultant, JMK Research.

The report finds that several Indian manufacturers are looking to set up module lines in the U.S. and cell or ingot/wafer lines in India.

The report also notes that the success of the IRA will influence the future PV manufacturing policy design by Indian regulators.

“The U.S. is a global leader and superpower, which other countries look up to and try to emulate. The IRA, by all measures, is a landmark legislation on climate change. An initiative of this magnitude by the largest country in the world will motivate others to do the same. Future iterations of PLI may include layered incentives, an extended policy impact period, easier eligibility criteria to avail incentives, etc,” says Gulia

Read the report: New Paradigms of Global Solar Supply Chains

Media contact: Prionka Jha ([email protected]) Ph: +91 9818884854

Author contacts: Vibhuti Garg ([email protected]); Jyoti Gulia ([email protected]); Prabhakar Sharma ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About JMK Research: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewables, electric mobility, and the battery storage market. www.jmkresearch.com