IEEFA: Solar is the new ruler of the Indian electricity market

The International Energy Agency’s (IEA) World Energy Outlook 2020 forecasts India to lead the recovery of global energy demand out of the COVID-19 pandemic for the coming decade.

However, the IEA has downgraded its projection for the global energy demand growth rate to 9% from its pre-COVID forecast of 12% for the period 2019 to 2030. And it could be drastically lower at 4% in a delayed recovery scenario in which the global economy does not return to pre-COVID levels until 2023.

However, the IEA has downgraded its projection for the global energy demand growth rate to 9% from its pre-COVID forecast of 12% for the period 2019 to 2030. And it could be drastically lower at 4% in a delayed recovery scenario in which the global economy does not return to pre-COVID levels until 2023.

Although electricity only forms 20% of total global energy consumption, increased electrification will see the renewable energy sector play an increasingly significant part of the global investment horizon coming out of this economic downturn – even more so in India given the still unsustainable reliance on fossil fuel imports, with all the associated energy security risks and current account headwinds.

With solar power tariffs hitting another record low of US$13/MWh in Portugal in August 2020, solar is now the lowest-cost source of electricity in modern energy history.

India, as the world’s third largest electricity market with an ambition to build 450 gigawatts (GW) of renewable energy by 2030, is well positioned to be a leading driver of growth in investment into solar power generation infrastructure globally.

Solar is now the lowest-cost source of electricity in modern energy history

In the last two years, growth in renewable energy capacity in India has slowed, impacted by some short-term policy headwinds and flattening of electricity demand in the fiscal year (FY)2019/20 and the pandemic from March 2020 onwards.

IEEFA notes that despite the pandemic, domestic and global investor interest in India’s renewable energy market remains robust – demonstrated by the very positive outcomes of some recent auctions.

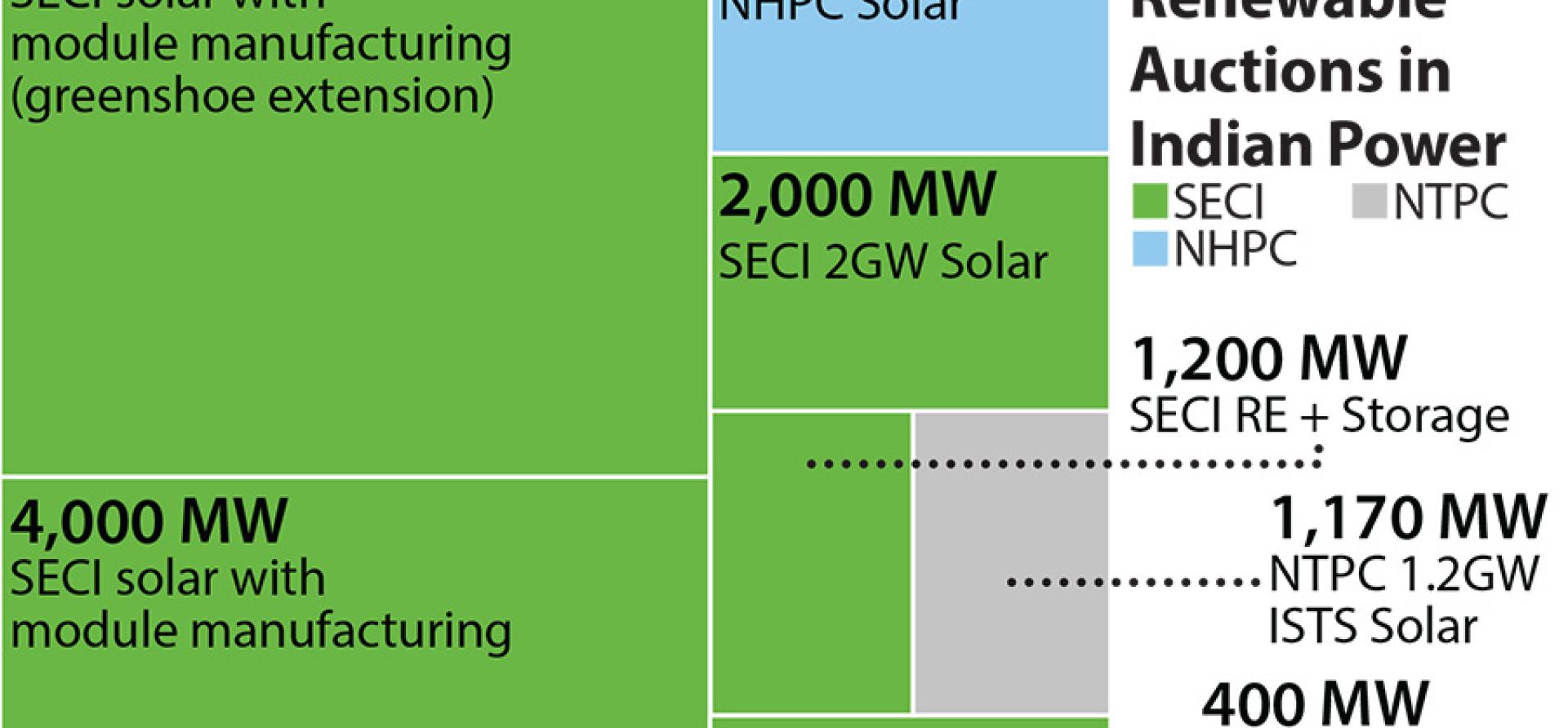

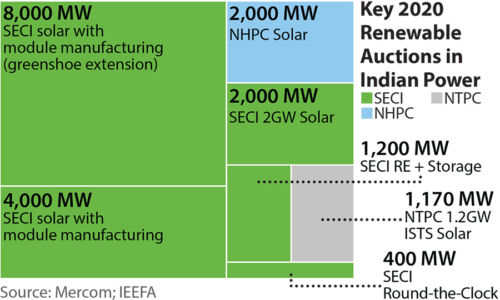

SOLAR ENERGY CORPORATION OF INDIA’S (SECI) 2GW SOLAR AUCTION IN JUNE 2020 DELIVERED INDIA’S LOWEST-YET RENEWABLE ENERGY TARIFF at Rs2.36/kWh (US$31/MWh) with zero indexation for 25 years.

Other important auctions in 2020 from SECI included 12GW of solar plus 3GW of module manufacturing capacity, 1.2GW of solar with storage for peak power supply auction and 400MW of round-the-clock (RTC) renewable energy tender.

The success of these important first-of-their-kind auctions are a step towards preparing India’s electricity system for the integration of a large influx of variable renewable energy capacity.

And Prime Minister Narendra Modi’s visionary 41.5GW renewable energy park in Gujarat gives the strongest indication yet of the scale of things to come. Global capital and corporates are increasingly fleeing stranded asset risks, as recent new coal power exit announcements by GE, JERA and Mitsui & Co highlight.

The cost of solar PV is falling faster than the IEA can cut their estimates

The IEA predicts the levelised cost of energy (LCOE) of solar will be dramatically down at US$15/MWh (~Rs1.1/kWh) by 2040 from US$35/MWh (~Rs2.6/kWh) in 2019.

But the record-low solar tariff outcome of Rs2.36/kWh (US$31/MWh) in SECI’s 2GW tender suggests that the cost of solar PV is falling faster than the IEA can cut their estimates. IEEFA believes that the solar LCOE could reach the IEA’s projected US$15/MWh a decade earlier.

The IEA also views India to be one of the world’s largest markets for utility-scale battery storage by 2040. India currently projects a requirement of 27,000MW/108,000MWh of battery storage capacity by 2030.

SIMILAR TO SOLAR, THE GROWTH IN BATTERY STORAGE CAPACITY COULD BE EVEN HIGHER IF COSTS CONTINUE TO DECLINE FASTER THAN EXPECTED, offering materially lower ‘firmed’ solar tariffs than the Rs6.12/kWh (US$83/MWh) discovered in SECI’s 1.2GW solar plus peak storage supply auction.

The winner of the long-term race between renewable energy and coal-fired plants is well established, especially given the two-part tariff structure of thermal power.

For an average thermal tariff of >Rs4/kWh (US$54/MWh), the Indian power distribution companies (discoms) have to pay a fixed capacity charge of ~Rs2/kWh for the contracted capacity in the power purchase agreement (PPA) – even if no power is drawn from the plant. The remaining >Rs2/kWh is the variable charge (landed fuel cost + production costs) which is paid for every unit of power drawn from the plant. Also, the variable charge increases with inflation in landed fuel costs and currency (for plants reliant on imported coal).

Due to the inflationary and suboptimal structure of legacy thermal tariffs, ultra-low-cost solar will undermine thermal power plants’ capacity utilisation and will even accelerate the closure end-of-life coal plants – those for which it is unviable to install emission control systems and inefficient plants that are not able to operate flexibly to provide better grid balancing.

THE PANDEMIC HAS EXACERBATED STRUCTURAL AND FINANCIAL ISSUES IN INDIA’S POWER DISTRIBUTION SECTOR — the Achilles heel of India’s electricity sector. As of September 2020, the state-owned discoms had accumulated total overdue payment liabilities of Rs126,655 crore (US$17.2bn) to power generators across India. This has increased counter party risk as well as creating a massive liquidity crunch in the sector.

The Indian government has had to sponsor a bailout package of Rs125,000 crore (~US$19bn) through the state-owned agency, Power Finance Corporation (PFC), to resolve the liquidity issue in the power distribution sector, reducing bandwidth for a green stimulus to step up investment into renewable energy and grid infrastructure.

Moreover, SECI has been struggling to sign PPAs with discoms for its already auctioned 6GW of renewable energy capacity. However, when electricity demand growth rebounds, the discoms will be able to contract this lowest-cost source of supply. As a short-term remedial measure, the Ministry of New and Renewable Energy (MNRE) has suggested blending tariffs from different auctions to bring the average tariffs down for the discoms.

Thermal power will bear the maximum impact of the downside risks in a transitioning market

As the pandemic has illustrated, thermal power will bear the maximum impact of the downside risks in a transitioning market given its high marginal cost of production and lack of flexibility. In contrast, renewables are proving resilient. A long-term price signal for peaking power is a key next step to ensure grid stability and investment in balancing firm peak capacity.

The Indian government must endeavour to resolve the structural issues of the discom sector and policy-related issues in the renewable energy sector.

Unlocking India’s renewable energy potential has immense long-term economic and energy security benefits for the country.

Kashish Shah is a Research Analyst at IEEFA.

This commentary first appeared in SolarQuarter India.

Related articles:

IEEFA: These 7 auctions show India’s renewables sector is still primed for growth

IEEFA India: Renewables-rich Rajasthan has potential to lead India’s energy transition