Fixing Bangladesh's power sector

Download Full Report

View Press Release

Key Findings

While the Bangladesh Power Development Board’s (BPDB) installed power system capacity soared by 125% between June 2016 and October 2024, its financial troubles brewed due to tepid power demand growth, use of expensive fuels, limited success with renewable energy, and unfavourable economic conditions.

During the fiscal year (FY)2019-20 to FY2023-24, the BPDB’s total annual expenditure increased 2.6-fold against revenue growth of 1.8 times, prompting the government to allocate a combined subsidy of Bangladeshi Taka (Tk)1,267 billion (US$10.64 billion).

The power sector's reserve margin will likely reach 66.1% by December 2024, which is much higher for a country with limited renewable energy. With IEEFA's assessment showing that Bangladesh's demand may rise to 25,834MW in 2030, a system capacity of 35,239MW will be sufficient, leading to a reserve margin of 36.4% in 2030.

By shifting half of the industrial demand that is met by captive generators to the grid, adding 3,000MW of renewables, reducing load shedding to 5% from the FY2023-24 level, and limiting transmission and distribution losses to 8%, Bangladesh can reduce its subsidy burden by Tk138 billion (US$1.2 billion) per annum.

Executive Summary

In recent years, the Bangladesh Power Development Board (BPDB) has registered a hefty revenue shortfall, which eroded its financial strength. During the fiscal year (FY)2019-20 to FY2023-24, the BPDB’s total annual expenditure increased 2.6-fold against revenue growth of 1.8 times, prompting the government to allocate a combined subsidy of Bangladeshi Taka (Tk)1,267 billion (US$10.64 billion) to ensure power supply to keep the economy afloat. Yet, the BPDB recorded a cumulative loss of Tk236.42 billion (US$1.99 billion).

Despite a series of power tariff adjustments, the revenue shortfall and subsidy allocation are likely to persist in the foreseeable future. Key problems of the sector, however, lie elsewhere and are often overlooked.

A comparative assessment of the Indian and Vietnamese power sectors substantiates that Bangladesh’s power sector has an overcapacity problem. Following the COVID-19 pandemic, the failure to downgrade the power capacity growth rate contributed to the problem. Moreover, industries operate a combined gas-fired captive generation capacity of over 3,000 megawatts (MW) amid an unreliable grid electricity supply. Gas-fired captive generation is economically compelling for industries, saving them between Tk1.3/kilowatt-hour (kWh) (US$0.011/kWh) and Tk3.53/kWh (US$0.03/kWh).

This overcapacity obligates BPDB to pay capacity charges to almost all power plants, excluding those under its ownership and those based on renewable energy, raising its revenue shortfall.

The use of expensive oil-fired plants in meeting peak demand due to limited grid-connected renewable energy capacity has further compounded the sector’s financial woes. Available data from July 2023 to May 2024 show that oil-fired plants contributed 10.9% of the total power generation, registering a 32% fuel cost.

The transmission and distribution losses hovering around 10.33% are still higher than the global average of less than 8%. Moreover, BPDB’s weak financial health compels it to opt for load-shedding, eventually resulting in capacity payments to idle plants.

The study estimates that Bangladesh’s power demand will likely reach 25,834MW in 2030, for which a system capacity of 35,239MW will suffice. This will help BPDB lower its reserve margin from 66.1% (December 2024 level) to 36.4% (including variable renewable energy), making it comparable to other countries. The country may set a combined renewable energy target of 5,500MW, including off-grid systems, by 2030.

On a rough estimate, by installing new grid-connected renewable energy capacities of 3,000MW under a conservative scenario, encouraging industries to shift to the grid for half of the gas-fired captive power capacity, reducing T&D losses to 8% and limiting load shedding to 5% of the FY2023-24 level, the BPDB can save Tk138 billion (US$1.2 billion) annually. However, to further cut the BPDB’s subsidy burden of Tk382.89 billion (US$3.22 billion) recorded in FY2023-24, Bangladesh should ensure that industries fully rely on the national grid. Additionally, the country should gradually transition to electric systems from gas-driven appliances like boilers. This will help increase the BPDB’s revenue from selling additional energy while reducing capacity payments to idle plants.

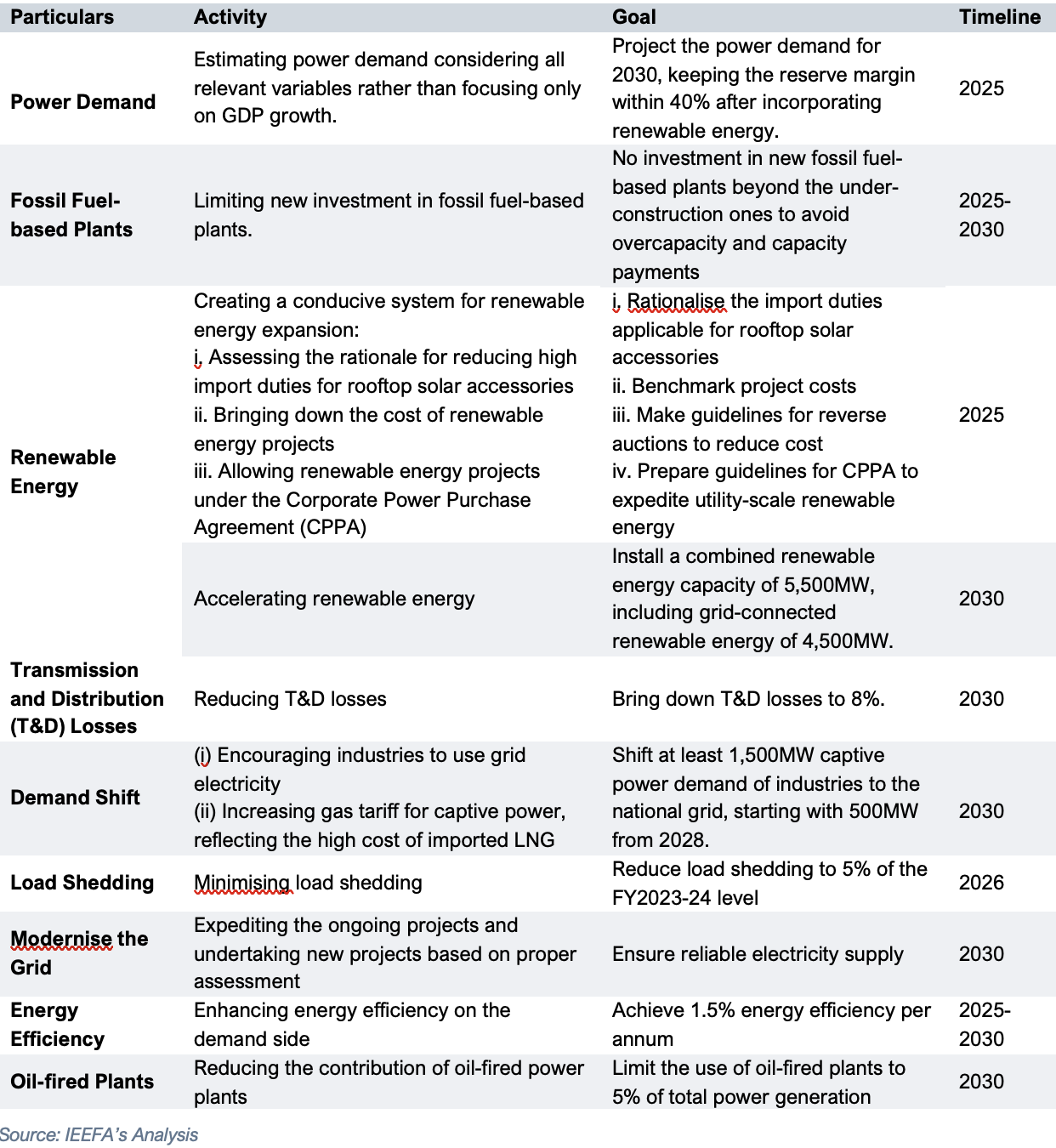

The window to make Bangladesh’s power sector sustainable is rapidly narrowing, but there is still time to get the sector back on track by following a suitable roadmap. This study proposes a time-bound roadmap through 2030, articulating key areas of concern and chalking out a way to streamline the power sector.

Table 1: Roadmap for the Power Sector’s Sustainability

While the proposed roadmap till 2030 shows measures for sustainability, the country must undertake consistent actions to narrow the gap between the sector’s cost and revenue, bringing down the subsidy burden close to zero. The success will depend on devising policies, estimating rational power demand by factoring the role of energy efficiency, modernising the grid to encourage industries to use grid power and addressing the challenges with renewable energy.