Key Findings

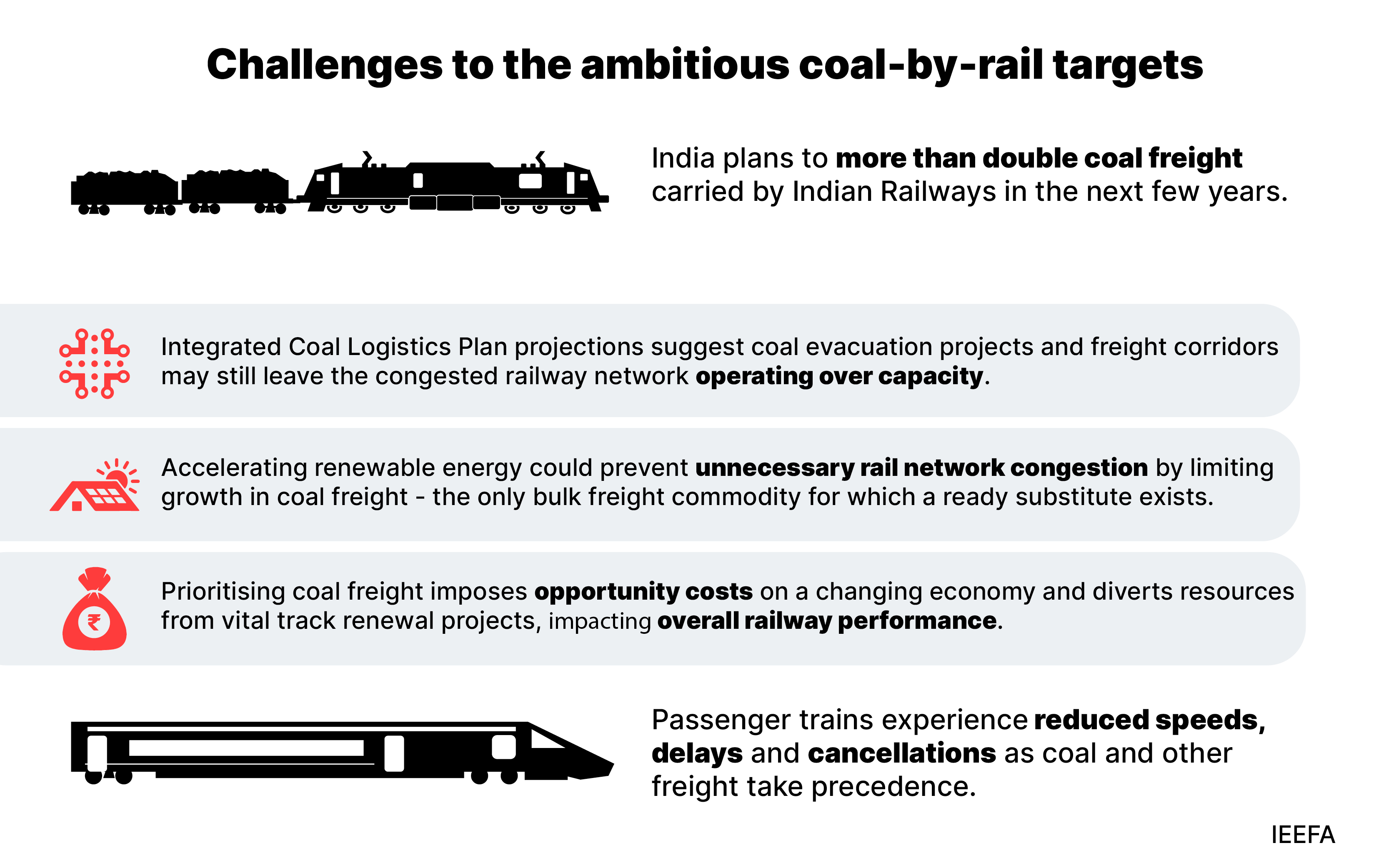

India’s plans for expanding coal freight by rail face congestion and logistical challenges, divert resources from vital network upgrades, and impose an opportunity cost on a growing economy.

There are several indications that network congestion is returning to pre-pandemic levels following a temporary, lockdown-related easing.

New rail projects for coal frequently delay urgent network maintenance and upgrades.

Accelerating clean energy and recognising coal’s network congestion effects can enable the Indian Railways to better serve a changing economy.

Executive Summary

India’s power demand is rising more quickly than its renewable capacity additions, accelerating plans to mine, transport and burn up to 65% more thermal coal for electricity generation by 2030. Several planning documents have sought to gauge this demand and identify bottlenecks in moving coal from mines to power plants.

The Indian Railways plays a central role in coal freight and the government expects it to transport almost all the additional production. A range of rail infrastructure projects, including the Eastern Dedicated Freight Corridor, aimed at easing coal evacuation, are recently completed, imminent or ongoing. The authorities are actively considering more such projects.

This report considers factors that may hinder such ambitious coal-by-rail targets, including signs that rail network congestion is back to pre-pandemic levels. Evidence includes:

- Higher freight loads than in 2019, but freight train speeds at similar levels

- Non-suburban passenger bookings at 83% of 2019 levels and lower passenger train speeds

- Passenger train cancellations to prioritise coal during crises

- Increased wagon turnaround times

Coal India Ltd (CIL) is likely to be the largest contributor to new coal production and has the most ambitious goals – floating plans to move an additional 400 million tonnes by rail in just four years. This timeline appears unrealistic, especially since almost all the extra 91 million tonnes that CIL has mined in the last two years moved not by rail but by truck. The company now reports more than 600,000 truck movements each month. Meeting CIL’s targets requires a rapid reversal of this trend.

The Government of India has set aside record budget allocations (reaching US$31.5 billion for the fiscal year (FY) 2024) for the Indian Railways to make upgrades, in which coal evacuation features prominently. An analysis of these projects in the recent Integrated Coal Logistics Plan includes forecasts that many lines will exceed 100% capacity even after commissioning all the current work. There are calls to urgently add even more infrastructure to support coal movement, including dedicated coal evacuation corridors.

India’s Ministry of Statistics and Programme Implementation, however, warns that railway projects are the second-most delayed category of infrastructure, so timely completion is not guaranteed. As detailed in a later section, Railway planning also issues guidelines that appear to exclude the possibility of negative ‘network effects’, resulting from new coal traffic worsening congestion outside the immediate project area.

Even if the Indian Railways meets the coal transport targets, further special measures may be a requirement. In the past, these have included relaxing maintenance schedules for wagons and, when coal stocks were at critical levels in May 2022, the cancellation of 1,900 passenger train services.

The highly variable freight-to-passenger traffic ratios in India’s 16 railway zones illustrate the Indian Railways’ emphasis on freight and revenues. These ratios favour freight in the eastern coal-bearing regions and by the priority accorded to freight and revenue indices in the Key Performance Indicators (KPIs) issued to the railway zones. Freight KPIs outweigh those for passengers 4-to-1, and safety enhancement makes up just 2% of the total.

The prioritisation of coal freight presents opportunity costs for the Indian Railways and, more broadly, the economy. The Indian Railways is devoting planning and engineering resources to coal evacuation projects when major routes require significant track renewal. Poor track conditions are blamed for service delays and for limiting the speed of the new Vande Bharat trains.

The prioritisation of coal freight presents opportunity costs for the Indian Railways and more broadly, the economy.

In an expanding and changing economy, transporting raw materials, refrigerated food and finished goods, and enhanced passenger services require network capacity. These services could face significant constraints as a result of coal freight expansion.

Coal is the only commodity on India’s rail system for which a technical substitute is already available. A renewed focus on generating electricity from renewable sources and moving it over wires, rather than in solid form as coal, would give the Indian Railways the breathing space it needs in order to play a broader and more effective role in India’s changing economy.