IEEFA Update: Politics Is the Main Barrier to Solar Energy Independence in Puerto Rico

Tesla Inc.’s interest in turning Puerto Rico into a renewable-energy powerhouse is in its infancy, but the company’s experience with solar is not.

The core challenges to bringing a sun-powered electricity-grid to the island are not in the technical constraints but in the political ones—the government’s historic tolerance for innovation and modernization is well known.

That said, it is encouraging to see Gov. Ricardo Rosselló publicly express a willingness to talk now about how Puerto Rico—most of which is still blacked out—can turn to its abundant solar energy as part of both its immediate and long-term responses to its electricity crisis.

This is a welcome change.

Just a few days before Hurricane Irma, and then Hurricane Maria arrived, the Puerto Rico Electricity Power Authority (PREPA) and the federal PROMESA oversight board filed papers in PREPA’s bankruptcy case aimed at undermining the very modest goals that Puerto Rico has in place for solar energy.

The filing is part of a pattern. The status-quo powers-that-be have consistently thwarted Puerto Rico electricity regulators who have been pushing PREPA toward renewable energy. Such a shift makes financial and economic sense, and business leaders and environmentalists alike support it, but the vested interests do not.

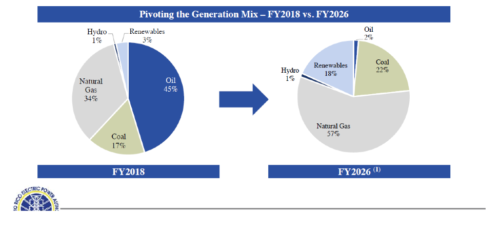

The aim of the filing is to destroy the ability of regulators to push for popular reforms that are sorely needed. If PROMESA and PREPA were to be successful in their filing, Puerto Rico will be relegated to further long-term dependence on natural gas, coal, some hydroelectric and a commitment mostly in name only to solar energy.

WE SEE PREPA’S OFFICIAL RENEWABLES COMMITMENT AS MISLEADING (see the chart above) because plans submitted by PREPA to the regulatory Puerto Rico Energy Commission show the agency pushing mainly for reliance on imported liquefied natural gas.

PREPA is essentially thumbing its nose at a law passed by Puerto Rico legislators in 2010 requiring PREPA to achieve a 12 percent renewable energy footprint by 2015 and an expansion of that footprint to 20 percent by 2035.

When the agency presented its long-term integrated resource plan to the Puerto Rico Energy Commission, it showed serious noncompliance with the law, with only a 3.3 percent renewable energy footprint in place, barely a quarter of what it was supposed to be. PREPA managers not only missed the mandate in 2015, but unilaterally proposed lowering the 2035 to 15 percent, instead of 30.

As it stands—even after Irma and Maria—PREPA continues to promote a high-cost, highly-volatile bet on fossil-fuel dependence. This is the case even though the least-cost option involves solar energy, which could sensibly follow a transition to natural gas from the current system, which is run principally on oil.

PREPA now budgets $1.1 billion for fuel expenses, most of which goes to off-island oil and coal interests. The stakes are quite high, for oil companies especially, and the potential for corruption is big.

Renewable energy companies like Tesla see opportunity in Puerto Rico. The question is whether Governor Rosselló and his government will allow progress to happen.

Cathy Kunkel is and IEEFA energy analyst. Tom Sanzillo is director of finance.

RELATED POSTS:

IEEFA Update: Puerto Rico Bankruptcy Court Weighs a Motion to Turn Back the Clock on Electricity System Reform in Puerto Rico

IEEFA Update: Here’s How You Can Help Get Solar Power to Puerto Rican Households Now