IEEFA: Santos’ Barossa gas field emissions create major risks for shareholders

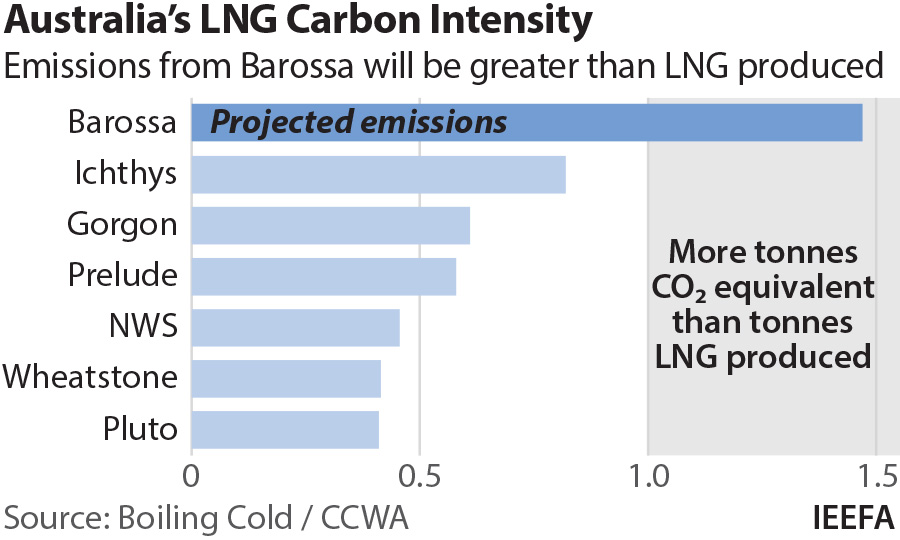

31 March 2021 (IEEFA Australia): Santos’ proposed offshore Barossa gas field near Darwin, Northern Territory has the unfriendly tag of having more carbon dioxide than any gas currently made into LNG, finds a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

Barossa gas contains so much CO2 that most of it will have to be separated and vented

The gas contains so much CO2 that most of it will have to be separated and vented offshore to meet the requirements of the Darwin LNG plant it will be piped to.

“Barossa gas has 3 times the CO2 content that the Darwin LNG plant facility can handle,” says report author and LNG industry expert John Robert.

“When the venting and combustion emissions both off- and on-shore are calculated, the Barossa to Darwin LNG project looks more like a CO2 emissions factory with an LNG by-product.

“The unprecedented scale of the Barossa emissions relative to the LNG production creates major risks for shareholders.”

Robert examines the proposed Barossa development in his new report, Should Santos’ Proposed Barossa Gas ‘Backfill’ for the Darwin LNG Facility Proceed to Development? and finds it will be both a major financial and climate risk if developed.

The Barossa gas field’s major owner and operator Santos and its equity partner South Korea’s SK E&S achieved final investment decision (FID) on 30 March 2021 for the project.

And Santos signed an LNG sales agreement with Mitsubishi Corporation’s Diamond Gas International late last year for 1.5 million tonnes of Santos-equity LNG for 10 years with extension options.

“This 10 year contract is simply not long enough to attract the necessary additional finance to get the expensive Barossa project off the ground,” says Bruce Robertson, gas/LNG analyst with IEEFA. “Without 20 year offtake contracts, investors still don’t have a deal.”

Without 20 year offtake contracts, investors still don’t have a deal

A further contract was awarded last week by Santos to Norwegian operator BW Offshore for a Floating Production Storage and Offloading facility (FPSO) to develop the gas reservoir in time for production to begin in 2025, should the FID go ahead.

Robert says this contract is problematic as BW Offshore’s new Barossa FPSO would need to reduce the Barossa gas CO2 content from 18 volume% CO2 to 6 volume% CO2 to meet the requirements of the Darwin LNG plant.

“BW Offshore’s current FPSO fleet averages a gas-handling capacity only one-tenth of that required for Barossa and with nothing like the complexity of processing for partial CO2 removal,” says Robert.

Shareholders and investors will be carrying the burden of very high emitting gas

“This contract highlights an additional, significant liability risk being worn by company shareholders in both Santos and BW Offshore.”

BW Offshore, which has published its intent to take urgent action to combat climate change and its impacts, is backed by major financial institutional shareholders including Folketrygdfondet, Morgan Stanley, Citibank, The Bank of New York Mellon, State Street, Nordea Bank, JPMorgan, Skandinaviska Enskilda Banken AB, and Nordnet Bank AB, many of whom have announced policies divesting from oil sands and Arctic drilling to reduce global emissions.

“If Barossa goes ahead, Santos’ and BW Offshore’s shareholders and investors will be carrying the burden of very high emitting gas that can’t be sold in the near term as export markets shrink,” says Robert.

Australia’s largest LNG export markets, South Korea, Japan and China have all committed to net zero commitments by 2050 and 2060, which means those countries will be investing more in domestic energy security and renewable energy options rather than importing expensive and dirty LNG.

Robert says Australian agency NOPSEMA must address serious questions about its approval of the Barossa offshore development and other high emitting LNG offshore fields proposed going forward.

Fields like Barossa contain such high emitting gas that they can never be made into acceptable LNG

“Fields like Barossa are very problematic because they contain such high emitting gas that they can never be made into acceptable LNG in the very competitive market which now is more aware of the climate impact of its product,” says Robert.

“This is a big and real risk to proponents like Santos, SK E&S and its partners in the Barossa field and Darwin LNG plant – a plant which will most likely become a stranded asset if Barossa doesn’t go ahead. But with even more money lost if the Barossa FID is approved, investors should be particularly wary.”

Media contact: Kate Finlayson ([email protected]) +61 418 254 237

Author contact: John Robert ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)