IEEFA: New coal-fired power plants in India will be economically unviable

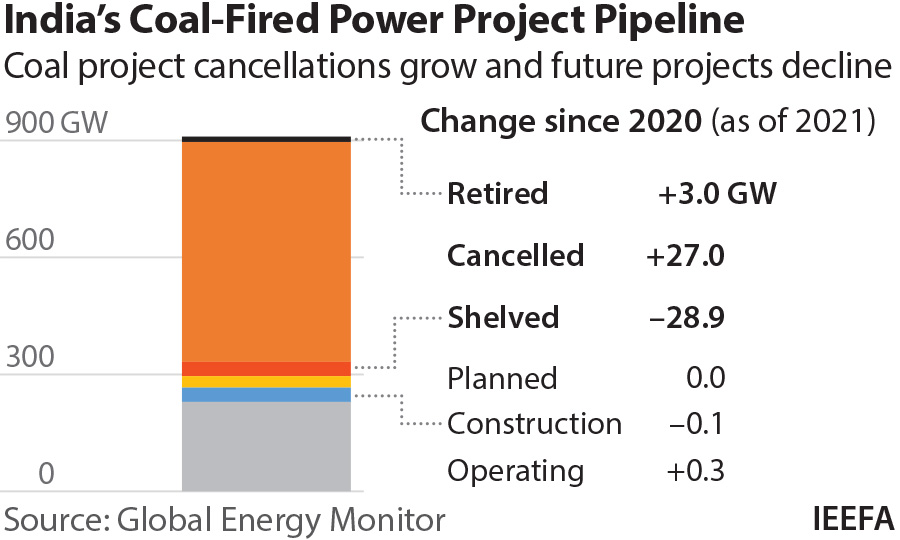

4 June 2021 (IEEFA India): Much of India’s 33 gigawatts (GW) of coal-fired power capacity currently under construction and another 29GW in the preconstruction stage will end up stranded, according to a new briefing note by the Institute for Energy Economics and Financial Analysis (IEEFA).

“Coal-fired power simply cannot compete with the ongoing cost reductions of renewables. Solar tariffs in India are now below even the fuel costs of running most existing coal-fired power plants,” says author Kashish Shah, Research Analyst at IEEFA.

“In the last 12 months no new coal-fired power plants have been announced, and there has been no movement in the 29GW of preconstruction capacity.

“This reflects the lack of financing available for new coal-fired power projects, and also the flattening of electricity demand growth, which has impacted coal the most.”

Coal-fired power cannot compete with the ongoing cost reductions of renewables

Despite these headwinds, the Central Electricity Authority (CEA) still projects India will reach 267GW of coal-fired capacity by 2030 which would require adding 58GW of net new capacity additions – or about 6.4GW annually.

Our note points out it is “highly improbable” that the CEA’s projections will materialise given the ongoing financial and operational stress in the thermal power sector, and puts the case that India’s coal capacity requirements should be urgently revised.

“Any projections for India’s future generation mix should take into account that new coal-fired power plants are likely to become stranded assets,” says Shah.

“The new capacity would only be economically viable if it replaced end-of-life, polluting power plants with outdated combustion technology and locations remote to coal mines.

“Even then, there would need to be sufficient coal plant flexibility to deliver power into periods of peak demand, and the time-of-day pricing would need to be high enough to justify the low over the day utilisation rates.”

Shah adds that without material growth in electricity demand, installing additional inflexible high emissions baseload capacity will increase the financial distress of state-owned distribution companies (discoms) by adding to their burden of paying fixed capacity charges to thermal power plants that are used only sparingly.

IEEFA expects coal-fired capacity in India to peak at 220-230GW by 2025 and models additions of 2-3GW of net new coal-fired capacity annually in this five-year window – and only then if financing can be found amid the accelerating global retreat from coal.

IEEFA expects coal-fired capacity to peak at 220-230GW by 2025

The International Energy Agency’s (IEA) recent roadmap on reaching net zero emissions by 2050 recommends no new investment in fossil fuel supply projects, and no further final investment decisions for new unabated coal plants. Also ahead of this month’s summit, G7 country leaders agreed to stop unabated coal finance before the end of 2021.

IEEFA notes there is little appetite from investors – except for state-owned Power Finance Corporation (PFC) and Rural Electrification Corporation (REC) – to risk new capital in a sector that continues to carry US$40-60 billion of non-performing or stranded assets.

With the pool of capital available to fund coal-fired power projects shrinking, nearly half (49%) of the 33GW of capacity now under construction in India is sponsored by state power generation companies. NTPC and NLC India Ltd, both Government of India-owned entities, have 29% and 6%, respectively, while the remaining 16% is privately sponsored.

Half of the capacity now under construction is sponsored by state power generation companies

IEEFA suggests state generation companies should “walk away” from delayed under-construction projects, to avoid the risk of fully built plants sitting idle – stranded assets.

Notably, NTPC has begun a pivot towards renewables, saying it will not be pursuing any new greenfield development of coal-fired power projects and announcing a target to install 32GW of renewable energy capacity by 2032; this shift should be accelerated.

“Governments, investors and utilities across the globe are rapidly transitioning to cheaper domestic zero emissions renewable energy,” says Shah.

“India should be taking advantage of the falling cost of renewables plus rising viability of battery storage, which can provide clean grid-firming, to meet incremental power demand.

“Accelerating renewable energy capacity commissioning is critical to lower India’s overall energy costs and support faster electrification of transportation and other industries.

“Ultra-low cost renewables would also enable development of a green hydrogen economy to strengthen India’s long-term objective of energy security.”

Read the report: New Coal-Fired Power Plants in India: Reality or Just Numbers?

Media contact: Rosamond Hutt ([email protected]) +61 406 676 318.

Author contact: Kashish Shah ([email protected]).

The author is available for interviews or background briefings.

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)