Sightline/IEEFA report: U.S. fracking industry posts disappointing Q4 results

March 19, 2019 (Sightline/IEEFA) — Record-setting oil and gas production in Q4 did not lead to corresponding financial success. To the contrary, U.S. fracking-focused companies “spilled alarming volumes of red ink in 2018,” according to a report released today by the Sightline Institute and the Institute for Energy Economics and Financial Analysis (IEEFA).

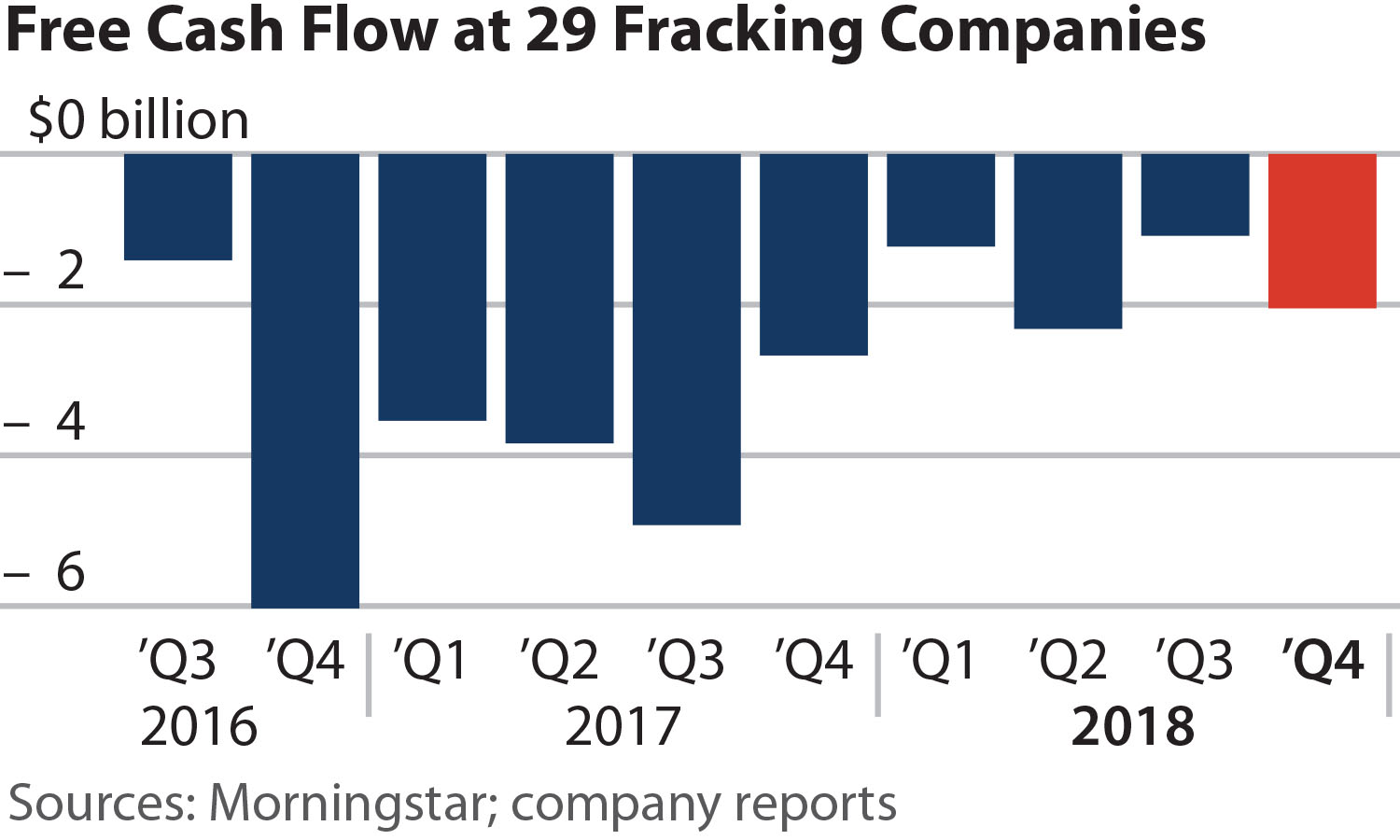

The joint analysis examined performance results from a cross-section of 29 publicly-traded, fracking-focused oil and gas companies. They concluded that these companies posted $6.7 billion negative free cash flows in 2018.

“The companies we examined spent $6.7 billion more on drilling than they realized from selling oil and gas,” said Clark Williams-Derry, energy analyst at Sightline Institute and lead author of the report. “During the fourth quarter alone, this cross-section of exploration and production companies outspent their operating cash flows by more than $2 billion.”

The Sightline/IEEFA report raises questions about the industry’s “persistent inability to produce positive cash flows.”

The Sightline/IEEFA report raises questions about the industry’s “persistent inability to produce positive cash flows.”

“Until fracking companies can demonstrate that they can produce cash as well as hydrocarbons, investors would be wise to view the fracking sector as a speculative enterprise with weak and uncertain fundamentals,” the report concluded.

Full report here: “More Red Flags on Fracking: Cash Flows Still Negative”

Media Contact: Vivienne Heston, [email protected], +1 (914) 439-8921

About Sightline Institute

Sightline Institute promotes sustainable policy and monitors regional sustainability progress in the U.S. More can be found at www.sightline.org.

About IEEFA

The Institute for Energy Economics and Financial Analysis conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org