Risks mount for embattled Surat Gas Project despite Arrow’s optimism

Losses and obstacles fail to dim developer’s CSG ambitions

Key Takeaways:

Arrow Energy is progressing development of its A$10 billion Surat Gas Project after a decade of financial losses.

Declining LNG market prices, and the potential for lower domestic prices, threaten the financial returns for the project and create stranded asset risks.

The coal seam gas development also poses risks for highly valuable agricultural areas in the Surat Basin – risks that have already been realised in some areas.

26 July 2024 - (IEEFA Australia): New analysis from an energy think tank has found that local communities and farmers will join Arrow Energy in suffering financial consequences from the Surat Gas Project, as the local groundwater vital for farming could be impacted. Arrow Energy is pressing ahead with the project, despite more than A$10 billion in losses and a dire outlook for international LNG prices.

A new briefing note from the Institute of Energy Economic and Financial Analysis (IEEFA) shows that declining east coast gas demand, weaker LNG market fundamentals, and consequently lower gas prices will threaten returns from the project. The financial risks extend beyond developers and investors.

Arrow Energy, a Shell and PetroChina joint venture, was the second-largest holder of proven and probable (2P) gas reserves on Australia’s east coast as of June 2022. However, Arrow has been only a minor gas supplier, largely due to costly delays in sanctioning its problematic Surat coal seam gas (CSG) project in Queensland, which has seen significant writedowns of its reserves.

“Declining international LNG and oil prices are likely to lower taxation revenue and potentially royalty payments, a possibility acknowledged by the Queensland government,” says Josh Runciman, IEEFA Lead Analyst, Australian Gas and the briefing note’s author.

“The Surat Basin project could further affect government revenue from agricultural production in a region that is a significant contributor to Queensland’s gross state product and taxation revenue.”

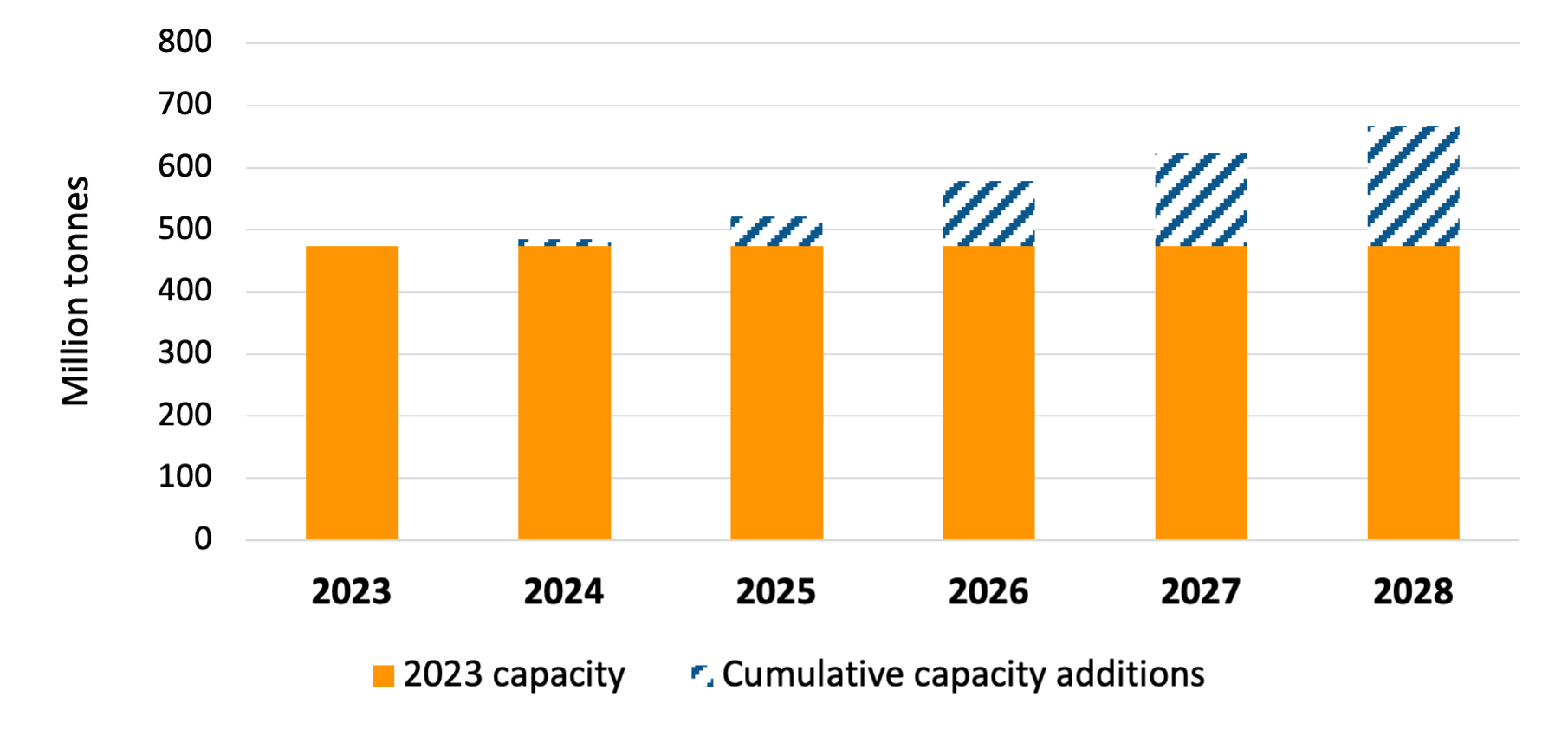

Record LNG prices following Russia’s invasion of Ukraine in 2022 sparked a flurry of development activity in the sector. IEEFA estimates that global LNG liquefaction capacity will increase by an unprecedented 40% by 2028, mostly from low-cost suppliers Qatar and the US. This new supply will lead to a supply glut and push down international gas prices.

Despite the booming gas prices of recent years, Arrow had already incurred losses of more than A$10 billion by 2023, rising to more than A$14 billion when accounting for acquisition costs to Shell and PetroChina. Arrow owes shareholders more than A$3 billion due to loans from the joint venture partners and the mounting losses, which prompted PetroChina to consider selling its stake in the venture.

Estimated global LNG liquefaction capacity, million tonnes (Mt)

Source: IEEFA, The Future of Australian LNG

The Surat Basin has been a major coal seam gas hub for decades, but gas development has been linked to subsidence and groundwater issues for farmers and pastoralists in the area. Arrow plans to drill 2,500 additional wells through a fragile aquifer.

“The risks are magnified as the project is on the Condamine Alluvium, a key underground water resources vital for the region’s agriculture,” Mr Runciman says.

“This value is reflected in the market prices for traded water, with contemporary prices of A$10,0000 per megalitre. Methane leakage is a key risk given the alluvium feeds more than 3,000 bores across the region.”

Arrow has already been fined a record A$1 million for drilling 48 deviated wells below 13 properties without authorisation. At least one landholder has reported drainage issues due to CSG-induced subsidence. In addition, premature corrosion of existing CSG well casings have been blamed for methane leaks and bore failures in the area.

“The risks associated with CSG wells are likely to increase over time due to the potential for well corrosion and degradation of concrete used to case and cap wells,” Mr Runciman says. “Indeed, these risks may persist well beyond the productive life of existing CSG fields.

“The gas industry faces a limited future due to the transition to clean energy, whereas agriculture is set to play a vital role in Australia’s economy over the foreseeable future. It is vital that a focus on short-term gas development does not harm our longer-term economic prosperity.”

Read the report: Risks mount for embattled Surat Gas Project despite developer’s optimism

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contacts: Joshua Runciman, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)