Report: Teck Resources, a Major Canadian Oil Sands Promoter, Faces Difficulties

CLEVELAND, April 20, 2015 (IEEFA.org) — The Institute for Energy Economics and Financial Analysis released a report today questioning the financial viability of Teck Resources, a Canadian energy company with a substantial stake in the flagging oil sands development of Alberta.

The report, titled “Teck Resources: Tough Road on Oil Sands Investments,” analyzes finances from 2011-2014 and incorporates additional data from other oil sands developers.

Teck, which is based in Vancouver, B.C. and has roots that go back to the early 1900s, has struggled with two oil sands efforts in particular:

- Its Fort Hills project, in which the company has a 20 percent interest and in which it has made a capital commitment of $2.9 billion through 2017.

- Its proposed Frontier oil sands project, which does not appear to be viable in either the medium or long term.

“There may be no better example of Canada’s deeply afflicted oil sands industry than Teck Resources, the long-established mining company that is on hard times today in part for its overly optimistic expectations regarding its venture in oil sands, an expensive source of energy,” Tom Sanzillo, the lead author on the report and the director of finance for IEEFA wrote in a commentary accompanying the report.

“While oil sands projects are a small part of Teck’s overall portfolio, they absorb a large and growing portion of the company’s shrinking resources,” Sanzillo said.

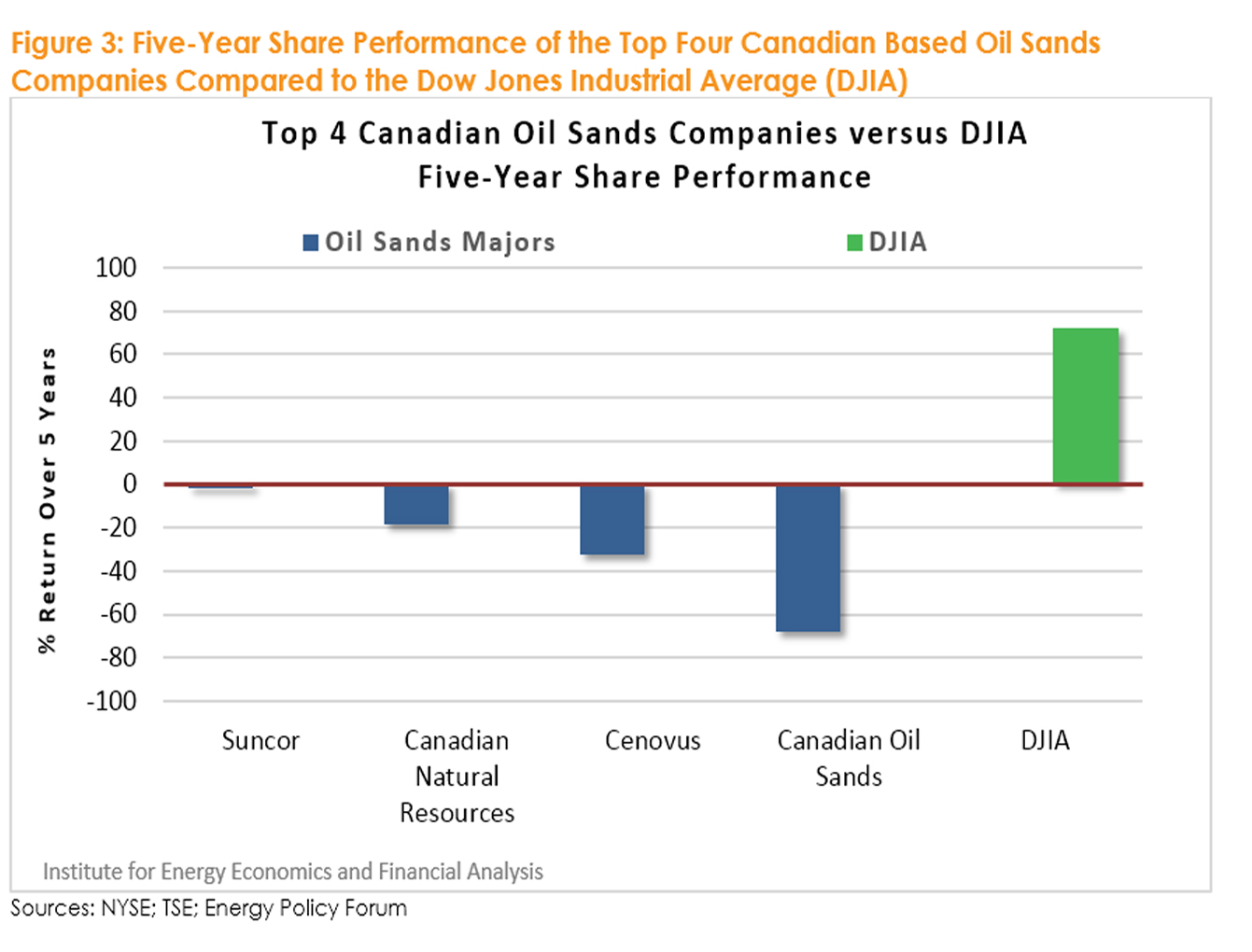

The report notes also that numerous oil sands projects by other companies have been delayed recently in the face of low oil prices and difficult market conditions.

It details Teck numbers that show Teck’s net income in 2014 plunging to $330 million, down from $951 million in 2013 and $1.145 billion in 2012; a drop in free cash flow $207 million in 2014 from $1.2 billion in 2012, a trend that suggests the company will report a negative free cash flow in 2015; deteriorating in gross profits from to $1.3 billion in 2014 from $3.5 billion in 2012; a drop in operating income to $905 million in 2014 from $3.2 billion in 2012. The report notes, too, that Teck’s stock has lost roughly 78 percent of its value since 2011.

The report raises pointed questions for investors around whether the company’s oil sands venture make financial sense and to what extent the work puts the company at risk.

Sanzillo said, “These are tough questions, to be sure, and our report suggests some tough answers.”

A full copy of the report is available here.

Media contact: Karl Cates, [email protected], 917.439.8225

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.