Renewable energy auctions in India will continue to attract interest from large developers

The major companies can withstand the pressures of rising materials costs and surging interest rates

Key Takeaways:

Supply chain disruptions, implementation of trade barriers and a tightening monetary policy pose fresh challenges for renewable energy companies.

Multiple levers remain with renewable energy companies to enhance returns and cushion against downside risks.

The rise in solar module prices is an aberration, and long-term average prices should revert to sub-US$0.20 (before duties and taxes) levels from the current US$0.28.

22 June (IEEFA India): Large developers in the renewable energy sector have enough options to boost returns even as challenges mount and will fight aggressively in the various auctions scheduled in 2022, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

Falling costs of solar modules, which in turn brought down tariffs, fuelled the growth of India’s renewable energy sector. However, turmoil in global supply chains caused by the COVID-19 pandemic and the Russia-Ukraine war have pushed up costs. Further, renewable energy developers face higher financing costs as surging inflation has forced central banks to tighten monetary policy, pushing up interest rates.

The challenges, though, are unlikely to have a lasting impact on India’s renewable energy story.

“We believe India will be able to continue its renewable energy capacity addition trajectory because current supply chain challenges will ease in the short-to-medium term, and the industry has enough cushion to absorb these downside risks,” says the report’s co-author Shantanu Srivastava, IEEFA Energy Finance Analyst.

“Central and state nodal agencies should proceed with their pipeline of renewable energy auctions, given that interest from the large companies in the sector should continue, even in these unprecedented times,” says co-author and IEEFA guest contributor Ankur Saboo, an infrastructure finance specialist.

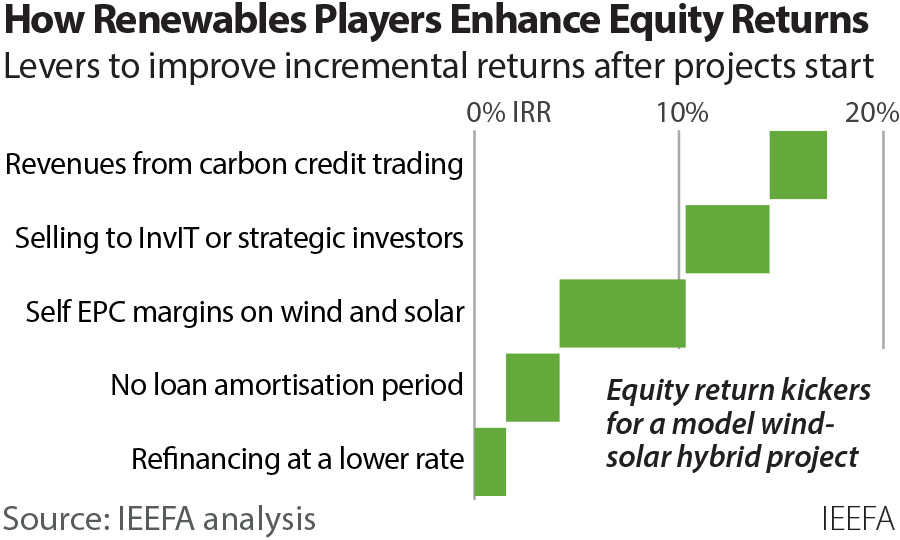

The report highlights various options that large renewable energy companies have to enhance their return on equity, which would help them tackle the challenges.

According to Srivastava and Saboo, large renewable energy developers can lean on bond markets to refinance debt at lower rates and take advantage of a non-amortisation period on debt repayments. This leads to the front loading of equity returns.

Further, margins on in-house engineering, procurement and construction (EPC) provide a kicker to returns.

The sale of stakes in operational projects to strategic investors such as global oil & gas majors and financial investors like infrastructure investment trusts (InvITs) is another avenue developers have used to increase returns.

Finally, the selling of carbon credits to developed economies is increasingly considered a viable source of additional income for developers, further enhancing their returns.

The report analyses how these measures can help a solar power project and a hybrid wind-solar power project enhance their equity returns. It finds that refinancing at a 100 basis point lower rate of interest can help add 2% to a hybrid wind-solar power project’s equity internal rate of return (IRR).

Further, bond market refinancing, which has a non-amortising period of five years, can help add another 2% to the equity IRR, in-house EPC can add up to 6%, and selling operational assets can add 4%.

Revenues from carbon credit trading can add 3% to the equity IRR taking the total upside potential to 17%, over and above the baseline returns.

According to Srivastava, as attractive as the equity IRRs look, it is essential to note that sensitivity towards interest rates and raw material prices is extremely high and the margins of error minuscule. In worst-case scenarios, developers with a tight grip on capital and financing costs will be better prepared to weather any storm, he added.

Read the report: Renewable Energy Assets in India: A Project Finance Perspective

Media contact: Rosamond Hutt ([email protected]) Ph: +61 406 676 318

Author contact: Shantanu Srivastava ([email protected]).

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)