The Lamu Coal Plant will hinder, not spur, economic growth in Kenya

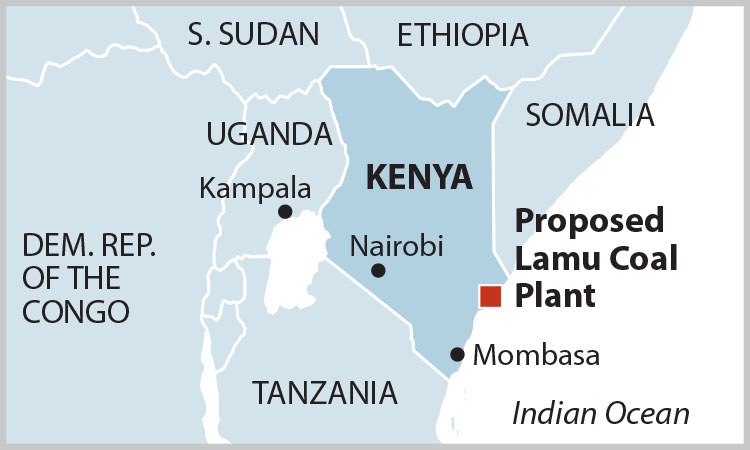

June 10, 2019 (NAIROBI) – The proposed Lamu coal plant in Kenya, a three-unit, 981-megawatt (MW) facility, would be a costly mistake, locking the country into a 25-year deal at a cost to consumers of more than US$9 billion, even if the plant never generates any power, according to a report released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

June 10, 2019 (NAIROBI) – The proposed Lamu coal plant in Kenya, a three-unit, 981-megawatt (MW) facility, would be a costly mistake, locking the country into a 25-year deal at a cost to consumers of more than US$9 billion, even if the plant never generates any power, according to a report released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

The report, The Proposed Lamu Coal Plant: The Wrong Choice for Kenya, examines how the Lamu project was intended to replace the country’s aging diesel-fired generation and strengthen baseload capacity but factors, such as lower-than-projected demand and higher costs for imported coal, have rendered the plan obsolete.

“This project would lead to excess generating capacity in Kenya and sharply increase electricity rates for consumers,” said IEEFA director of resource planning analysis David Schlissel, who wrote the report. “The original assumptions that justified the project, no longer apply.”

Cost projections are unrealistically low and generation assumptions overly optimistic.

First proposed in 2015, the Lamu plant is scheduled to enter commercial service in 2024 at an initial cost of US$2 billion. It is being built by Amu Power Company Limited, a single-purpose entity, 51 percent owned by Centum Investments, a Kenyan investment firm, with the remainder held by Gulf Energy. The construction contract for the plant was awarded to Power Construction Corporation of China in 2016.

The plant would slow the development of readily available, clean and increasingly low-cost geothermal, wind and solar resources.

Highlights from the report:

- The existing 25-year PPA would force Kenya to pay at least $360 million in annual capacity charges, even if no power is generated at the plant.

- Amu Power’s claims for the cost of Lamu-generated electricity are unrealistically low, and assumptions about how much electricity the plant will generate are overly optimistic.

- Using more realistic assumptions, electricity from the plant could cost as much as US 75 cents (76 Kenya Shillings) per kilowatt-hour (KWh), on average, during the years 2024 to 2037—more than 10 times what the plant’s proponents have claimed.

- This estimate does not include costs for port upgrades that would be required to bring coal to the plant, nor construction of the transmission infrastructure needed to distribute the power; dramatically increasing the overall cost and impact on electricity consumers and taxpayers.

- The government’s own analysis demonstrates that, when using the most likely demand growth scenarios, Kenya’s abundant renewable resources render no new coal generation necessary in the country until 2029, at the earliest.

“Building this facility would burden consumers with costly power for years to come,” said Schlissel. “In addition, the project would make it difficult, if not impossible, for Kenya to meet its obligations under the Paris Agreement on climate change.”

Report

The Proposed Lamu Coal Project: The Wrong Choice for Kenya

Author

David Schlissel ([email protected]) is IEEFA’s director of resource planning analysis.

Media Contacts

Vivienne Heston ([email protected]) +1 (914) 439-8921

Omar Elmawi ([email protected])

About IEEFA

The Institute for Energy Economics and Financial Analysis conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org