India shows urgency for energy storage systems by already awarding more than 8GW of tenders

Renewable energy storage systems are the missing link in India’s power transformation. A growing market and incentives for new technologies will smoothen the transition from fossil fuels to a stable clean energy supply.

Key Takeaways:

Energy storage systems (ESS) will be the major disruptor in India’s power market in the 2020s.

ESS will attract the highest investment of all emerging sectors as renewable energy’s penetration of the electricity grid ramps up.

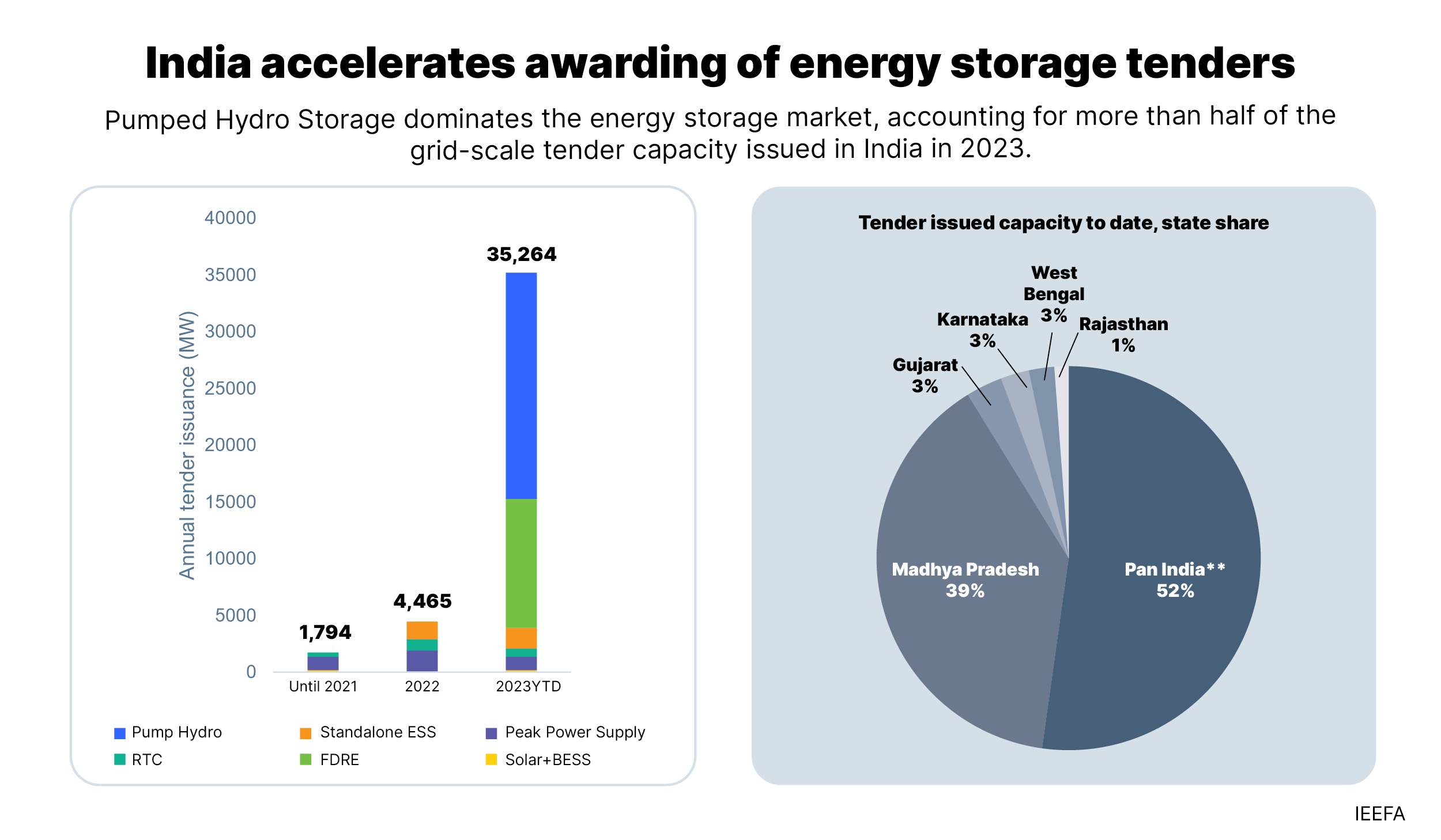

Pumped hydro storage (PHS) dominates the ESS market, accounting for more than half of the grid-scale tender capacity issued in India in 2023.

New demand-driven firm and dispatchable renewable energy (FDRE) tenders will help reduce India’s reliance on coal and other conventional power sources.

India’s policymakers have recognised the importance of energy storage systems (ESS) to the country’s evolving power landscape and have already awarded more than 8 gigawatts (GW) of such tenders, allocating 60% of these in 2023 alone, according to a new joint report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

Examining India’s burgeoning ESS sector in depth, the report finds it poised to boom in the coming years, in line with the exponential growth of the renewable energy sector.

“Globally, power systems across different regions are undergoing a pivotal phase of development,” says the report’s contributing author, Vibhuti Garg, Director, South Asia, IEEFA.

“The exponential surge in renewable energy installations within the past decade has exposed the grid infrastructure to increased risks arising from renewables’ intermittent and variable nature,

especially solar and wind. ESS is crucial in overcoming this intermittency and enabling a continuous energy supply when needed. Thus, for sustainable renewable energy addition, a concurrent growth of ESS capacity is also imperative,” she adds.

Battery-based ESS (BESS) and pumped hydro storage (PHS) are the most widespread and commercially viable means for implementing energy storage solutions in India, with green hydrogen expected to gain a greater share of the renewable energy mix in coming years.

The Central Electricity Authority estimates India will need about 42GW of BESS and 19GW of pumped hydro storage (PHS) capacity by 2030.

Large, grid-scale ESS projects will be crucial in meeting these future energy needs. To this end, the latest demand-driven Firm and Dispatchable Renewable Energy (FDRE) tenders offer the ideal model for India.

“FDRE tenders, first issued in 2023, are demand profile-driven tenders to ensure firmness and dispatchability of renewable energy, and create a win-win scenario for power developers and offtakers,” says the report’s co-author, Jyoti Gulia, Founder, JMK Research.

“With similar power quality and declining costs of renewable energy and ESS, FDRE can potentially replace thermal, a situation electricity distribution companies (DISCOMs) are already exploring,” she adds.

FDRE is the latest, most advanced iteration of tender models, such as round-the-clock (RTC), Solar + BESS and standalone ESS, whose tariffs are already comparable to, if not lower than, traditional fossil fuel-based power generation.

With longer tenures of up to 25 years, as grid-scale FDRE storage projects mature, their tariffs will likely become even more attractive.

“The discovered tariff in RTC tenders is lower than any peak power supply tenders, even though RTC tenders ensure higher availability and supply of renewable energy. This trend is due to the higher utilisation rate of ESS,” says the report’s co-author, Prabhakar Sharma, Consultant, JMK Research.

“Falling ESS costs, especially for BESS, and sustained cash flow over a longer duration enable ESS developers to quote lower tariffs,” he adds.

Policy measures like the energy storage obligation (ESO) targets are also helping create a conducive environment for ESS projects.

“ESS trading on power markets is also likely to increase in the coming years, driven by entities aiming to meet their energy storage obligation (ESO) targets and storage developers looking for avenues to sell the excess power from soon-to-be commissioned grid-scale ESS projects,” says Sharma.

“Other policy measures supporting the growth of ESS include the viability gap funding (VGF) scheme for BESS projects, the National Energy Storage Policy and the National Pumped Hydro Policy,” he adds.

However, obstacles to the expansion of ESS remain, such as high initial capital expenditure, longer gestation periods (especially for PHS projects), suboptimal infrastructure and a dearth of domestic manufacturing, highlighting potential supply chain risks.

“India aims to augment its VRE installed capacity (solar and wind) from 117GW to more than 392GW by 2030. This surge in VRE penetration needs to be supported by a simultaneous growth in ESS capacity,” says Gulia.

Read the report: Energy Storage: Connecting India to Clean Power on Demand

Media contact: Prionka Jha ([email protected]) Ph: +91 9818884854

Author contacts: Jyoti Gulia ([email protected]); Prabhakar Sharma ([email protected]); Vibhuti Garg ([email protected]); Charith Konda ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About JMK Research: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewables, electric mobility, and the battery storage market. www.jmkresearch.com