India issues record 73 gigawatts of utility-scale renewable energy tenders in 2024

This was the second year in a row that the country exceeded its target of tender issuance, but more post-bidding challenges are now emerging.

Key Takeaways:

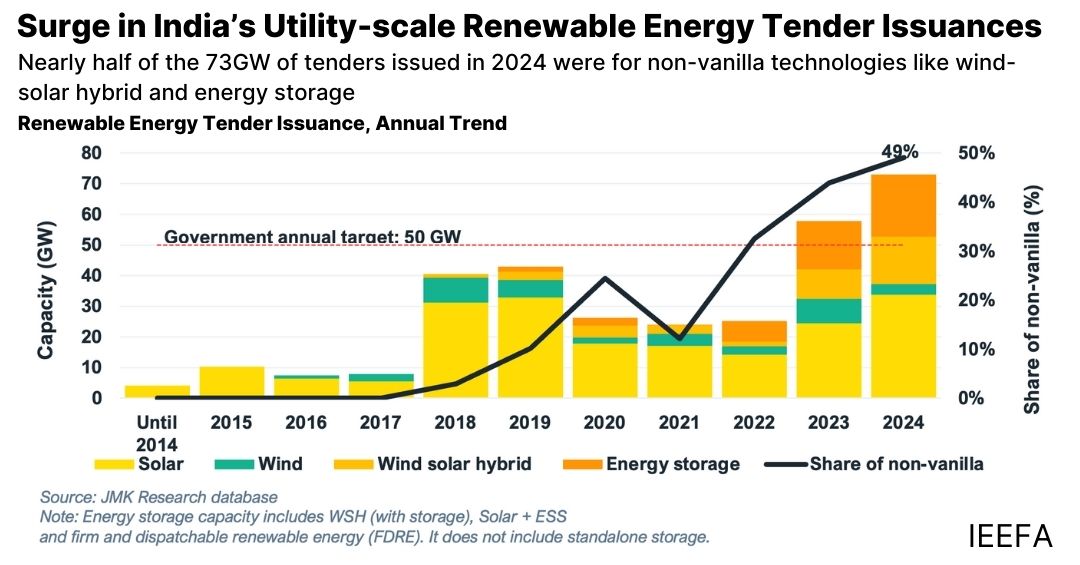

Non-vanilla technologies, such as wind-solar hybrids and battery energy storage, accounted for nearly half of India’s utility-scale renewable energy tender issuance in 2024.

Since 2023, there has been a notable rise in post-bidding challenges of utility-scale renewable energy tenders, including undersubscription, power agreement delays and cancellations.

Power developers argue that the strict mandate to meet an annual bidding target of 50 gigawatts (GW) puts pressure on tendering agencies to issue bids and finalise auctions without securing and planning for offtake agreements, delaying the signing of power agreements.

From 2020 to 2024, 38.3GW of utility-scale renewable energy capacity was cancelled, accounting for about 19% of the total issued capacity during that period.

India’s grand vision for a decarbonised economy has been embraced by market stakeholders, with two consecutive years of record renewable energy tendering capacity issuances surpassing even the central government’s ambitious targets, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

The report finds that India issued tenders inviting utility-scale renewable energy capacity addition totalling a record-high 73 gigawatts (GW), eclipsing 2023’s 58GW. This far exceeds the Ministry of New and Renewable Energy’s annual target of 50GW. Further, nearly half of the tenders in 2024 were for non-vanilla renewable technologies like wind-solar hybrid and battery energy storage in response to demand from energy offtakers for improved power quality.

“The evolution of renewable energy tenders demonstrates that market stakeholders are actively working to overcome shortcomings,” says the report’s contributing author, Vibhuti Garg, Director – South Asia, IEEFA.

“The renewable energy market has matured considerably, and all stakeholders, from investors to energy offtakers, have built a strong understanding of the intricacies of renewable energy technologies,” she adds.

The report also finds that the surge in tendering activity has brought fresh challenges that could temper investor enthusiasm and delay or cancel major projects.

“Tender undersubscription is emerging as a challenge for tendering authorities. Last year, about 8.5GW of utility-scale renewable energy tenders went undersubscribed, five times more than in 2023, owing to complex tender designs, aggressive bidding during reverse auctions and delays in the readiness of the interstate transmission system (ISTS) infrastructure,” says the report’s co-author, Prabhakar Sharma, Senior Consultant, JMK Research.

Further, the report also highlighted delays in signing power sale agreements (PSA) with energy offtakers, which have now exceeded 40GW. Solar Energy Corporation of India (SECI)-led tenders comprise 30% (12GW) of the large backlog of unsigned PSAs.

Tender cancellations are also on the rise. From 2020 to 2024, 38.3GW of utility-scale renewable energy capacity was cancelled, accounting for about 19% of the total issued capacity during that period.

Cancellations were due to tender design issues, location or technical complexity, undersubscription and PSA delays, the report finds.

“Delays in project implementation pose a significant challenge to India’s renewable energy target for 2030,” says the report’s co-author, Ashita Srivastava, Senior Research Associate, JMK Research.

“Ongoing issues with project realisation could deter investor interest in future renewable energy projects in India, potentially affecting the availability of low-cost financing from large-scale investors,” he adds.

The report recommends authorities focus equally on all aspects of the tendering process, from issuance of requests for selection to allotment and signing of PSAs, to keep momentum high on adding renewable energy capacity via such tenders.

“In addition to issuing tenders, the government should establish annual targets for both allotments and the execution of PSAs. This will ensure that renewable energy implementing agencies (REIAs) issue bids only after securing the necessary offtake agreements,” says the report’s co-author Deepalika Mehra, Research Associate at JMK Research.

Read the report: Challenges in India’s Tender-Driven Renewable Energy Market

Media Contact: Prionka Jha ([email protected]); +91 9818884854

Author contacts: Vibhuti Garg ([email protected]); Prabhakar Sharma ([email protected]); Ashita Srivastava ([email protected]); Deepalika Mehra ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About JMK Research: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewables, electric mobility, and the battery storage market. www.jmkresearch.com