Improving ESG ratings relies on agreed objective and standardization of measurements, methodologies and disclosures

Collective efforts of companies, rating providers and regulators could enhance rating consistency and transparency

10 October (IEEFA Asia): Environmental, Social and Governance (ESG) factors are increasingly applied to better understand a company’s growth opportunities, material risk and sustainability levels. However, ESG ratings have also been seen as a gimmick, given that inconsistent rating practices across rating providers do not necessarily measure a company’s impact on society and the planet.

As the Institute for Energy Economics and Financial Analysis’ (IEEFA) Hazel James Ilango explains in her new report, the lack of agreed objective and unified standards could complicate investment decisions and impede ESG disclosure and improvement incentives.

“If ESG ratings are to encourage sustainable investments, significant improvements of the rating system are crucial for investors and the overall capital market,” says Ilango.

In the report, she provides recommendations specific to the current shortcomings: ESG rating bias, the low correlation of ESG outcomes between providers, and the lack of impact materiality.

Clean energy players could be underrated

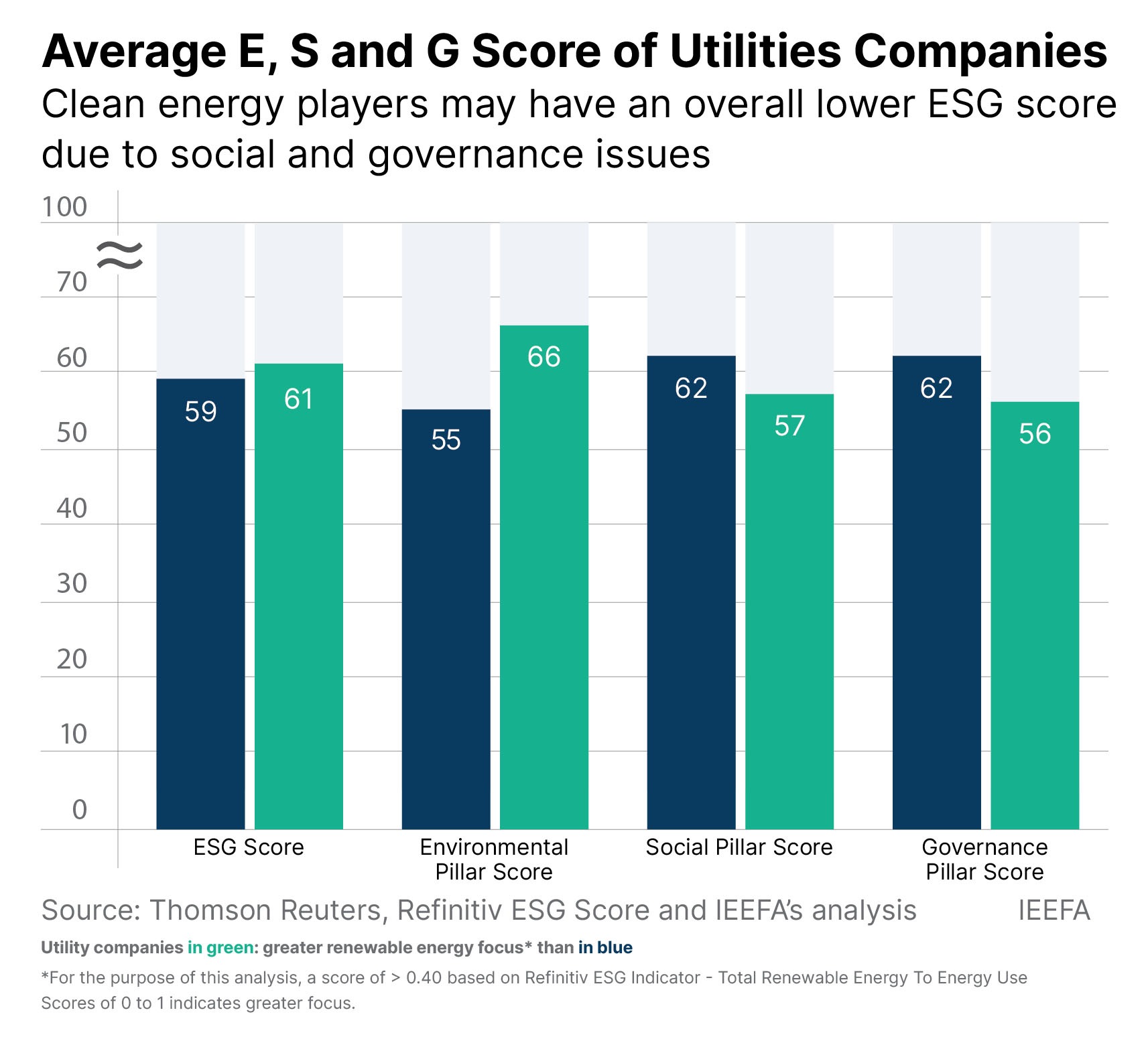

A key industry that ESG ratings would need attention to is the utilities sector, which plays a critical role in the low-carbon transition, particularly those developing clean power.

Energy companies transitioning or already contributing to a low-carbon economy could have their sustainability impact downplayed due to many factors: the subjective nature of ESG ratings, industry peer assessment, as well as its ESG data disclosure and methodology based on numerous ESG indicators.

A coal-based power company could be rated the same or even more favourably than its peer, which uses a low-emission source, such as renewable energy.

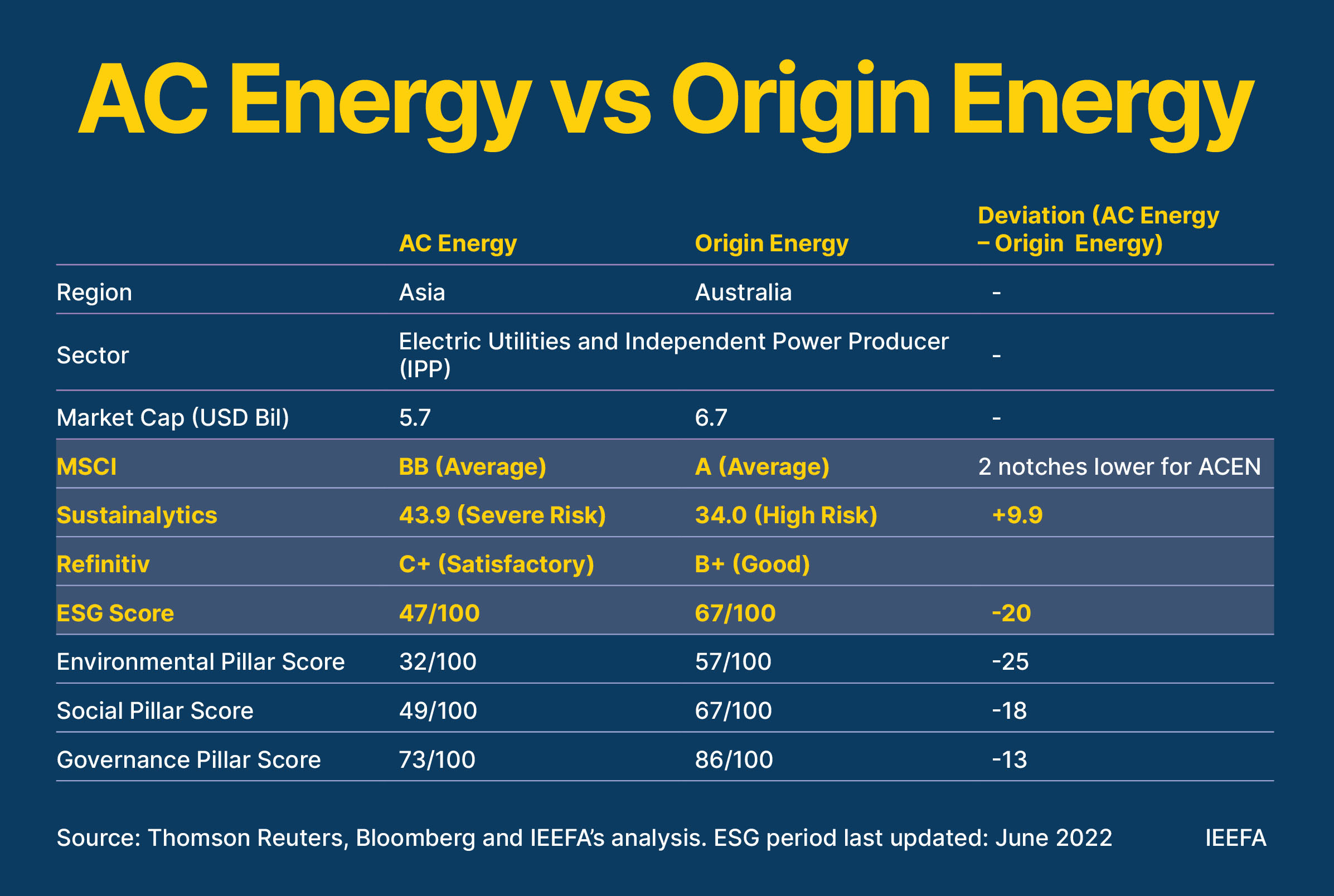

Consider two power generation companies: AC Energy, which is domiciled in Asia and focussed on renewable energy, and Australia’s fossil fuel-based Origin Energy. Refinitiv and Sustainalytics rated Origin Energy more positively than AC energy.

“Neither the lack of clean energy transition by Origin Energy nor the renewable energy procurement of AC energy is distinctly reflected in their respective ESG and environmental scores,” says Ilango.

Based on the energy profile of both companies, it is expected that Origin Energy’s exposure to carbon transition risk, as opposed to AC Energy, is a significant concern. However, the ESG scores do not appear to reflect the elevated risk.

The present ESG rating methodologies suggest that companies transitioning into cleaner energy may be underrated in contrast to a company that still has active operations in fossil fuels.

Improving the evaluation of the utilities sector

Ilango finds that the utilities sector stacked the highest ESG score, among other sectors, with an average score of 50 based on almost 7,700 Refinitiv ESG scores.

“The E, S and G pillars cover a wide and varying array of factors. The subsequent aggregation of these analyses into one single metric will not precisely reflect the actual ESG performance of a company’s operation,” Ilango explains. “A mandatory reporting of each E, S, and G pillar separately, as well as sub-key components that influence these scores could better reflect a company’s key drivers and risk in terms of ESG performance.”

Ilango also suggests strengthening renewable energy disclosure, whether for rating providers or companies, is needed to gauge overall low-carbon transition measures.

Renewable energy procurement, such as new renewable generation added to the grid, the viability of clean energy strategy, and carbon reduction should be distinctly addressed in ESG scoring methodologies.

Exposing biases and discrepancies

The overall ESG rating system relies highly on a company’s level of disclosure of ESG performance, resulting in regional and company size biases.

“These metrics are often self-reported and not audited by third-party sources or ESG providers,” says Ilango. “This leaves room for manipulating ESG credentials, increasing the risk of greenwashing.”

Ilango finds that European-based companies received the highest ESG score of 56, compared to those domiciled outside the region.

“We find that companies domiciled in countries with robust ESG regulatory reporting requirements and larger market capitalization are awarded favourable ESG ratings,” adds Ilango.

Ilango also notes that 80% of total small and medium-cap companies have low ESG ratings. Lower ratings can be attributed to less favourable ESG performance and insufficient transparency of ESG data. Conversely, 54% of large and mega-cap companies were assigned high ESG ratings.

Towards standardization and specialization

For standardized ESG definition and data disclosure, a universally accepted reporting framework helps investors make better-informed decisions and enables comparability between companies irrespective of their industry, geography and company size.

“The aggregation into one single metric has proven challenging for investors that have specific ESG focus such as clean energy transition or climate change,,” says Ilango.

A more transparent ESG disclosure by rating providers such as key weightages, sub-indicators and their underlying assumptions could also guide investment screening. In addition, ESG rating transition over time or “accuracy rate” would be valuable. A generally stable rating, without any steep or drastic changes since its initial rating assignment, could indicate greater accuracy and credibility.

“The goal is to help investors to evaluate the validity of its ESG rating sources and to incentivize improvements in the rating model and approach,” says Ilango.

Read the report: Greater ESG Rating Consistency Could Encourage Sustainable Investments

Report contact:

Hazel James Ilango ([email protected])

Media contact:

Alex Yu ([email protected]) Ph: +852 9614 1051