South Korea is building too many LNG import and storage terminals

Industry needs to align planned new capacity with LNG demand based on national net-zero targets and coordinate better between public and private sectors.

29 November (IEEFA): A new report by the Institute for Energy Economics and Financial Analysis (IEEFA) finds that South Korea is rapidly developing liquefied natural gas (LNG) import and storage terminals, presenting a high risk of overinvestment and overcapacity.

IEEFA estimates the country’s LNG industry is pouring ₩11.3 trillion (US$8.7 billion) into an infrastructure build-out that has projects at the construction or planning stage to boost receiving capacity for the fossil fuel.

“Our analysis demonstrates a growing mismatch between LNG import infrastructure and projected LNG demand based on the country’s net-zero goal,” says Michelle Chaewon Kim, the report author and an Energy Finance Specialist, South Korea, at IEEFA.

Kim’s report identifies reasons why state-owned and private-sector firms are overly developing LNG import infrastructure, and the issues worsening the overinvestment risks. The report also suggests how the South Korean government and companies can mitigate those risks.

LNG fuel costs for power generation have nearly doubled since Russia started invading Ukraine. As Kim explains, disruptions in global energy markets, such as the Israeli-Palestinian conflict, could keep South Korean gas prices elevated.

“This could decrease imports by LNG receiving terminals operated or leased by independent power producers, adding to underutilization and stranded asset risks,” she says.

“We believe that a faster transition to renewable energy will mitigate the highly volatile fossil fuel cost of power generation caused by unforeseen supply shocks and bolster the energy security of South Korea.”

Stranded asset risks

South Korea began importing LNG in 1986 and has historically been one of the world’s largest customers of the fuel. More recently, despite declining natural gas demand amid the country’s transition to net zero, five private-sector companies and six state-owned entities are either constructing or proposing new LNG terminal projects.

Kim points to three key factors: a perceived need to boost energy security amid the Russian-Ukrainian war; growing competition in the domestic gas market; and the development of new LNG applications, including blue hydrogen, bunkering services, and hydrogen blending in power generation.

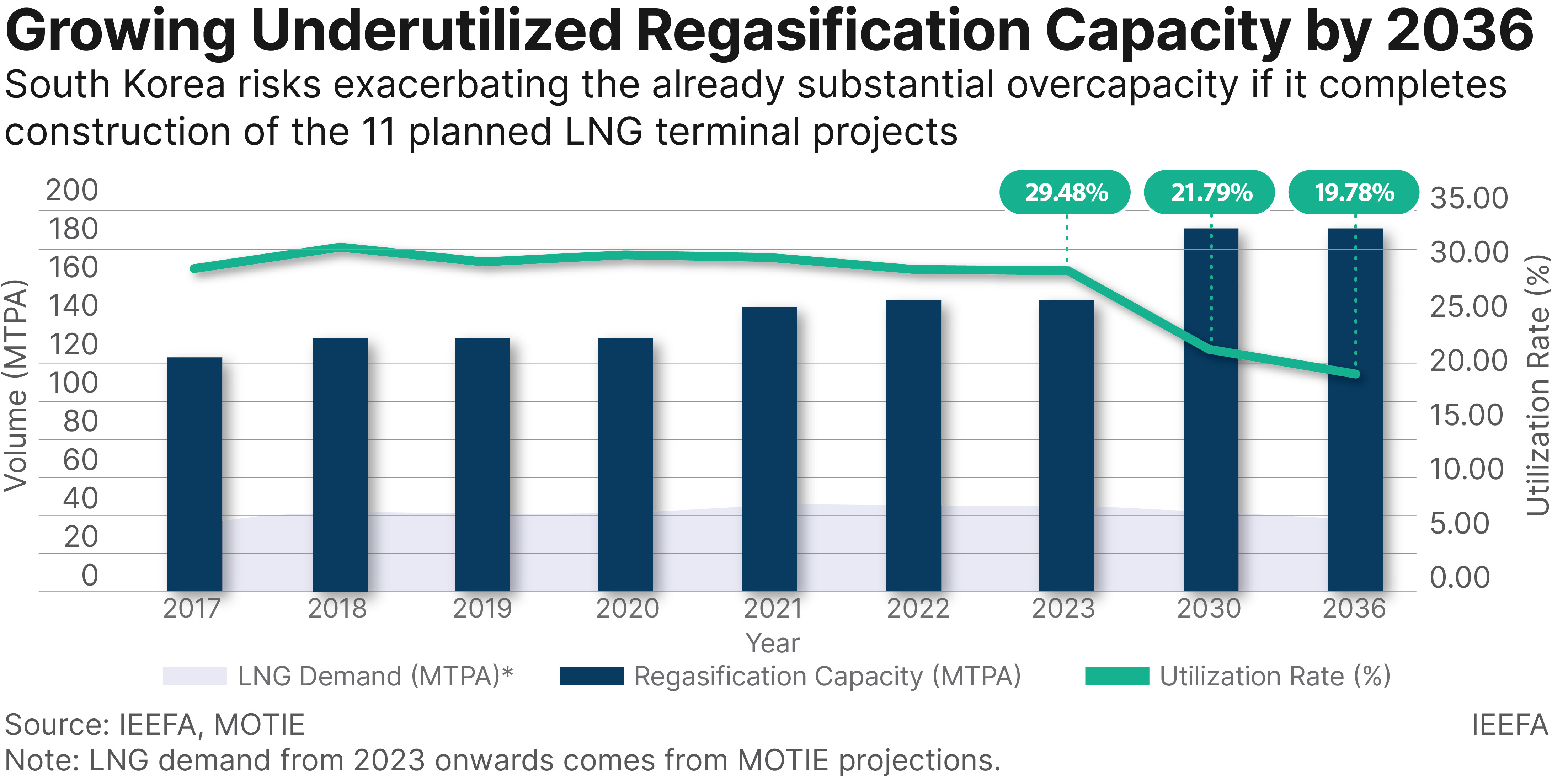

Based on the International Gas Union’s 2022 data, South Korea’s annual average regasification utilization was one of the lowest at 33%, compared with the global rate of 41% and Asia’s 52.4%.

“We believe that the underutilization of LNG receiving terminals will likely worsen if South Korea further revises its Nationally Determined Contribution target to reduce the share of LNG-fired power generation in the energy mix in the coming years,” says Kim.

As of 2023, South Korea has seven LNG import terminals with a combined regasification capacity of around 153 million tonnes per annum (MTPA), along with 6.3 million tonnes (MT) of LNG storage capacity. IEEFA’s projections show that unused LNG regasification capacity could rise from 107.9 MTPA this year to 152.8 MTPA in 2036, dampening the already muted utilization rate of 29.5% to 19.8%.

Storage capacity of the proposed projects, if completed, would meet 25.6% of annual LNG demand in 2036. This is nearly double the 14.1% presently.

“In practical terms, the planned storage capacity could store around 93 days’ worth of annual LNG demand in 2036, up from the current 52 days. This figure well surpasses the government’s mandated target of nine days of peak winter demand,” says Kim.

Limited role for new facilities

Smaller companies are spurring regasification and storage tank investment to secure a larger market share and reduce dependence on state utility Korea Gas Corporation (KOGAS).

“Fierce competition is causing developers to propose large LNG infrastructure projects in close proximity to one another, which will pose a challenge in securing end-users for the terminals,” says Kim.

For example, the infrastructural push is playing out in Dangjin, where KOGAS is competing with independent power producers (IPPs) and other private companies, and in neighboring Boryeong, where state-owned power generation companies are vying with IPPs. Both cities are part of South Chungcheong province.

These firms will all likely end up jostling for the limited number of terminal users, highlighting a need for better public-private coordination.

The industry feels that repurposing and retrofitting its existing LNG import infrastructure can help mitigate the risk of stranded assets, such as by producing blue hydrogen from natural gas and sequestrating greenhouse gases through carbon capture, utilization and storage.

However, the new technologies are “premature and controversial,” says Kim. IEEFA recommends avoiding the promotion of technologies and services that would prolong LNG use without helping national climate goals.

Ultimately, the state-run firms’ excessive investment is expected to place a heavier burden on taxpayers. Private-sector companies engaging in overinvestment may also exacerbate financial stability concerns by increasing their debt.

“An overbuild of new gas import infrastructure threatens to further bind the health of the South Korean economy to unpredictable global commodity markets, hindering the country’s energy transition to cheaper, domestically sourced renewable energy,” says Kim.

Read the report: South Korea’s LNG Overbuild

Report contact: Michelle (Chaewon) Kim ([email protected])

Media contact:

Alex Yu ([email protected]) Ph: +852 9614 1051

About the author:

Michelle Chaewon Kim is an Energy Finance Specialist, South Korea at IEEFA. Over the past 15 years, she has worked across various energy and commodity sectors in Singapore and South Korea.

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)